Discover effective tips for trading forex and maximizing your profits. Learn about risk management, technical analysis, and more.

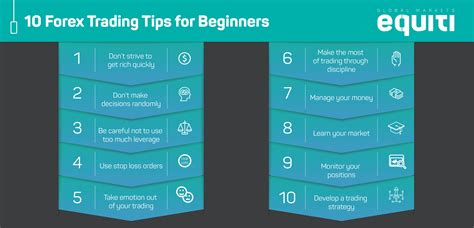

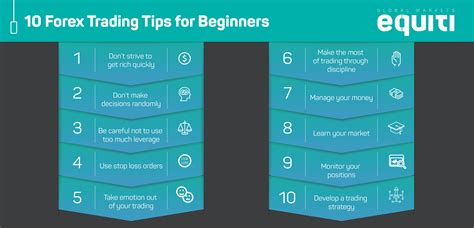

Are you looking to make a profit by trading forex? With the right knowledge and strategies, it’s possible to succeed in the world of currency trading. However, navigating the complex market can be daunting for beginners. That’s why we’ve compiled some tips to help you get started and increase your chances of success.

Firstly, it’s important to have a solid understanding of the basics. This includes knowledge of currency pairs, market trends, and risk management. Additionally, keeping up-to-date with global economic events and news can give you an edge in making informed trades.

Another crucial aspect of forex trading is having a well-defined strategy. Whether you prefer technical analysis or fundamental analysis, having a clear plan can help you stay focused and avoid making impulsive decisions. It’s also important to set realistic goals and stick to them.

Lastly, it’s essential to practice patience and discipline when trading forex. Avoid chasing quick profits and instead focus on long-term gains. By implementing these tips and staying committed to learning and adapting, you can achieve success in the exciting world of forex trading.

Daftar Isi

Introduction

Forex trading is a popular way to earn money from the comfort of your home. However, it is not as easy as it may seem. To be successful in forex trading, you must have a clear understanding of how it works and the strategies to use. In this article, we will discuss some tips that can help you trade forex successfully.

Tip 1: Learn the basics

Before diving into forex trading, you must learn the basics of forex. This includes understanding the currency pairs, how to read charts, and the different types of orders. You can find plenty of free resources online that can help you learn the basics of forex trading.

Tip 1.1: Understand currency pairs

In forex trading, you buy one currency and sell another. This means that you must understand the different currency pairs, such as EUR/USD, USD/JPY, and GBP/USD. Each currency pair has its own unique characteristics, and understanding them is vital to successful trading.

Tip 1.2: Learn how to read charts

Forex traders use charts to analyze the market and make trading decisions. You must learn how to read charts, including candlestick charts, line charts, and bar charts. This will enable you to identify trends and patterns that can inform your trading decisions.

Tip 1.3: Know the different types of orders

Forex traders use different types of orders to buy and sell currencies. These include market orders, limit orders, and stop-loss orders. Understanding these orders is crucial to managing risk and maximizing profits.

Tip 2: Develop a trading strategy

Forex trading requires a well-defined trading strategy. This involves identifying entry and exit points, setting stop-loss levels, and determining the amount of risk you are willing to take.

Tip 2.1: Identify entry and exit points

To be successful in forex trading, you must identify the best entry and exit points. This involves analyzing the market trends and patterns to determine when to buy or sell currencies.

Tip 2.2: Set stop-loss levels

Stop-loss orders are vital in managing risk in forex trading. You should set stop-loss levels at a reasonable distance from your entry point to minimize losses if the market moves against you.

Tip 2.3: Determine risk tolerance

Forex trading involves taking risks, and you must determine how much risk you are willing to take. This involves setting a risk-reward ratio and only taking trades that offer a favorable risk-reward ratio.

Tip 3: Practice with a demo account

Before trading with real money, it is essential to practice with a demo account. This will enable you to test your trading strategy and hone your trading skills without risking any money.

Tip 3.1: Choose a reputable broker

When choosing a broker for your demo account, ensure that they are reputable and offer a realistic trading environment. This will enable you to simulate real trading conditions and prepare you for live trading.

Tip 3.2: Take your time

Practice trading with a demo account for as long as necessary to gain confidence and refine your trading strategy. Rushing into live trading without sufficient practice can lead to costly mistakes.

Tip 4: Manage your emotions

Emotions such as fear, greed, and excitement can cloud your judgment and lead to poor trading decisions. To be successful in forex trading, you must learn to manage your emotions.

Tip 4.1: Develop a trading plan

Having a well-defined trading plan can help you manage your emotions. This involves setting clear goals, identifying potential risks, and determining the best trading strategies to achieve your goals.

Tip 4.2: Practice discipline

Discipline is key in forex trading. You must stick to your trading plan and avoid making impulsive decisions based on emotions.

Conclusion

Forex trading can be a profitable venture if you have the right knowledge and skills. By following the tips discussed in this article, you can improve your chances of success in forex trading. Remember to learn the basics, develop a trading strategy, practice with a demo account, and manage your emotions.As a forex trader, staying informed about current events is essential to making informed trading decisions. Following news outlets and social media accounts that offer daily updates on economic data releases, political developments, and other relevant information can help you keep up with the global market. Additionally, understanding technical analysis is a common practice among many forex traders. It involves studying price charts and identifying trends to help make trading decisions. To use technical analysis effectively, traders must understand how to read charts and recognize common chart patterns. Having a solid trading plan is also crucial for success in forex trading. Your plan should outline your trading strategy, risk management approach, and other important factors that may affect your trading performance. Without a solid plan in place, it can be challenging to navigate the volatile forex market. Stop-loss orders are an important risk management tool that can help limit losses in the event of a sudden market downturn. These orders automatically close out a trade when a specific price level is reached, providing traders with a level of protection against sudden market shifts.Proper risk management is also crucial in forex trading. Be realistic about the potential for gains and losses, and use tools like stop-loss orders and position sizing to manage your risk effectively. Avoid overtrading by sticking to your trading plan and avoiding impulse trades. Discipline is a critical component of successful trading, so stick to your plan and avoid making impulsive decisions based on emotions or market fluctuations.Remember that no trader is perfect, and everyone makes mistakes. Use each trade as an opportunity to learn and improve your trading strategies over time. Keeping a journal of your trades can be a helpful way to track your progress and identify patterns over time. Use this information to make informed decisions and adjust your trading strategy accordingly. Finally, identify your trading style and stick to it to ensure consistency in your trading approach. By following these tips, you can increase your chances of success in forex trading.As a journalist covering the financial markets, I would like to share some tips on trading forex. Forex, or foreign exchange, involves buying and selling currencies with the aim of making a profit. It is a highly liquid and volatile market that operates 24 hours a day, five days a week. Here are some tips to keep in mind when trading forex:1. Educate yourself: Before you start trading, it’s essential to understand the basics of forex, including the terminology, trading strategies, and risk management techniques. You can find plenty of online resources, such as webinars, tutorials, and forums, to help you learn more about forex.2. Choose a reliable broker: A broker is a crucial link between you and the forex market. Look for a reputable broker who is regulated by a financial authority, has a good track record, and offers competitive trading conditions, such as low spreads and fast execution.3. Develop a trading plan: A trading plan outlines your goals, risk tolerance, entry and exit points, and position sizing. Stick to your plan and avoid impulsive trades based on emotions or rumors.4. Use technical analysis: Technical analysis uses charts and indicators to identify trends, patterns, and support and resistance levels. It can help you make informed trading decisions based on objective data rather than subjective opinions.5. Practice with a demo account: Most brokers offer demo accounts that allow you to trade with virtual money and test your strategies without risking real funds. Use this opportunity to gain experience and confidence before you switch to a live account.Despite the potential benefits of trading forex, there are also some cons to consider:1. High volatility: The forex market can be highly volatile, which means that prices can fluctuate rapidly and unpredictably. This can lead to significant gains or losses, depending on your position.2. Leverage risk: Forex trading often involves using leverage, which means borrowing money from your broker to increase your trading position. While leverage can amplify your profits, it can also magnify your losses if the market moves against you.3. Market manipulation: The forex market is decentralized, which means that there is no central exchange or regulator. This makes it vulnerable to market manipulation by large players, such as banks or hedge funds, who can influence prices through their trading activity.In conclusion, trading forex can be a lucrative and exciting venture, but it requires careful planning, discipline, and risk management. By following these tips and being aware of the pros and cons, you can make informed decisions and increase your chances of success in the forex market.

As a journalist, it is my job to inform and educate the public about important topics and issues. One such topic that has gained widespread attention in recent years is forex trading. While it can be a lucrative venture for those who know what they’re doing, it can also be risky for those who are not well-informed. In this article, I will provide some tips on how to trade forex successfully without a title.

The first tip is to do your research. Before investing any money in forex trading, it is important to understand what it is and how it works. There are many resources available online that can help you get started, including blogs, forums, and educational websites. Take the time to read as much as you can and ask questions if you don’t understand something. It is also important to stay up-to-date on market trends and news that may affect currency values.

Another tip is to start small. It can be tempting to invest a large sum of money into forex trading in the hopes of making a quick profit, but this is often a recipe for disaster. Instead, start with a small amount and gradually increase your investment as you become more comfortable with the process. This will not only help you avoid significant losses but also allow you to learn from your mistakes without risking too much.

In conclusion, forex trading can be a great way to make money, but it requires knowledge, patience, and discipline. By doing your research, starting small, and staying informed, you can increase your chances of success without a title. Remember, there is no shortcut to success in forex trading, but with the right approach, you can achieve your financial goals.

As the world of foreign exchange (forex) trading becomes more accessible to retail traders, many are seeking tips and advice on how to navigate this complex market. Here are some common questions people ask about trading forex, along with answers from industry experts:

-

What is forex trading?

Forex trading is the act of buying and selling currencies with the goal of profiting from changes in their exchange rates. It is the largest financial market in the world, with an average daily turnover of over $5 trillion.

-

What are the risks involved in forex trading?

Like any investment, forex trading carries risks. The most significant risk is the potential for loss. Currency prices can be volatile, and sudden market movements can result in significant losses. Traders must also be aware of the impact of leverage, which can magnify both gains and losses.

-

What are some tips for beginner forex traders?

-

Start with a demo account to practice trading without risking real money.

-

Learn the basics of technical analysis and charting.

-

Develop a trading plan and stick to it.

-

Manage your risk by using stop-loss orders and limiting your leverage.

-

Stay up-to-date on economic and political news that can affect currency prices.

-

-

Is it possible to make a living trading forex?

Yes, it is possible to make a living trading forex. However, it requires a significant amount of skill, discipline, and risk management. Many successful traders have years of experience and have developed their own unique trading strategies.

-

What are some common mistakes that forex traders make?

-

Overtrading – taking too many trades at once or trading too frequently

-

Not using stop-loss orders

-

Trading without a plan or strategy

-

Letting emotions drive trading decisions

-

Ignoring fundamental analysis and economic news

-

By keeping these tips and advice in mind, traders can better navigate the world of forex trading and increase their chances of success.