Learn to trade online and take control of your financial future. Gain the skills and knowledge needed to succeed in the markets.

Learning to trade online can be a daunting task, but it doesn’t have to be. With the rise of technology, more and more people are turning to the internet to invest in stocks, currencies, and commodities from the comfort of their own homes. But where do you start? How do you sift through the countless resources available to find the right platform or strategy for you? Fortunately, there are several steps you can take to make the process easier and more effective.

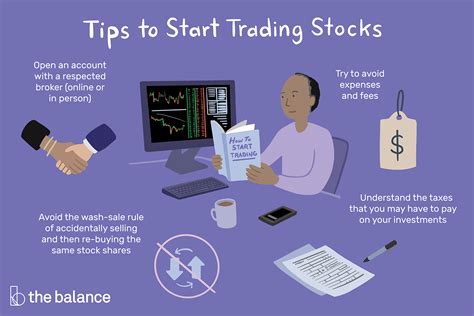

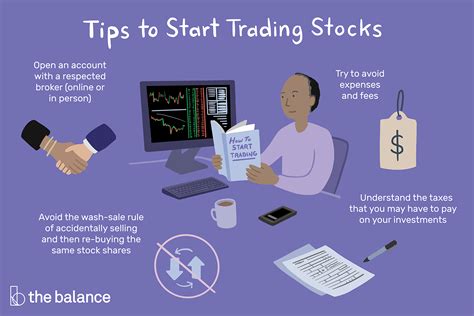

Firstly, it’s essential to educate yourself on the basics of trading. This includes understanding the different types of markets, the risks involved, and the terminology used. Once you have a solid foundation, you can start researching online brokers and platforms to find one that suits your needs. Look for user-friendly interfaces, low fees, and a wide range of trading options.

Once you’ve chosen a platform, it’s time to develop a trading strategy. This involves setting goals, analyzing market trends, and using tools such as technical analysis or fundamental analysis to make informed decisions. Remember, trading is not a get-rich-quick scheme, and success requires patience, discipline, and continuous learning.

In conclusion, learning to trade online can be a rewarding and profitable experience, but it requires effort and dedication. By educating yourself, choosing the right platform, and developing a solid trading strategy, you can increase your chances of success in the exciting world of online trading.

Daftar Isi

Introduction

With the rise of the internet and technology, trading has become more accessible than ever before. Nowadays, anyone can learn to trade online from the comfort of their own home. However, it is important to approach trading with caution and a willingness to learn. In this article, we will explore some tips and tricks for learning how to trade online successfully.

Choose a Trading Platform

The first step in learning to trade online is choosing a trading platform. There are many different platforms available, each with their own strengths and weaknesses. It is important to do your research and choose a platform that suits your needs and preferences. Some popular options include E-Trade, TD Ameritrade, and Robinhood.

Understand Your Risk Tolerance

Before you start trading, it is important to understand your risk tolerance. This refers to the amount of risk you are willing to take on in order to achieve potential rewards. It is important to set realistic expectations and avoid taking on more risk than you are comfortable with.

Learn About Different Investment Vehicles

There are many different types of investment vehicles available, such as stocks, bonds, and mutual funds. Each type of investment has its own unique features and risks. It is important to do your research and understand the pros and cons of each type of investment before diving in.

Start Small

When you are first starting out, it is best to start small. This means investing smaller amounts of money and taking on less risk. As you gain experience and confidence, you can gradually increase the size of your investments.

Develop a Trading Strategy

A successful trading strategy involves planning ahead and making informed decisions. This may involve setting specific goals, identifying entry and exit points, and monitoring market trends. It is important to have a plan in place before you start trading.

Use Stop-Loss Orders

A stop-loss order is a tool that can help minimize losses in the event of a sudden market downturn. This involves setting a specific price at which you will automatically sell your investment if the price falls below a certain level. This can help protect your investments from sudden drops in value.

Practice Patience

Trading can be exciting, but it is important to practice patience. Avoid making impulsive decisions based on emotions or short-term trends. Instead, take a long-term approach and stick to your trading strategy.

Stay Informed

To be a successful trader, it is important to stay informed about market trends and news. This may involve reading financial news articles, following social media accounts of industry experts, or attending conferences and workshops.

Learn From Your Mistakes

Trading involves taking risks, and sometimes those risks don’t pay off. It is important to learn from your mistakes and avoid making the same mistakes in the future. Take time to reflect on your past trades and adjust your strategy accordingly.

Conclusion

Learning to trade online can be a rewarding experience, but it requires patience, discipline, and a willingness to learn. By following these tips and tricks, you can increase your chances of success and minimize your risk of losses.

Learn to Trade Online: How to Navigate the Online Trading World Successfully

Online trading has become one of the most popular ways to invest in financial markets and make profits from the comfort of your home. However, it can also be a daunting task if you do not know how to navigate the online trading world successfully. Here are some tips on how to start trading online:

Understanding the Basics of Trading before Jumping In

Before you start trading online, it is essential to understand the basics of trading, such as what is a stock, bond, or option, how to read financial statements, how to analyze market trends, and how to place orders online. You can find plenty of free educational resources online that can help you learn these skills, including webinars, tutorials, and online courses.

Choosing a Reliable Online Trading Platform

Choosing a reliable online trading platform is crucial for your success as an online trader. A good trading platform should be easy to use, have a wide range of financial instruments, offer real-time quotes and charts, provide research and analysis tools, and have excellent customer support. Some of the popular online trading platforms include E-Trade, TD Ameritrade, and Charles Schwab.

Developing a Solid Trading Strategy to Maximize Profits

A solid trading strategy is essential to maximize your profits and minimize your losses. Your trading strategy should include your investment goals, risk tolerance, trading style, and entry and exit points. You should also decide whether you want to trade stocks, options, futures, or forex, and what type of analysis you will use, such as fundamental or technical analysis.

Setting Realistic Goals to Stay Motivated and Focused

Setting realistic goals is crucial to stay motivated and focused on your trading journey. Your goals should be specific, measurable, achievable, relevant, and time-bound. For example, you can set a goal to make a certain percentage of profits per month or year, or to learn a new trading skill every week. Remember to celebrate your achievements and learn from your mistakes.

How to Manage Trading Risks Effectively

Managing trading risks effectively is critical for your survival as an online trader. You should always use stop-loss orders to limit your losses, diversify your portfolio to reduce your exposure to a single asset or market, and avoid overtrading or chasing hot stocks. You should also keep an eye on your emotional state and avoid trading when you are tired, stressed, or distracted.

The Importance of Staying Up-to-Date with Market Trends and Global News

Staying up-to-date with market trends and global news is vital for your success as an online trader. You should regularly read financial news, watch market updates, and follow social media influencers and analysts to get insights into the market sentiment and potential opportunities or threats. You should also keep an eye on economic indicators, such as interest rates, GDP, and inflation, as they can affect the overall market conditions.

The Benefits of Joining Online Trading Communities and Forums

Joining online trading communities and forums can be a great way to learn from other traders, share your experiences, and get support and advice. You can find plenty of online trading communities and forums on social media platforms, such as Facebook, Twitter, and LinkedIn, or specialized websites, such as StockTwits, TradingView, or Investopedia. However, you should be careful not to follow blindly other traders’ recommendations and always do your own research.

Tips and Tricks for Building a Diverse Trading Portfolio

Building a diverse trading portfolio is essential to reduce your risk exposure and maximize your returns. You should invest in different asset classes, such as stocks, bonds, commodities, and currencies, and diversify your investments across different sectors, industries, and regions. You can also use different trading strategies, such as value investing, growth investing, or momentum investing, to balance your portfolio and take advantage of different market conditions.

Balancing Trading and Personal Life to Avoid Burnout and Stress

Finally, balancing trading and personal life is crucial to avoid burnout and stress. Online trading can be addictive and time-consuming, especially if you are passionate about it. However, it is essential to take breaks, exercise, socialize, and pursue other hobbies and interests to maintain a healthy work-life balance. Remember that trading is just one part of your life, and it should not define your worth or happiness.

In conclusion, learning to trade online requires dedication, discipline, and patience. By understanding the basics of trading, choosing a reliable online trading platform, developing a solid trading strategy, setting realistic goals, managing risks effectively, staying up-to-date with market trends and news, joining online trading communities and forums, building a diverse trading portfolio, and balancing trading and personal life, you can increase your chances of success as an online trader. Good luck!

In today’s digital age, learning to trade online has become a popular option for individuals looking to invest and make profits from the comfort of their own homes. However, as with any investment opportunity, there are pros and cons to consider before diving in.Pros:1. Convenience: One of the biggest advantages of online trading is the convenience factor. With just a few clicks, investors can access a variety of trading platforms, research tools, and educational resources, all from the comfort of their own homes.2. Lower Costs: Online trading typically comes with lower costs compared to traditional methods. Investors can save on broker fees, commissions, and other expenses associated with in-person trading.3. Diversification: Online trading offers investors the ability to diversify their portfolio with a wide range of investment options, including stocks, bonds, and mutual funds.4. Control: With online trading, investors have more control over their investments. They can monitor their portfolio in real-time, make trades quickly and easily, and adjust their strategy as needed.Cons:1. Risk: As with any investment, online trading comes with risk. Investors must be prepared to lose money and understand that there are no guarantees of profits.2. Lack of Personal Interaction: Online trading can be a solitary experience, lacking the personal interaction and guidance that comes with traditional in-person trading.3. Overconfidence: The ease of online trading can lead some investors to become overconfident and make risky decisions without proper research and analysis.4. Security Concerns: Online trading requires investors to share personal and financial information, which can be vulnerable to cyber threats and hacking attempts.In conclusion, learning to trade online can offer convenience, lower costs, diversification, and control, but also carries risks, lack of personal interaction, overconfidence, and security concerns. It is important for investors to weigh these pros and cons carefully and conduct thorough research before entering the world of online trading.

As the world continues to shift towards a more digital landscape, it’s no surprise that many people are turning to online trading as a means of making money. However, with so many options available, it can be overwhelming to know where to start. The good news is that learning to trade online doesn’t have to be complicated or expensive.

One of the first steps to take when learning to trade online is to do your research. Take the time to read up on different trading platforms and strategies. Look for reputable sources and be wary of anyone promising overnight success or guaranteed profits. Remember that trading always involves risk, and there are no shortcuts to success.

Another important aspect of learning to trade online is to practice, practice, practice. Many trading platforms offer demo accounts that allow you to trade with virtual money and get a feel for how things work. Take advantage of these resources and don’t be afraid to make mistakes. Learning from your losses is an essential part of becoming a successful trader.

In conclusion, while learning to trade online may seem daunting at first, it is possible to do so without breaking the bank or getting scammed. By doing your research, practicing, and staying disciplined, you can develop the skills and confidence needed to navigate the world of online trading. So, take the plunge and start learning today!

Video learn to trade online

When it comes to learning how to trade online, there are several questions that people commonly ask. Here are some of the most frequently asked questions and their answers:

1. Is it possible to learn how to trade online?

Yes, it is definitely possible to learn how to trade online. There are many resources available that can teach you the basics of trading, as well as more advanced techniques. Some popular resources include online courses, books, webinars, and trading forums.

2. How long does it take to learn how to trade online?

The amount of time it takes to learn how to trade online varies depending on a number of factors, including your level of dedication, your previous experience with trading, and the complexity of the markets you are interested in. Some people are able to learn the basics of trading in just a few weeks, while others may take several months or even years to become proficient.

3. What skills do I need to learn how to trade online?

Some of the key skills you will need to learn in order to become a successful online trader include:

- A solid understanding of financial markets and trading terminology

- The ability to analyze market trends and make informed decisions based on that analysis

- Discipline and patience when it comes to executing trades and managing risk

- The ability to adapt to changing market conditions and adjust your trading strategy accordingly

4. Are there any risks involved in trading online?

Yes, there are definitely risks involved in trading online. The markets can be volatile and unpredictable, and there is always the possibility of losing money. However, by practicing good risk management techniques and using sound trading strategies, you can minimize your risk and increase your chances of success.

5. How much money do I need to start trading online?

The amount of money you need to start trading online depends on a number of factors, including the markets you are interested in and your individual trading strategy. Some markets, such as forex and cryptocurrencies, allow you to start trading with just a few hundred dollars, while others, such as stocks and commodities, may require a larger initial investment.

Overall, learning how to trade online can be a challenging but rewarding experience. By taking the time to educate yourself and practice good trading habits, you can increase your chances of success and achieve your financial goals.