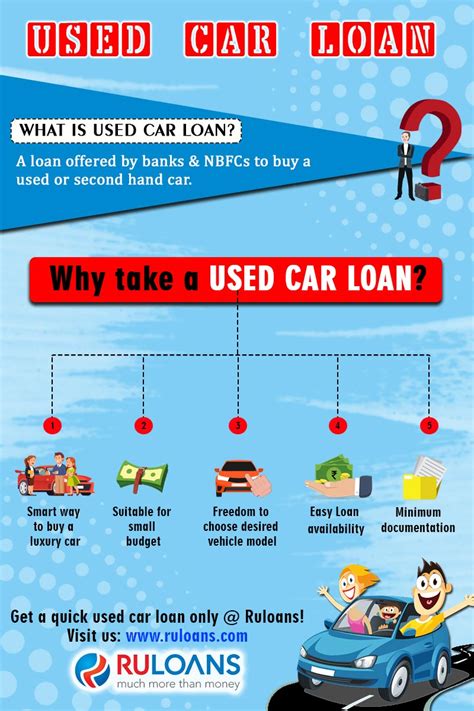

Get the best deals on used car loans with our fast and simple application process. Low interest rates and flexible repayment options available.

Looking for a used car can be a daunting task, especially when it comes to financing. However, obtaining a used car loan can make the process much easier. With various lenders and financial institutions offering used car loans, it is important to understand the benefits and drawbacks of each option.

Firstly, if you have a limited budget, a used car loan can help you purchase a vehicle that fits within your financial means. Additionally, used car loans often have lower interest rates than new car loans, which can save you money in the long run. However, it is essential to do your research and compare loan options to ensure you are getting the best deal possible.

Moreover, purchasing a used car can provide many advantages, such as avoiding the depreciation that occurs with new cars. In addition, used cars often come with lower insurance rates and registration fees. A used car loan can help you take advantage of these benefits and get you on the road without breaking the bank.

Overall, obtaining a used car loan can be a smart financial decision. By doing your due diligence and comparing loan options, you can find the best option for your needs and budget. So, why wait? Start exploring your options today and get on the road to your next adventure!

Daftar Isi

Introduction

Buying a used car can be an affordable way to get behind the wheel of a vehicle, but it can also come with some challenges. One of the biggest obstacles that buyers may face is obtaining financing for a car without a title. In this article, we’ll explore what options are available for those looking to secure a used car loan without a title.

What is a Title?

Before we dive into the specifics of obtaining a used car loan without a title, it’s important to understand what a title is and why it’s necessary. A car title is a legal document that proves ownership of a vehicle. It contains important information about the car, including the make and model, VIN number, and the owner’s name and address. When a car is sold, the title must be transferred to the new owner to legally transfer ownership of the vehicle.

Why Might a Car Not Have a Title?

There are a few reasons why a car may not have a title. For example, if the previous owner lost the title and never obtained a replacement, or if the car was purchased in a state where titles aren’t required. In some cases, a car may not have a title because it has been salvaged or rebuilt after being involved in an accident.

Options for Financing a Car Without a Title

Personal Loans

If you’re looking to finance a used car without a title, one option is to take out a personal loan. Personal loans are unsecured loans, which means they don’t require collateral like a car title. However, because they are unsecured, they may come with higher interest rates and stricter eligibility requirements.

Secured Loans

Another option for financing a car without a title is to take out a secured loan. Secured loans require collateral, such as a savings account or other asset, to secure the loan. This can make it easier to obtain financing, but it also means that if you default on the loan, you risk losing the collateral.

Dealer Financing

If you’re purchasing a used car from a dealer, they may offer financing options even if you don’t have a title. However, be prepared for higher interest rates and potentially stricter eligibility requirements than you would get with traditional financing.

Private Lenders

If you’re unable to obtain financing through a traditional lender, there are private lenders who specialize in providing loans to those with less-than-perfect credit or unique financing needs. These lenders may be more willing to work with you, but be aware that their interest rates may be much higher than what you would get with a traditional lender.

What to Consider Before Taking Out a Used Car Loan Without a Title

Before you decide to finance a used car without a title, there are some important factors to consider:

Interest Rates

Be sure to shop around and compare interest rates from different lenders. Interest rates on loans without collateral can be higher than those on traditional auto loans, so it’s important to find the best rate possible.

Loan Terms

Make sure you understand the terms of the loan, including the repayment period and any fees associated with the loan. Be aware that longer repayment periods may result in higher overall interest costs.

Vehicle Condition

If you’re purchasing a used car without a title, it’s important to thoroughly inspect the vehicle to ensure it’s in good condition. The last thing you want is to take out a loan for a car that has major mechanical issues.

Conclusion

Securing a used car loan without a title can be challenging, but it’s not impossible. By exploring your options and understanding the risks involved, you can make an informed decision about whether financing a car without a title is right for you.

Acquiring a used car loan without a title can be a tricky process, but it’s not impossible. Borrowers must understand what it means to apply for a used car loan without a title, as lenders use the title as collateral. However, there are other options available, such as credit unions, online lenders, and auto finance companies. To qualify for a used car loan without a title, borrowers must meet specific requirements, which may vary depending on the lender’s policies, credit score, income, and other factors. It’s important to be aware of the risks involved, such as higher interest rates and shorter loan durations. Borrowers should compare different lenders’ rates and fees to choose the best deal they can afford. If obtaining a used car loan without a title is not feasible, borrowers can explore other options such as using a personal loan, tapping into the equity of other assets, or borrowing from friends and family. Establishing ownership of the car is crucial in securing a car loan, and techniques such as obtaining a new title or applying for a lost title can help. Having the required documents ready, such as driver’s licenses, proof of income, bill of sale, and registration, is also essential. When choosing a reliable lender, it’s crucial to evaluate their reputation, interest rates, fees, and terms and conditions. With the right lender and documentation, getting a used car loan without a title is possible. It’s up to borrowers to weigh all their options before choosing the best one for their situation.Used car loans have become a popular option for people looking to purchase a vehicle without breaking the bank. While there are certainly benefits to this type of loan, it’s important to consider both the pros and cons before making a decision.Pros:1. Lower cost: One of the biggest advantages of a used car loan is that the overall cost is typically lower than purchasing a new vehicle. This means that you can often get a reliable car for a fraction of the price.2. Less depreciation: New cars tend to lose value quickly, which can be a big downside if you’re planning on selling or trading in your vehicle down the line. With a used car loan, you won’t experience the same level of depreciation since the car has already gone through its initial drop in value.3. Lower insurance premiums: Since used cars are typically less expensive, insurance premiums tend to be lower as well. This can save you a significant amount of money over time.Cons:1. Higher interest rates: In some cases, lenders may offer higher interest rates for used car loans compared to new car loans. This can make the overall cost of the loan more expensive over time.2. Higher maintenance costs: While used cars may be cheaper upfront, they may require more maintenance and repairs over time. This can add up quickly and negate any savings you may have had on the purchase price.3. Limited selection: Depending on where you’re shopping, the selection of used cars may be more limited compared to new cars. This can make it harder to find the exact make and model you’re looking for.In conclusion, used car loans can be a great option for those looking to save money on their next vehicle purchase. However, it’s important to weigh the pros and cons carefully before making a decision. By doing so, you can ensure that you’re making the best choice for your budget and lifestyle.

Are you in the market for a used car but don’t have the title? It can be challenging to secure a loan without a title, but it’s not impossible. Before you start your search for financing options, it’s essential to understand what a car title is and why lenders require it.

A car title is a legal document that proves ownership of a vehicle. When you buy a car, the title is transferred to your name, and you become the legal owner. Lenders require the title as collateral for a loan because it proves that you own the vehicle and can use it as collateral. If you default on the loan, the lender can take possession of the car and sell it to recover their losses.

If you’re looking for a used car loan without a title, your options may be limited. However, some lenders may offer alternative financing options. For example, you may be able to secure a personal loan or a secured loan using another asset as collateral. Keep in mind that these types of loans may come with higher interest rates and stricter repayment terms.

In conclusion, securing a used car loan without a title may be challenging, but it’s not impossible. Before you start your search, consider all your financing options and compare rates and terms from multiple lenders. Remember, it’s essential to understand the risks and responsibilities that come with borrowing money, so make sure you read the fine print before signing any loan agreements.

Video used car loan

Visit VideoAs a journalist, I understand that people have many questions when it comes to financing a used car. One common query is about used car loans. Here are some of the most frequently asked questions and their answers:

1. What is a used car loan?

A used car loan is a type of financing that allows you to purchase a pre-owned vehicle. It works similarly to a new car loan, but the interest rates and terms may be different.

2. How do I qualify for a used car loan?

To qualify for a used car loan, you typically need to have a good credit score and a steady income. Lenders may also consider factors like your debt-to-income ratio and employment history.

3. Where can I get a used car loan?

You can obtain a used car loan from a variety of sources, including banks, credit unions, and online lenders. You may also be able to secure financing through the dealership where you’re purchasing the vehicle.

4. What are the interest rates for used car loans?

Interest rates for used car loans vary depending on the lender, your credit score, and other factors. On average, rates for used car loans are slightly higher than those for new car loans.

5. How long can I finance a used car?

The length of a used car loan can vary, but most lenders offer terms ranging from 36 to 72 months. Keep in mind that longer loan terms may result in higher interest charges over time.

6. Can I get a used car loan if I have bad credit?

It may be more difficult to obtain a used car loan with bad credit, but it’s not impossible. You may need to shop around for lenders who specialize in subprime loans or consider getting a cosigner to improve your chances of approval.

7. What should I consider when choosing a used car loan?

When selecting a used car loan, it’s important to compare interest rates, terms, and fees from multiple lenders. You should also consider factors like the size of the down payment required and any restrictions on the type of vehicle you can purchase.By keeping these questions and answers in mind, you can make an informed decision about financing a used car that fits your budget and needs.