Maximize your profits with forex trading. Learn the strategies and tools needed to succeed in the dynamic and fast-paced forex market.

Profit trading forex has garnered immense popularity in recent years due to its potential for high returns on investment. With the advent of technological advancements, trading in foreign exchange has become more accessible to the general public, and the market has become more liquid than ever before. However, with great potential for profit comes an equal amount of risk, and it is essential to understand that forex trading is not a get-rich-quick scheme.

Nevertheless, for those who are willing to put in the time, effort, and resources to learn and develop their skills, forex trading can be an incredibly lucrative venture. The key to success lies in understanding the market, developing a sound trading strategy, and having the discipline to stick to it. In this article, we will delve deeper into the world of profit trading forex, exploring the various aspects that make it such an attractive proposition for investors around the world.

So, if you are looking for a potentially rewarding investment opportunity that requires dedication, hard work, and a willingness to learn, read on to discover how forex trading could be the path to financial freedom that you have been searching for.

Daftar Isi

Introduction

Forex trading is one of the most lucrative markets in the world, allowing traders to earn significant profits while trading on global currencies. However, it can be a challenging market to navigate, and many traders struggle to make profits consistently. In this article, we will discuss some tips and strategies that can help you profit from forex trading.

Understand the Market

Before you can start trading forex, it is essential to understand the market. Forex trading involves buying and selling different currencies, and the value of these currencies fluctuates based on various factors such as economic data, geopolitical events, and market sentiment. Therefore, it is crucial to stay up-to-date with the latest news and trends that could affect the market.

Use Fundamental Analysis

One way to understand the market is by using fundamental analysis. This involves analyzing economic data such as GDP, inflation, and employment figures to determine the health of an economy and its currency. By understanding the fundamentals, you can make informed trading decisions that are based on actual data.

Use Technical Analysis

Another way to analyze the market is by using technical analysis. This involves studying price charts and identifying patterns that indicate potential price movements. Technical analysis can help you identify entry and exit points for trades and can be a valuable tool for making profitable trades.

Develop a Trading Strategy

To be successful in forex trading, it is essential to have a trading strategy. A trading strategy outlines your approach to the market and includes things like your entry and exit points, risk management plan, and profit targets. It is essential to have a well-defined strategy that you follow consistently to maximize your profits and minimize your losses.

Practice with a Demo Account

Before you start trading with real money, it is a good idea to practice with a demo account. A demo account allows you to trade with virtual money, giving you the opportunity to test your trading strategy without risking any real money. This can help you refine your strategy and gain confidence before you start trading with real money.

Manage Your Risk

Forex trading involves risk, and it is crucial to manage your risk carefully to protect your capital. One way to manage your risk is by using stop-loss orders, which automatically close your position if the market moves against you. It is also essential to use proper position sizing and not risk more than a small percentage of your capital on any one trade.

Use Proper Position Sizing

Proper position sizing involves determining the appropriate amount of money to risk on each trade based on your account size and risk tolerance. By using proper position sizing, you can minimize your risk and maximize your profits over the long term.

Be Patient and Disciplined

One of the most important traits of successful forex traders is patience and discipline. Forex trading can be volatile, and it is crucial to wait for the right opportunities to present themselves before entering a trade. It is also important to stick to your trading plan and not let emotions like fear or greed cloud your judgment.

Control Your Emotions

Controlling your emotions is essential in forex trading. Fear and greed can lead to impulsive trading decisions that can result in significant losses. By staying calm and disciplined, you can make rational trading decisions that are based on your strategy and analysis.

Conclusion

Forex trading can be a profitable endeavor if approached with the right mindset and strategies. By understanding the market, developing a trading strategy, managing your risk, and being patient and disciplined, you can increase your chances of success in this exciting market. Remember to always stay informed and never stop learning, as the forex market is constantly evolving.

Introduction: Understanding Forex and Profit Trading

Forex trading is the exchange of foreign currencies in the global market and has become increasingly popular among investors over the years. Profit trading, on the other hand, is the practice of placing trades with the goal of generating profits. In this article, we explore how profit trading works in the Forex market, its advantages, and risks that come with this investment approach.

Know the Market and Trading Strategies

The first step in making profits is to understand how the market works and the different trading strategies that can be used to take advantage of fluctuations in price. Currencies are generally traded in pairs, and traders need to monitor market trends and choose suitable trading strategies to maximize their profits. Some popular trading strategies include scalping, swing trading, and position trading.

Scalping

Scalping is a short-term trading strategy where traders aim to profit from small price movements by entering and exiting trades quickly. This strategy requires a lot of time and attention, as traders need to make multiple trades within a day to generate profits.

Swing Trading

Swing trading is a medium-term trading strategy where traders hold positions for several days or weeks. This strategy involves analyzing market trends and using technical analysis tools to identify potential entry and exit points.

Position Trading

Position trading is a long-term trading strategy where traders hold positions for several months or even years. This strategy involves analyzing fundamental factors such as economic indicators and geopolitical events to identify currency pairs that are likely to appreciate over time.

Understanding Risk Management

Profit trading in Forex can be very lucrative, but it’s essential to manage risk to avoid losses. Risk management strategies such as stop-loss orders or hedging can help traders minimize their exposure to market volatility and reduce losses. Traders should also ensure that they have adequate capital to withstand market fluctuations and avoid over-leveraging their trades.

Choose a Reputable Broker

Choosing a reliable Forex broker is crucial for successful profit trading. A good broker should offer competitive spreads, low trading fees, and reliable trading platforms to allow traders to execute trades swiftly and efficiently. It’s also important to consider factors such as regulation, customer support, and the broker’s reputation in the industry.

Take Advantage of Technological Advancements

Technology has revolutionized the Forex market, and traders can now benefit from sophisticated tools such as automated trading systems and algorithm-based trading strategies. These advanced technologies can help traders achieve better results while reducing the risks associated with trading. However, it’s important to test these tools thoroughly before using them in live trading to ensure that they are reliable and effective.

Stay Informed About Market Developments

Market developments such as political events, economic reports, and corporate earnings can significantly impact the Forex market. It is, therefore, essential to stay informed about global events to make informed trading decisions and maximize profits. Traders should also keep an eye on market sentiment and adjust their trading strategies accordingly.

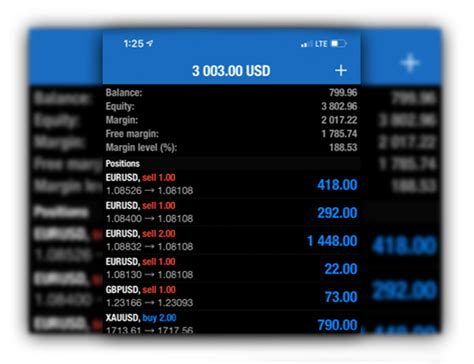

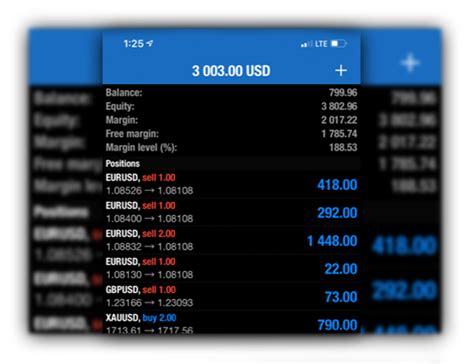

Monitor Your Trading Performance

Profit trading requires a disciplined approach, and traders need to monitor their performance continually. This allows them to evaluate what’s working and what’s not and adjust their strategies accordingly. This also helps traders to avoid emotional trading decisions and stick to their trading plans. Keeping a trading journal can be an effective way to track trading performance and identify areas for improvement.

Be Patient and Avoid Greed

Patience is essential in Forex profit trading. It takes time to develop a reliable trading strategy and establish consistent profitability. Traders should avoid being greedy and set realistic profit targets while always being mindful of the risks involved. It’s also important to avoid impulsive trades and stick to the trading plan.

Conclusion: Making Profits from Forex Trading

Profit trading in Forex can be a lucrative venture when done correctly. Understanding the market, building a robust trading strategy, and managing risks are crucial for traders looking to maximize their profits. With the right mindset, a disciplined approach, and continuous learning, Forex profit trading can be a rewarding experience. Traders should always stay informed about market developments, monitor their performance, and avoid being greedy or impulsive when making trading decisions.Profit trading forex has become increasingly popular in recent years, with people looking to make significant gains from the currency markets. However, while there are certainly opportunities to make money, there are also risks that should be carefully considered.Pros of Profit Trading Forex:1. High Potential Returns: The forex market is known for its high volatility, which means there is the potential to make significant profits if traders can correctly predict market movements.2. Diversification: Forex trading allows investors to diversify their portfolios and spread their risk across multiple currencies.3. Accessibility: With advances in technology, it is now easier than ever to access the forex market from anywhere in the world. This means that anyone with an internet connection can trade forex.Cons of Profit Trading Forex:1. High Risk: Due to the high volatility of the forex market, there is also a high risk of losing money. Traders must be aware of this risk and have a solid understanding of the market before investing.2. Complexity: The forex market can be complex and difficult to understand, especially for beginners. Traders must have a good understanding of technical analysis and fundamental analysis to make informed trading decisions.3. Lack of Regulation: The forex market is largely unregulated, which means that traders must be vigilant when choosing a broker. There is a risk of fraud and scams in the market, so traders should do their due diligence before investing.In conclusion, profit trading forex can be a lucrative opportunity for those who are willing to put in the time and effort to learn about the market. However, it is important to remember that there are risks involved and traders must be cautious and informed before investing.

As a journalist, it’s my responsibility to provide you with accurate and informative information. Today, I want to talk about the possibility of making a profit through forex trading. While it’s true that forex trading can be a lucrative venture, it’s important to approach it with caution and a willingness to learn.

The first thing to understand is that forex trading involves buying and selling currencies in an attempt to make a profit. This is done through a broker, and there are many different strategies you can use to try to predict which way a currency will move. Some people use technical analysis, while others rely on fundamental analysis. Regardless of your strategy, it’s important to remember that forex trading is inherently risky, and you should never invest more than you can afford to lose.

That being said, many people have been able to make a significant profit through forex trading. The key is to approach it with a clear head and a willingness to learn. There are many resources available online that can help you develop your trading strategy, and many brokers offer demo accounts that allow you to practice trading without risking any real money.

In conclusion, while forex trading can be a profitable venture, it’s important to approach it with caution and a willingness to learn. If you’re interested in getting started, take the time to research different brokers and strategies, and don’t be afraid to start small. With patience and persistence, you may be able to turn a profit through forex trading.

Video profit trading forex

Visit VideoPeople also ask about profit trading Forex, and we’re here to provide answers. Here are some frequently asked questions and their corresponding answers:1. What is Forex Trading?Forex trading, also known as foreign exchange trading, involves buying and selling currencies in the global marketplace. Traders aim to profit from fluctuations in currency prices. It is one of the largest and most liquid financial markets in the world.2. Can You Make Money Trading Forex?Yes, it is possible to make money trading forex. However, it requires knowledge, skill, and experience. It is not a get-rich-quick scheme, and there is always risk involved. Traders need to have a solid understanding of market trends and technical analysis, as well as the ability to manage risk effectively.3. How Much Money Can You Make Trading Forex?There is no fixed answer to this question, as it depends on various factors such as market conditions, trading strategy, and risk management. Some traders make significant profits, while others may experience losses. It is important to set realistic expectations and develop a trading plan that aligns with your goals and risk tolerance.4. Is Forex Trading Legal?Forex trading is legal in most countries, but regulations may vary. It is important to check the laws and regulations in your country before getting started. In some countries, forex trading may be restricted or require a license or registration.In conclusion, Forex trading can be a profitable venture for those who are willing to put in the time and effort to learn and develop their skills. However, it is important to approach it with caution and manage risk effectively. Always seek professional advice and stay informed about market developments.