Trading refers to the buying and selling of financial instruments such as stocks, bonds, or commodities with the goal of making a profit.

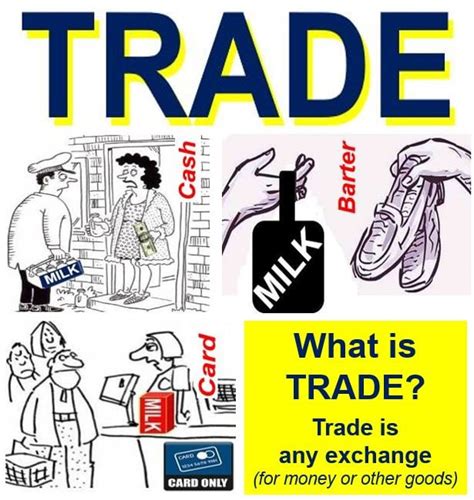

Trading is the act of buying and selling goods and services. It has been a part of human history for centuries, evolving from simple bartering systems to complex financial markets that we see today. In modern times, trading has become more accessible to the general public, thanks to advancements in technology and the internet. However, with this accessibility comes a level of risk and complexity that can be daunting for beginners. That said, for those who are willing to put in the effort and learn the ropes, trading can provide an opportunity for financial growth and independence.

One of the most important things to understand about trading is that it involves taking risks. Whether you’re investing in stocks, currencies, or commodities, there is always a chance that you could lose money. However, with proper research and analysis, these risks can be mitigated. Additionally, trading requires a certain level of discipline and patience. It’s not a get-rich-quick scheme, and success often comes from making small gains over time.

Another key aspect of trading is the importance of staying up-to-date with current events and market trends. Factors such as political instability, natural disasters, and economic policies can all have an impact on the value of assets. Traders must be able to quickly adapt to changing circumstances and make informed decisions based on the latest information available.

In short, trading is a complex and dynamic field that requires a combination of knowledge, skill, and intuition. While it may not be suitable for everyone, for those who are willing to put in the effort, the potential rewards can be significant.

Daftar Isi

Trading Without Title: Understanding the Concept

Trading without a title refers to a situation where a seller offers goods or services for sale, but without disclosing the legal ownership status of the item. This practice is common in many marketplaces, and it raises some important questions about the nature of trade and property ownership.

The Basics of Trading Without Title

At its core, trading without title involves a seller who has some degree of control over an item, but who may not have full legal ownership. For example, a person may be selling a car on behalf of a friend who still technically owns the vehicle. Alternatively, a seller may be offering a piece of land that is subject to a dispute over ownership.

The Risks of Trading Without Title

Trading without title can be risky for both buyers and sellers. For buyers, there is the possibility that they will purchase an item that is not legally owned by the seller. This could result in the buyer losing their investment if the true owner comes forward to claim the item. Sellers may also face risks if they sell an item that they do not fully own. They could face legal action if the true owner comes forward, or if the buyer suffers damages as a result of the transaction.

Why Do People Trade Without Title?

There are many reasons why someone might engage in trading without title. In some cases, the seller may not be aware of the ownership status of the item they are selling. Alternatively, they may be knowingly attempting to sell an item that is not legally theirs. This could be because they need to raise funds quickly, or because they believe they will not be caught.

The Legal Implications of Trading Without Title

Trading without title is often illegal, and can result in serious consequences for both buyers and sellers. If a buyer purchases an item that is not legally owned by the seller, they could lose their investment if the true owner comes forward. Sellers could face legal action if they sell an item that they do not fully own.

How to Protect Yourself When Trading Without Title

If you are considering engaging in trading without title, it is important to take steps to protect yourself. This may include conducting thorough research into the ownership status of the item you are interested in purchasing, and seeking legal advice before entering into any transactions.

The Role of Marketplaces in Trading Without Title

Marketplaces such as eBay and Craigslist have made it easier for people to engage in trading without title. While these platforms have implemented measures to combat fraud and other illegal activities, it is still possible for buyers and sellers to engage in risky transactions.

Alternatives to Trading Without Title

For buyers and sellers who want to avoid the risks associated with trading without title, there are alternative options available. These may include purchasing items from reputable sellers who can provide proof of ownership, or working with a trusted third party to facilitate the transaction.

The Importance of Transparency in Trade

Ultimately, trading without title undermines the transparency and trust that underpins the entire trade system. By engaging in this practice, buyers and sellers are exposing themselves to unnecessary risks and potentially damaging the reputation of the marketplace.

Conclusion

Trading without title is a complex issue that raises many important questions about property ownership and trade. While it may be tempting to engage in this practice in order to score a good deal, the risks and potential legal consequences are simply not worth it. Instead, buyers and sellers should focus on building trust and transparency in their transactions, and working together to create a more secure and reliable marketplace.

Introduction: Trading without Title

Traders are familiar with the concept that ownership of goods must be legally transferred before it can be sold. However, trading without title (also known as “naked trading) may be less known. In this type of transaction, the seller transfers the physical possession of the goods but not the legal ownership.

The Legal Implications of Trading without Title

Without legal ownership, there could be several legal implications for the trader. The buyer could face issues such as a lack of security over the goods, potential legal disputes, and some subsequent issues for future resale of the said goods. It is essential to understand that this type of trading may put traders at significant risk, and it’s crucial to have a proper understanding of the legal implications involved.

Where is Trading without Title Allowed?

Trading without title is allowed only in certain circumstances, such as in the commodities market. The reason for this is in many cases, the physical possession of the goods is more important than the legal ownership. Example of such goods can be raw materials or finished goods in large warehouses. However, it is essential to note that this type of trading is not allowed in most markets.

Risk Assessment

For traders thinking of conducting naked trading, it’s essential to undertake a thorough risk assessment. They will need to understand all potential risks associated with the trade, from the contract details to the terms and conditions. This will help them mitigate risks effectively and make informed decisions.

Impact on Trade Finance

Trading without title can affect trade finance agreements by changing the way that goods are held in transit. Importantly, it is necessary to consider how these agreements can be affected by any in-transit sales. The financial tools used in trade finance like letters of credits may require special consideration. Therefore, it is crucial to have a proper understanding of the impact on trade finance before engaging in naked trading.

Insurance and Trading Without Title

Traders must also consider insurance when dealing with naked trading. As there is no legal title transfer, the trader must ensure that adequate insurance coverage is in place to prevent significant losses. This can help mitigate the risks involved in this type of trading.

Consideration for Import and Export Regulations

Trading without title can also impact on import and export regulations, with some countries and regions having different regulations pertaining to ownership and in-transit sales. Therefore, it’s important to have a proper understanding of import and export regulations before engaging in naked trading.

Trading in Financial Derivatives

Naked trading is not only restricted to goods; it can also be applied to financial derivatives. In this case, traders who engage in naked trading do not hold the underlying asset. The risks associated with this type of trading are even higher than physical commodities, and it’s essential to understand the potential risks before engaging in this type of trading.

Complying with Regulations in Naked Trading

Before dealing in trading with naked trading, traders must work to comply with existing regulations. For certain products, such as physical commodities, there may be specific regulations in place to protect consumer, investors, and the economy at large. Therefore, it is essential to have a proper understanding of the regulations involved before engaging in naked trading.

Conclusion

In conclusion, naked trading is allowed in specific limited circumstances but comes with particular inherent risks. Understanding these risks, ensuring compliance with the regulations, and understanding the impact on finances and legal ownership is crucial in mitigating risks effectively. It’s essential to conduct thorough risk assessments and have a proper understanding of the implications involved before engaging in naked trading.Trading refers to the buying and selling of goods, securities or services in a market. It is a crucial element of the global economy and has played an important role in the growth and development of many countries. Trading can involve various types of assets, including stocks, commodities, currencies, and derivatives.Pros of Trading:1. Profit Potential: Trading provides an opportunity to earn profits by buying low and selling high. This has the potential to generate significant returns for investors.2. Liquidity: Trading markets offer high liquidity, which means that investors can easily buy and sell assets without affecting the price significantly.3. Diversification: Trading allows investors to diversify their portfolios by investing in different assets. This can help to reduce risks and improve returns.4. Flexibility: Trading can be done from anywhere, at any time, making it a flexible investment option.Cons of Trading:1. High Risk: Trading carries a high level of risk, and investors can potentially lose all their investments if the market moves against them.2. Lack of Control: Trading requires investors to rely on the market for their returns, which means they have limited control over their investments.3. Emotional Impact: Trading can be emotionally challenging, as investors may experience anxiety, fear, and greed when making investment decisions.4. Time-Consuming: Trading requires significant time commitment and research to make informed investment decisions.In conclusion, trading can be a profitable investment option, but it also carries significant risks. Investors should carefully consider their financial goals and risk tolerance before engaging in any trading activities.

As a trader, you may have heard the term “trading without title” and wondered what it means. Simply put, trading without title refers to the practice of buying and selling securities without actually owning them. This may sound like an odd concept, but it’s a common practice in the financial world that can offer some significant benefits to savvy traders.

One of the main advantages of trading without title is that it allows traders to take advantage of market movements without having to commit a large amount of capital upfront. This is because when you trade without title, you only need to put up a fraction of the total value of the security you’re trading. This means that you can potentially make much larger profits than you would be able to if you were trading with traditional ownership.

Of course, there are also risks involved with trading without title, as there are with any type of investment. One of the biggest risks is that you could end up losing more money than you originally invested if the market moves against you. Additionally, trading without title can be more complicated than traditional ownership, so it’s important to make sure you understand the process before you start trading.

In conclusion, while trading without title may not be suitable for everyone, it’s a valuable tool that can help traders take advantage of market movements and potentially increase their profits. If you’re interested in exploring this option further, be sure to do your research and consult with a financial advisor to determine if it’s the right choice for you.

Video what is meant by trading

As a journalist, it is important to provide clear and concise answers to the questions that people commonly ask. One such question is: what is meant by trading?

Here are some of the key things that people want to know:

-

What is trading?

Trading refers to the buying and selling of assets, such as stocks, bonds, commodities, or currencies, with the aim of making a profit. Traders can work independently or for financial institutions, and they use various strategies and tools to analyze market trends and price movements in order to make informed decisions about when to buy and sell.

-

Why do people trade?

There are several reasons why people might choose to trade. Some do it as a way to earn a living, while others see it as a way to diversify their investments and potentially earn higher returns than they would with more traditional savings accounts or mutual funds. Additionally, some people simply enjoy the intellectual challenge of analyzing market data and making predictions about future trends.

-

Is trading risky?

Yes, trading can be risky. Markets can be unpredictable, and even the most skilled traders can experience losses. However, there are ways to manage risk, such as setting stop-loss orders to limit potential losses and diversifying one’s portfolio to spread out risk across multiple assets.

-

Do I need a lot of money to start trading?

Not necessarily. Some brokers allow traders to open accounts with as little as a few hundred dollars, and there are also platforms that allow for fractional share trading, which can make it easier to invest smaller amounts in expensive assets like stocks. However, it’s important to remember that trading fees and commissions can add up, so it’s important to factor those costs into any investment strategy.

-

What resources are available for beginners who want to learn about trading?

There are many online resources, including books, blogs, and video tutorials, that can help beginners learn the basics of trading. Additionally, many brokers offer educational materials and demo accounts that allow traders to practice with virtual funds before risking real money.

By answering these common questions, journalists can help demystify the world of trading and provide valuable information to readers who are interested in exploring this exciting and potentially lucrative field.