Gain a comprehensive understanding of forex trading through our expert insights and guides. Learn the ins and outs of the market and start trading confidently today.

As the world becomes increasingly globalized, more and more people are turning to forex trading as a way to make money. However, understanding the ins and outs of this complex market can be a daunting task. Whether you’re a seasoned investor or just starting out, it’s important to have a solid understanding of the fundamentals of forex trading. Fortunately, with the right knowledge and tools, anyone can become a successful forex trader. In this article, we’ll explore some key concepts and strategies that will help you navigate the world of forex trading with confidence.

Daftar Isi

Introduction

Forex trading is a lucrative venture that has attracted many investors globally. However, the forex market can be complex and volatile, which makes it difficult for traders to make informed decisions. Understanding the basics of forex trading is essential for any trader who wants to succeed in this industry. In this article, we will explore the fundamentals of forex trading and equip you with the knowledge you need to make informed trading decisions.

What is Forex Trading?

The foreign exchange (forex) market is a global decentralized financial market where currencies are traded. Forex trading involves buying and selling currencies with the aim of making a profit from the fluctuations in their value. Currencies are traded in pairs, and the most commonly traded pairs include the Euro/US dollar, US dollar/Japanese yen, and British pound/US dollar.

How Does Forex Trading Work?

Forex trading involves speculating on the movements of currency pairs. If a trader believes that the value of a particular currency will rise, they will buy that currency. Similarly, if they believe that the value of a currency will fall, they will sell that currency. Traders make a profit by buying low and selling high or selling high and buying low.

The Importance of Currency Pairs in Forex Trading

Currency pairs are the backbone of forex trading. The value of a currency pair is determined by the exchange rate between the two currencies. For example, if the EUR/USD exchange rate is 1.10, it means that one euro can buy 1.10 US dollars. The exchange rate is constantly fluctuating, and traders use technical analysis and fundamental analysis to predict the future movements of currency pairs.

Factors That Affect Currency Prices

The forex market is affected by numerous factors that influence the value of currencies. Some of the factors that affect currency prices include economic indicators, political events, and central bank decisions. Traders need to keep abreast of these factors and their impact on the forex market to make informed trading decisions.

The Importance of Risk Management in Forex Trading

Risk management is an essential aspect of forex trading. Traders need to have a clear understanding of the risks involved in forex trading and implement strategies to mitigate those risks. Some of the risk management strategies that traders can use include stop-loss orders, limiting leverage, and diversifying their portfolio.

Technical Analysis in Forex Trading

Technical analysis is a common trading strategy used by forex traders. It involves analyzing past price movements and using that information to predict future price movements. Traders use various technical indicators such as moving averages, RSI, and MACD to identify trends and patterns in the forex market.

Fundamental Analysis in Forex Trading

Fundamental analysis is another common trading strategy used by forex traders. It involves analyzing economic and financial data to predict the future movements of currency pairs. Traders look at factors such as GDP, inflation rates, and interest rates to determine the strength of a currency.

Choosing a Forex Broker

Choosing a reliable forex broker is crucial for any trader who wants to succeed in forex trading. Traders need to consider factors such as regulation, trading platforms, customer support, and fees when choosing a forex broker.

Conclusion

Forex trading can be a profitable venture for those who take the time to understand its basics and employ sound trading strategies. The key to success in forex trading is to stay informed, manage risks, and choose a reliable forex broker. With these fundamental principles in mind, any trader can make informed decisions and achieve success in the forex market.

Forex trading: An overview of the global currency market

Forex trading is the buying and selling of currencies in the global marketplace. The foreign exchange market is the largest financial market in the world, with over $5 trillion traded daily. The forex market operates 24 hours a day, five days a week, allowing traders to participate in the market at any time. Forex trading is popular among investors due to its high liquidity and potential for profit.

Understanding the basic terminology of forex trading

Before diving into forex trading, it is important to understand the basic terminology used in the industry. Some common terms include:

- Pip: The smallest unit of measurement in forex trading.

- Currency pair: Two currencies that are being traded against each other.

- Bid/ask price: The bid price is the highest price a buyer is willing to pay for a currency, while the ask price is the lowest price a seller is willing to accept.

- Spread: The difference between the bid and ask price.

- Leverage: The ability to control a large amount of currency with a small investment.

Familiarizing yourself with the different types of currency pairs

There are three main types of currency pairs: major pairs, minor pairs, and exotic pairs. Major pairs include the most heavily traded currencies, such as the US dollar, Euro, Japanese yen, British pound, Swiss franc, and Canadian dollar. Minor pairs involve trading less popular currencies, such as the New Zealand dollar or the Norwegian krone. Exotic pairs involve trading a major currency with a currency from a developing country, such as the USD/MXN (US dollar/Mexican peso) or the USD/ZAR (US dollar/South African rand).

The significance of leverage and the potential risks of high leverage trading

Leverage is a tool that allows traders to control a large amount of currency with a relatively small investment. For example, if a trader has a 100:1 leverage, they can control $100,000 worth of currency with a $1,000 investment. While leverage can increase profits, it also increases the potential for losses. High leverage trading can be risky, as even small market movements can result in significant losses. It is important for traders to understand the risks associated with leverage and to use it wisely.

Fundamental analysis: Evaluating economic indicators and news releases

Fundamental analysis involves evaluating economic indicators and news releases to predict market trends. Economic indicators include data such as GDP, inflation rates, and employment figures. News releases, such as central bank announcements and political events, can also have a significant impact on the forex market. Traders who use fundamental analysis must stay up-to-date with economic news and events to make informed trading decisions.

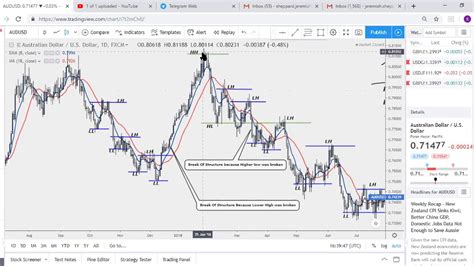

Technical analysis: Reading charts and recognizing patterns to predict profitable trades

Technical analysis involves using charts and other tools to analyze past market trends and predict future ones. Traders use technical analysis to identify patterns and trends in the market, such as support and resistance levels. There are many different technical analysis tools available, including moving averages, trend lines, and oscillators. Traders who use technical analysis must have a strong understanding of charting tools and be able to interpret them effectively.

Importance of risk management and developing a sound trading plan

Risk management is an essential part of successful forex trading. Traders must develop a sound trading plan that includes risk management strategies such as setting stop-loss orders and limiting leverage. It is important for traders to only risk a small percentage of their trading account on any given trade. By developing a sound trading plan and managing risk effectively, traders can minimize losses and maximize profits.

Choosing the right trading platform and broker

Choosing the right trading platform and broker is essential for successful forex trading. Traders should choose a platform that is user-friendly and offers a wide range of features and tools. It is also important to choose a broker who is reputable and offers competitive spreads and fees. Traders should research different platforms and brokers before making a decision.

The role of emotions and psychology in forex trading

Emotions and psychology play a significant role in forex trading. Traders must be able to control their emotions and make rational decisions based on market trends and analysis. Fear and greed are common emotions that can lead to poor trading decisions. Traders must also have discipline and patience, as successful trading requires a long-term approach.

Continuous learning and staying updated with market trends and developments

Forex trading is a constantly evolving industry, and it is important for traders to stay up-to-date with market trends and developments. Traders should continuously learn about new trading strategies and tools and stay informed about economic news and events. By staying informed and continuously learning, traders can improve their trading skills and make more informed trading decisions.

As a journalist covering financial topics, it is important to understand the basics of forex trading. Forex, or foreign exchange, trading involves buying and selling currencies in order to make a profit. Here are some pros and cons of understanding forex trading:

- Pros:

- Forex trading can be a lucrative way to make money if done correctly.

- The forex market operates 24 hours a day, allowing for more flexibility in trading.

- With online trading platforms, forex trading is more accessible than ever before.

- Forex trading can diversify an investment portfolio.

- Cons:

- Forex trading can be incredibly risky and can result in significant losses.

- The forex market can be volatile and unpredictable, making it difficult to make informed decisions.

- Many forex brokers charge high fees and commissions, which can eat into potential profits.

- Forex trading requires a significant amount of time and effort to learn and master.

Overall, understanding forex trading can be beneficial for those looking to diversify their investments and potentially make a profit. However, it is important to approach forex trading with caution and to thoroughly research and educate oneself before diving in.

In today’s world, forex trading has become a popular investment option for many people. However, for beginners, it can be challenging to understand the ins and outs of forex trading. It is essential for individuals to understand the basics of forex trading before investing their hard-earned money into it.

Firstly, it is crucial to understand that forex trading involves buying and selling currencies. The exchange rate between two currencies determines the profit or loss in forex trading. There are various factors that affect the exchange rate, such as economic and political events, interest rates, and inflation rates. Therefore, it is essential to keep an eye on these factors while trading in forex.

Moreover, forex trading requires a significant amount of research and analysis. Traders need to analyze the market trends, chart patterns, and other indicators to make informed decisions. It is also important to have a trading plan and stick to it. Additionally, traders should not let emotions guide their decisions. They should avoid making impulsive decisions based on fear or greed as it can lead to significant losses.

In conclusion, forex trading can be a lucrative investment option for those who understand its basics and are willing to put in the effort. It is essential to stay updated with the latest news and market trends, have a trading plan, and avoid making emotional decisions. With patience and discipline, anyone can become a successful forex trader.

Video understanding of forex trading

As a journalist covering the financial industry, I often receive questions from readers about forex trading. Here are some of the most common questions and my answers:

1. What is forex trading?

Forex trading, also known as foreign exchange trading, is the buying and selling of currencies in order to make a profit. Traders speculate on the value of one currency against another, hoping to buy low and sell high.

2. How does forex trading work?

Forex trading takes place in the global currency market, which is open 24 hours a day, five days a week. Traders use an online platform to place trades, which can be based on technical analysis, fundamental analysis, or a combination of both. The goal is to predict the direction of currency prices and make profitable trades.

3. Is forex trading risky?

Like any form of investment, forex trading carries risk. The market can be volatile and unpredictable, and traders can lose money as well as make money. It is important to have a solid understanding of the market and to use risk management strategies to protect your capital.

4. How much money do I need to start forex trading?

The amount of money you need to start forex trading depends on the broker you choose and the size of the trades you want to make. Some brokers allow you to open an account with just a few hundred dollars, while others require thousands or even tens of thousands. It is important to choose a broker that fits your budget and your trading style.

5. Can anyone learn to trade forex?

Yes, anyone can learn to trade forex with the right education and practice. There are many resources available online, including courses, webinars, and demo accounts that allow you to practice trading without risking real money. It is important to approach forex trading as a serious endeavor and to invest the time and effort necessary to succeed.

Overall, forex trading can be a rewarding and exciting way to invest your money. However, it is important to approach it with caution and to always do your research before making trades.