Simulated forex trading allows you to practice trading without risking real money. Test strategies, hone skills, and gain confidence before risking your capital.

Simulated forex trading has been gaining popularity among both beginner and professional traders. This innovative practice allows traders to experience the thrill of trading in the forex market without risking real money. Whether you are looking to hone your skills or simply enjoy the excitement of the market, simulated forex trading can provide you with a valuable learning experience. Moreover, it offers a safe environment to experiment with different strategies and tactics before implementing them in live trading. In this article, we will explore the benefits of simulated forex trading and how it can help you become a better trader.

Daftar Isi

The World of Simulated Forex Trading

Forex trading has become a popular investment option for many individuals, with the potential to earn high returns. However, it can also lead to significant losses if not done correctly. To reduce the risk of losing money, many traders turn to simulated forex trading.

What is Simulated Forex Trading?

Simulated forex trading is a practice that allows traders to simulate the experience of trading in the forex market without risking real money. Instead, traders use virtual currencies to buy and sell forex pairs in a simulated environment.

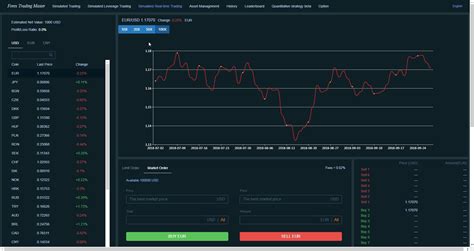

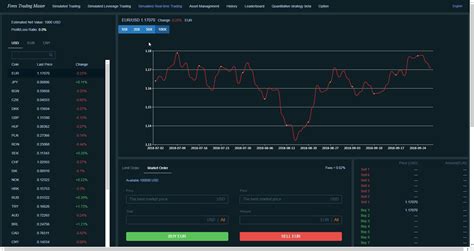

Simulated forex trading platforms are designed to mimic the real-time market conditions, allowing traders to test their strategies and hone their skills before investing real money. These platforms also provide access to historical data, charts, and news updates, enabling traders to make informed decisions.

The Benefits of Simulated Forex Trading

The benefits of simulated forex trading are numerous. Firstly, it allows traders to practice trading without risking real money, which helps build confidence and reduce anxiety. Secondly, it provides an opportunity to test trading strategies and identify strengths and weaknesses. Thirdly, it enables traders to learn how to use the trading platform and familiarize themselves with the market.

Simulated forex trading also helps traders to avoid costly mistakes. By learning from their mistakes and analyzing their trading decisions, traders can identify areas for improvement and refine their strategies. Additionally, traders can test out different trading styles and approaches, such as swing trading, day trading, or scalping.

The Drawbacks of Simulated Forex Trading

While simulated forex trading has many benefits, there are also some drawbacks to consider. Firstly, simulated trading does not replicate the emotional roller coaster that comes with trading real money. Traders may not feel the same level of stress or excitement when using virtual currencies as they would with real money.

Secondly, simulated trading may not accurately reflect the market conditions. While platforms try to replicate real-time market conditions, there may be discrepancies between the simulated environment and the real market. As such, traders may not get an accurate picture of how their strategies will perform in the real market.

How to Get Started with Simulated Forex Trading

Getting started with simulated forex trading is relatively easy. Most brokers offer demo accounts that allow traders to access their trading platform and begin trading with virtual currencies. Traders can take advantage of these demo accounts to practice their trading skills and test out their strategies.

It’s important to treat simulated trading like real trading. Traders should set up a trading plan and stick to it, just as they would with real money. They should also keep a trading journal to track their progress and analyze their performance. By doing so, traders can identify areas for improvement and refine their strategies.

Conclusion

Simulated forex trading is an excellent way for traders to practice their skills and learn how to navigate the forex market without risking real money. It provides an opportunity to test trading strategies, identify weaknesses, and refine approaches. While there are some drawbacks to consider, the benefits of simulated trading outweigh the risks. By taking advantage of demo accounts and treating simulated trading like real trading, traders can improve their skills and increase their chances of success in the forex market.

Introduction to Simulated Forex Trading

Simulated forex trading is a valuable tool for traders looking to learn and practice forex trading without risking real money. It involves using trading simulation software to simulate real market conditions, providing traders with real-time market data, and allowing them to practice different trading strategies.

How Simulated Forex Trading Works

Simulated forex trading is done through trading simulation software that simulates real market conditions. Traders are presented with market data in real-time, including charts, prices, and financial news. They can use this information to practice their trading strategies and see how they react in different market situations.

Advantages of Simulated Forex Trading

One of the main advantages of simulated forex trading is that traders can learn and practice different trading strategies without risking real money. This also helps traders develop discipline, patience, and emotional control. Additionally, simulated trading allows traders to evaluate their performance and identify areas that need improvement.

Limitations of Simulated Forex Trading

While simulated forex trading is a useful tool for learning and practicing, traders may not experience the same emotions that come with trading real money. This can lead to a false sense of confidence, which can be detrimental to their trading career. It is important to keep in mind that simulated trading should only be used as a supplement to real trading.

Setting Realistic Simulation Conditions

To get the most out of simulated forex trading, it is important to set realistic simulation conditions. This includes utilizing the same amount of capital, trading conditions, and trading strategies that one would use while trading real money. By doing so, traders can better prepare themselves for real trading conditions.

Using Simulated Forex Trading for Skill Development

Simulated forex trading is an excellent tool for skill development. Traders can use it to test different trading strategies and analyze their performance in different market conditions. This way, they can identify their strengths and weaknesses and make the necessary adjustments.

Adapting to Real Market Conditions

By practicing in simulated market environments, traders can get used to the speed and volatility of real markets. This can help them adapt to real market conditions more quickly and effectively.

Combining Simulated Trading with Real Trading

Traders can combine simulated forex trading with real trading to improve their performance. By practicing new strategies in a simulated environment before implementing them in real trading conditions, traders can better prepare themselves for real market conditions.

Evaluating Performance through Simulation Testing

Simulated trading allows traders to evaluate their performance and identify areas that need improvement. They can use different metrics, such as win rate, risk-reward ratio, and trade duration, to evaluate their trading performance and make necessary adjustments.

Conclusion

Overall, simulated forex trading is an effective way for traders to learn and practice forex trading without the risk of losing real money. It provides traders with valuable experience and skills that are crucial for becoming successful in the forex market. However, it should only be used as a supplement to real trading and traders should keep in mind the limitations of simulated trading.

Simulated forex trading, also known as paper trading or demo trading, is a practice that allows traders to test their strategies and skills in a simulated trading environment without risking real money. While this approach may seem attractive to novice traders who want to gain experience before entering the real market, it has its pros and cons.

Pros of Simulated Forex Trading

- Low risk: Since traders use virtual money, they don’t have to worry about losing real money if their trades go wrong.

- Practice and experience: Simulated trading allows traders to test their strategies and skills, gain experience, and improve their performance in a risk-free environment.

- No cost: Unlike real trading, there are no costs associated with simulated trading, such as brokerage fees or commissions.

- Real-time market conditions: Simulated trading platforms usually provide real-time market data and conditions, allowing traders to simulate actual market movements and trends.

- No emotional attachment: Since there’s no real money involved, traders can avoid being emotionally attached to their trades and make rational decisions based on their analysis and strategy.

Cons of Simulated Forex Trading

- No real profits: The biggest disadvantage of simulated trading is that traders can’t make any real profits. Even if they make successful trades, it’s all virtual, and they can’t withdraw any money.

- No emotional attachment: While this was listed as a pro, it can also be a con. Since traders have no emotional attachment, they may not take the practice as seriously, which can lead to careless mistakes.

- No real consequences: Without any real money at stake, traders may not take simulated trading seriously and may not learn valuable lessons about risk management and discipline.

- No slippage or execution problems: In real trading, traders may experience slippage or execution problems that can affect their profits or losses. Simulated trading platforms usually don’t simulate these issues, which can create a false sense of security for traders.

- No psychological pressure: Simulated trading doesn’t replicate the psychological pressure and stress that traders may experience in real trading, such as fear, greed, and anxiety.

Overall, simulated forex trading can be a useful tool for novice traders to gain experience and test their strategies without risking real money. However, it’s important to recognize its limitations and not rely solely on simulated trading. Traders should also seek to develop their skills and knowledge through other means, such as reading books, attending seminars, and analyzing the real market.

As a journalist covering the world of finance, I have seen many people try their hand at forex trading, some with great success and others with not so much. One thing that can greatly benefit those looking to get started in forex trading is simulated trading. This allows traders to practice trading without risking any real money.

Simulated trading is a valuable tool for beginners to learn the ins and outs of forex trading, as well as for experienced traders to test out new strategies. These simulations are designed to mimic real market conditions, giving traders a realistic experience without the risk. Traders can use these simulations to test out different trading strategies and see how they would perform in a live market environment.

While simulated trading is a great tool for learning and practicing, it is important to remember that it is not the same as live trading. The emotions and pressures of trading with real money can drastically impact a trader’s decision-making process. That being said, simulated trading can help traders build confidence and gain experience before venturing into the live trading world.

In conclusion, simulated trading is a valuable tool for anyone looking to get started in forex trading or for experienced traders looking to try out new strategies. While it is not the same as live trading, it can help traders build confidence and gain experience without risking any real money. So, if you are interested in forex trading, give simulated trading a try and see how it can benefit you!

Video simulated forex trading

Simulated forex trading is a popular way for individuals to practice trading in the foreign exchange market without risking actual money. As such, it is common for people to ask questions about this type of trading. Here are some of the most frequently asked questions and their answers:

1. What is simulated forex trading?

- Simulated forex trading is a type of practice trading that allows individuals to experience the process of buying and selling currency pairs without using real money.

- It involves the use of a trading platform that simulates the actual market conditions, such as price movements and order execution.

2. Why do people use simulated forex trading?

- People use simulated forex trading to gain experience and confidence in trading without risking actual money.

- It allows them to test different trading strategies and techniques before using them in the real market.

- Simulated trading can also help traders identify their strengths and weaknesses and improve their skills.

3. Is simulated forex trading realistic?

- Simulated forex trading can be very realistic, as the trading platform simulates actual market conditions as closely as possible.

- However, it is important to note that there may be some differences between simulated trading and live trading, such as slippage and liquidity issues.

4. Can you make money from simulated forex trading?

- No, you cannot make actual money from simulated forex trading, as it is just a practice exercise.

- However, if you are successful in simulated trading, it can give you the knowledge and skills needed to make money in real trading.

5. Are there any risks involved in simulated forex trading?

- There are no actual financial risks in simulated forex trading, as you are not using real money.

- However, there is a risk of developing bad trading habits if you do not take the exercise seriously or treat it like a game.

Overall, simulated forex trading can be a valuable tool for individuals looking to gain experience and confidence in the foreign exchange market. However, it is important to approach it with seriousness and use it as a learning exercise rather than a game.