Looking to succeed in forex trading? Follow these expert tips for success: develop a strategy, manage risk, maintain discipline, and stay informed.

Are you interested in forex trading but unsure where to start? Many people jump into the world of forex without fully understanding how it works, leading to costly mistakes and lost profits. However, with the right tips and strategies, you can become a successful forex trader. In this article, we will provide you with some essential tips for successful forex trading, including how to manage your risk, choose the right broker, and analyze market trends. So, whether you’re a beginner or an experienced trader, read on to learn how to improve your forex trading skills and maximize your profits.

Daftar Isi

Introduction

Forex trading can be a lucrative venture for those who know how to navigate the market. However, it can also be a risky game if you don’t know what you’re doing. To help you succeed in forex trading, we’ve put together some tips that you should keep in mind.

Understand the Basics

Before you start trading, you need to understand the basics of forex trading. Learn about the different currency pairs, the factors that affect exchange rates, and the different types of orders you can use. This will give you a solid foundation to build upon as you start trading.

Choose a Reliable Broker

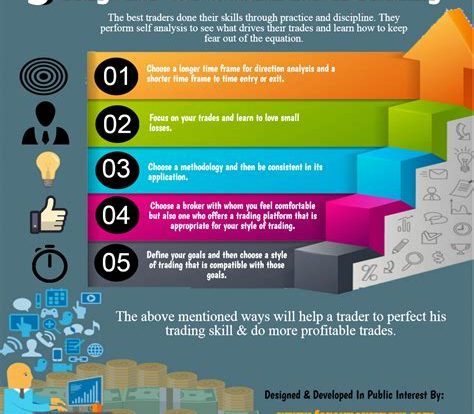

Your broker is your gateway to the forex market, so it’s important to choose one that is reliable and trustworthy. Look for a broker that is regulated by a reputable authority, has a good reputation in the industry, and offers competitive spreads and fees.

Develop a Trading Strategy

Successful forex traders don’t just trade on a whim – they have a well-defined trading strategy that they follow. Your trading strategy should take into account your risk tolerance, investment goals, and market analysis. It should also include rules for when to enter and exit trades.

Practice with a Demo Account

Before you start trading with real money, it’s a good idea to practice with a demo account. This will allow you to get a feel for the market and test out different trading strategies without risking any of your own money.

Manage Your Risk

Risk management is crucial in forex trading. You should never risk more than you can afford to lose, and you should always use stop-loss orders to limit your losses. You should also diversify your portfolio by trading different currency pairs and using different trading strategies.

Stay Informed

Forex markets are constantly changing, so it’s important to stay informed about the latest news and economic events. Follow financial news outlets, read analyst reports, and keep an eye on economic calendars to stay up-to-date on market trends.

Be Disciplined

Discipline is key to successful forex trading. Stick to your trading strategy, don’t let emotions cloud your judgment, and avoid impulsive trades. Remember that forex trading is a long-term game, and that consistent profits come from consistent trading.

Don’t Overtrade

Overtrading is a common mistake that many novice traders make. Don’t try to trade every currency pair or take every trade opportunity that comes your way. Instead, focus on a few currency pairs and only enter trades that meet your criteria.

Keep a Trading Journal

Keeping a trading journal can help you track your progress and identify areas for improvement. Record your trades, including the currency pair, entry and exit points, and the reason for the trade. Analyze your journal regularly to see what’s working and what’s not.

Conclusion

Forex trading can be a rewarding and exciting venture, but it requires discipline, knowledge, and practice. By following these tips, you’ll be well on your way to becoming a successful forex trader.

Successful forex trading requires a comprehensive understanding of basic concepts, such as currency pairs, trading platforms, and margin trading. As a beginner, it is essential to prioritize the development of a well-thought-out trading plan that includes specific goals, risk management strategies, and an overall trading strategy that suits your needs. Risk management is crucial in forex trading, especially during volatile market conditions, so use risk management tools, such as stop-loss orders, to minimize losses and protect profits.Forex trading can be impacted by various global events, such as political instability, economic indicators, and natural disasters. Therefore, it is crucial to stay informed about these events to gain a better understanding of market movements. Successful forex traders have a keen eye for analyzing market movements by using technical analysis tools, such as charts, graphs, and indicators. By analyzing market movements, traders can make informed decisions about when to enter or exit trades.Selecting a recognized and reputable forex broker with a proven track record for success, reliability, customer service, and transparent trading conditions is crucial. As a beginner, it is advisable to start trading with small amounts of money and gradually increase your investment as you gain more experience and understanding of market movements. Every trader makes mistakes, but it is essential to learn from them and avoid repeating them in the future.Continuous learning, evaluation, and adherence to your trading plan are critical to successful forex trading. Avoid impulsive decisions and stick to your strategy, regardless of market trends. Emotional trading decisions frequently result in losses, so remain calm and level-headed when analyzing market movements, executing trades, and managing risk.In conclusion, successful forex trading requires a combination of knowledge, discipline, risk management, and emotional control. Understanding the basics of forex trading, developing a trading plan, managing risk, analyzing market movements, finding a reputable forex broker, starting small, learning from mistakes, remaining disciplined, and controlling emotions are all essential components of successful forex trading. By following these tips, you can increase your chances of success in the forex market.

Forex trading can be a lucrative way to make money, but it can also be risky if not done correctly. Here are some tips for successful forex trading:

-

Stay Informed: Keep up to date with the latest news and events that could affect currency values.

-

Have a Strategy: Develop a clear plan for when to enter and exit trades, and stick to it.

-

Use Stop Losses: Set stop loss orders to limit potential losses in case the market moves against you.

-

Manage Your Risk: Only risk what you can afford to lose and never trade with money you need for essential expenses.

-

Keep a Record: Document your trades and analyze your performance to identify areas for improvement.

While following these tips can help increase your chances of success, there are also some pros and cons to keep in mind:

Pros:

-

Potential for High Returns: Forex trading can offer high returns if done correctly.

-

Diversification: Trading different currency pairs can help diversify your portfolio.

-

Around-the-Clock Trading: The forex market is open 24 hours a day, allowing for flexible trading opportunities.

Cons:

-

High Risk: Forex trading involves significant risk and potential losses.

-

Complexity: The forex market is complex and requires a deep understanding of economic and political factors that can affect currency values.

-

Scams: There are many scams and fraudulent brokers in the forex industry, so it’s important to do your research and choose a reputable broker.

Overall, forex trading can be a rewarding but challenging endeavor. By following these tips and carefully weighing the pros and cons, you can make informed decisions and increase your chances of success.

As the world’s largest financial market, forex trading is a highly lucrative business. It offers opportunities to earn profits quickly, but it’s also a risky venture that can cause significant losses. If you’re interested in venturing into the world of forex trading and want to be successful, there are some tips you need to keep in mind.

The first tip is to educate yourself about forex trading. Learn everything you can about the market, the currency pairs, and the various trading strategies. Attend seminars, read books, or take online courses to gain knowledge and experience. Remember that forex trading is a complex market, and you need to have a deep understanding of how it works to succeed.

The next tip is to have a solid trading plan. Develop a trading plan that includes your goals, risk tolerance, and preferred trading style. Your trading plan should also include your entry and exit strategies, as well as your money management rules. Stick to your plan and don’t let emotions dictate your decisions. Consistency is key to success in forex trading.

In conclusion, forex trading can be profitable if you approach it with the right mindset and strategies. Educate yourself, develop a solid trading plan, and stick to it. Remember to always manage your risks and never invest more than you can afford to lose. With discipline and perseverance, you can achieve success in the exciting world of forex trading.

Video tips for successful forex trading

As a journalist covering the financial markets, I often receive questions from readers about the world of forex trading. One common query is about tips for successful forex trading. Here are some answers to frequently asked questions:

-

What is forex trading?

-

What are some tips for successful forex trading?

-

Develop a trading plan and stick to it.

-

Manage your risk by using stop-loss orders.

-

Stay informed about economic and political news that could affect currency values.

-

Practice with a demo account before trading with real money.

-

Be patient and disciplined in your trading.

-

What are some common mistakes to avoid in forex trading?

-

Overtrading or trading based on emotions rather than logic.

-

Not having a clear exit strategy.

-

Ignoring risk management principles.

-

Not staying up-to-date with market developments.

-

Can anyone start forex trading?

-

Do I need a lot of money to start forex trading?

Forex trading is the act of exchanging one currency for another with the aim of making a profit from the difference in exchange rates.

Yes, anyone can start forex trading. However, it’s important to understand the risks involved and to have a solid understanding of the market before investing your money.

No, you don’t need a lot of money to start forex trading. Many brokers offer mini or micro accounts that allow you to trade with a small amount of money.

By following these tips and avoiding common mistakes, you can increase your chances of success in the exciting world of forex trading.