Paper trading is a way to practice trading without risking real money. It’s a great way to test strategies before entering the market.

Paper trading is a simulation of the stock market that allows investors to practice trading without risking real money. It’s an excellent way to test and refine investment strategies before putting them into action. However, paper trading is more than just a game; it’s a valuable tool that can help investors make better decisions in the real world. By using paper trading, investors can learn how to analyze market trends, identify potential risks, and manage their portfolios effectively.

Moreover, paper trading provides a low-risk environment for novice investors to gain experience and confidence in the financial markets. It’s an opportunity for them to learn from their mistakes and develop their trading skills without the fear of losing actual capital. In addition, paper trading allows investors to experiment with different investment strategies and compare the results side by side, which can be a powerful learning experience.

In conclusion, paper trading is not just a fun activity for aspiring traders; it’s a crucial step in the journey towards becoming a successful investor. By using paper trading, investors can gain valuable insights into the market, develop their trading skills, and build confidence in their abilities. Whether you’re a seasoned trader or a beginner, paper trading is an excellent way to hone your investment strategy and prepare for the challenges of the real world.

Daftar Isi

The World of Paper Trading

Paper trading is the practice of simulating trades in a risk-free environment. It is commonly used by novice traders who want to practice their investment strategies without risking any actual money. In this article, we will explore the world of paper trading and how it can benefit traders.

What is Paper Trading?

As mentioned earlier, paper trading is the practice of simulating trades in a risk-free environment. Instead of using real money, traders use virtual money to buy and sell stocks, options, and other securities. This allows them to test their investment strategies and see how they would perform in real market conditions without risking any actual capital.

The Benefits of Paper Trading

There are several benefits to paper trading. First and foremost, it allows traders to practice their investment strategies and gain experience without risking real money. This is especially important for novice traders who may not have a lot of capital to invest or who are unsure about their investment strategies.

Paper trading also allows traders to test new investment strategies before actually implementing them in the real market. This can help traders avoid costly mistakes and refine their strategies before putting real money on the line.

How to Get Started with Paper Trading

Getting started with paper trading is relatively easy. There are several online platforms that offer paper trading simulations, including Investopedia, TD Ameritrade, and E-Trade. These platforms allow traders to create virtual portfolios, trade virtual money, and track their performance over time.

Traders can also use paper trading to practice different investment strategies, such as day trading, swing trading, and long-term investing. By practicing these strategies in a risk-free environment, traders can gain confidence and improve their skills over time.

The Limitations of Paper Trading

While paper trading can be a useful tool for novice traders, it does have its limitations. One of the main limitations is that it does not replicate the emotional rollercoaster of real trading. When real money is on the line, traders may experience fear, greed, and other emotions that can impact their decision-making.

Additionally, paper trading simulations may not always reflect real market conditions. In some cases, the simulated prices may be different from actual market prices, which can impact the accuracy of the simulation.

Conclusion

Paper trading is a useful tool for novice traders who want to practice their investment strategies without risking real money. It allows traders to gain experience, test new strategies, and refine their skills over time. While it does have its limitations, paper trading can be an effective way to prepare for real market conditions and improve your chances of success as a trader.

Exploring the World of Paper Trading

For individuals new to the world of investing, paper trading is an excellent way to get started without risking real money. Paper trading allows investors to practice their trading strategies and gain experience before they make actual trades in the market. The concept of paper trading is simple: individuals use a simulated trading account to buy and sell securities, track their performance, and test various trading strategies.

The Benefits of Paper Trading

One of the most significant advantages of paper trading is that it allows individuals to practice trading without risking their hard-earned money. This helps investors build confidence in their trading abilities and develop effective strategies. Additionally, paper trading enables investors to test their strategies in real-time situations and make necessary adjustments. By using paper trading, investors can learn essential skills such as setting up trades, managing risk, and analyzing market conditions.

Choosing a Platform

Choosing the right paper trading platform is critical for success. There are many options available, from free online resources to paid subscription-based services. When selecting a platform, investors should consider the platform’s user interface, educational resources, and customer support. Some popular paper trading platforms include Virtual Trading, Stock Trainer, and TD Ameritrade’s Thinkorswim.

Creating a Strategy

Investors must develop a clear trading strategy for paper trading. A trading plan should include specific entry and exit points, risk management techniques, and trade size. A well-developed strategy helps investors stay disciplined and avoid impulsive decisions. It’s essential to remember that a successful trading strategy takes time and patience to develop. Investors must be willing to adjust their strategies based on their experiences and outcomes.

Testing Your Strategy

Once a trading plan is in place, investors must test their strategies thoroughly. Paper trading allows investors to evaluate their strategies’ effectiveness by tracking performance and making adjustments as needed. It is crucial to record all trades and analyze the data to identify patterns and areas for improvement. Investors should also use paper trading to test new strategies and techniques before implementing them in real trading situations.

Analysis and Tracking

Monitoring and assessing paper trading performance over time is critical for improving trading strategies. Investors should regularly review their trading performance, analyze their results, and adjust their strategies accordingly. Keeping a journal or log of trades is an excellent way to track performance and identify areas for improvement. Investors should also pay attention to market trends and news that may impact their trading strategies.

Emotions and Psychology

Managing emotions and psychology is a significant challenge for many investors. Paper trading can help individuals develop the discipline and emotional control necessary for successful trading. Investors must learn to manage their emotions, avoid impulsive decisions, and stick to their trading plans. It’s important to remember that trading involves risks, and losses are a natural part of the process. Investors must stay focused on their long-term goals and not let short-term setbacks derail their progress.

Incorporating Market News and Trends

Staying up-to-date on market news and trends is essential for successful paper trading. Investors should regularly read financial news and stay informed about changes that may impact their trading strategies. Keeping up with economic indicators, company earnings reports, and global events can help investors make more informed decisions. Incorporating market news and trends into trading strategies can help investors stay ahead of the curve and take advantage of opportunities.

Transitioning to Live Trading

Transitioning from paper trading to live trading can be a significant step for investors. It’s essential to start with small trades and gradually increase trading size as confidence and experience grow. Investors should also be prepared for the emotional challenges that come with live trading, such as dealing with losses and managing risk. It’s important to stick to a trading plan and avoid impulsive decisions.

Frequently Asked Questions

Some common questions and concerns about paper trading include:

- Is paper trading realistic? While paper trading is not the same as trading with real money, it does allow individuals to practice trading in a simulated environment that closely mirrors market conditions.

- How much should I paper trade before transitioning to live trading? There is no set amount of time or trades that an individual should complete before transitioning to live trading. However, investors should feel confident in their trading strategies and have a solid understanding of market conditions before making the switch.

- Can paper trading guarantee success in live trading? No, paper trading cannot guarantee success in live trading. However, it can help investors develop effective trading strategies, gain experience, and build confidence in their abilities.

Overall, paper trading is an excellent way for investors to gain experience and develop effective trading strategies without risking real money. By following these tips and guidelines, individuals can successfully navigate the world of paper trading and prepare themselves for live trading situations.

In the world of trading, paper trading is a popular method used by traders to practice and test their strategies before actually investing real money. Paper trading refers to simulating real trades without risking any actual capital.

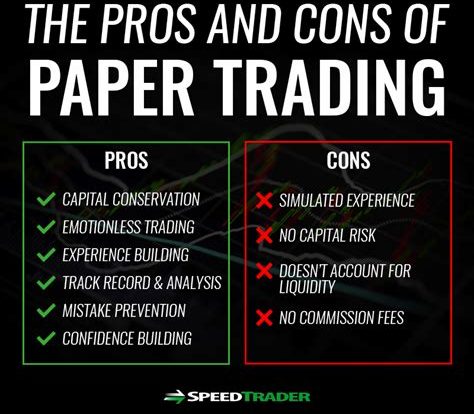

Pros of paper trading:

- Low risk: Since no actual money is being invested, paper trading provides a low-risk environment for traders to test out their strategies.

- No financial loss: If a trader makes a mistake during paper trading, they won’t experience any financial loss as they are only using virtual money.

- Realistic market conditions: Paper trading allows traders to simulate real market conditions and test their strategies in a realistic environment.

- Testing multiple strategies: Traders can use paper trading to test multiple strategies at the same time and evaluate which one works best for them.

- Learning experience: Paper trading can be a great learning experience for novice traders who are new to the world of trading.

Cons of paper trading:

- No emotional connection: Traders may not experience the same emotional connection during paper trading as they would when investing real money, which can affect their decision-making process.

- No real-world consequences: Since there are no real-world consequences, traders may take risks during paper trading that they wouldn’t take when investing real money.

- Limited testing: Paper trading may not provide an accurate representation of how a strategy would perform in real-world scenarios as it doesn’t take into account factors such as slippage and market liquidity.

- No guarantee of success: Even if a strategy performs well during paper trading, there is no guarantee that it will perform well when investing real money.

- Not a substitute for real-world experience: While paper trading can be a great learning experience, it should not be used as a substitute for real-world experience in the world of trading.

Overall, paper trading can be a valuable tool for traders who are looking to test their strategies and gain experience in the world of trading. However, it’s important to keep in mind that paper trading has its limitations and may not provide a completely accurate representation of how a strategy would perform in real-world scenarios.

As a journalist, I have come across a lot of online traders who are eager to make it big in the trading industry. However, some of these traders rush into live trading without first understanding the basics of trading. This is where paper trading comes in. Paper trading is a way of practicing trading strategies without risking any real money. It is an excellent way for beginners to test the waters before jumping into live trading.

If you are new to trading, paper trading is the perfect place to start. It will help you understand how the market works, how to use trading platforms, and how to manage your risk. You can also test different trading strategies and see which ones work best for you. Paper trading is not just for beginners; even experienced traders use it to test new strategies or refine their existing ones.

In conclusion, paper trading is an essential tool for anyone who wants to succeed in trading. It offers a risk-free way to practice trading strategies and learn how the market works. Whether you are a beginner or an experienced trader, paper trading can help you improve your skills and increase your chances of success. So, before you start trading with real money, take some time to paper trade and master the art of trading.

Video paper trading

As a journalist, I often receive questions from readers about paper trading. Here are some of the most common questions people ask, along with their answers:

-

What is paper trading?

Paper trading is a method of practicing trading in the stock market without using real money. It involves using a simulated trading platform to make trades, track performance, and analyze results.

-

Why do people paper trade?

People paper trade for several reasons. Some use it as a way to practice trading strategies and gain experience before risking real money. Others use it to test out new ideas or to see how different markets or securities perform without making actual trades.

-

Is paper trading the same as demo trading?

Yes, paper trading and demo trading are essentially the same thing. Both involve using a simulated trading platform to practice trading without using real money.

-

Do you need special software to paper trade?

There are several online brokers and trading platforms that offer paper trading functionality. You may need to sign up for an account or download software to access these platforms.

-

Can you make money from paper trading?

No, you cannot make real money from paper trading. However, it can be a useful tool for developing skills and testing trading strategies that can ultimately lead to profits in the real market.

-

Is paper trading a good way to learn about the stock market?

Yes, paper trading can be a great way to learn about the stock market and gain experience in trading without risking real money. It can help you understand how different securities and markets behave, as well as develop skills in analyzing market trends and making trades.