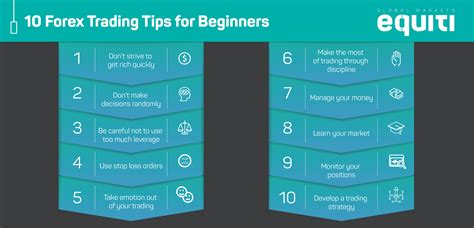

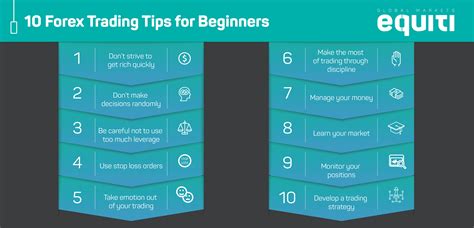

Learn how to trade forex for beginners with our comprehensive guide. Understand the basics, develop strategies and master the art of trading.

Foreign exchange, commonly known as Forex, is a lucrative market for beginners who want to invest their money and earn profits. However, trading in Forex can be challenging if you are unfamiliar with the market’s terminologies and strategies. Therefore, it is essential to equip yourself with the necessary knowledge and skills to make informed decisions when investing in Forex. Whether you are a novice or an experienced trader, understanding the basics of Forex trading is crucial. In this article, we will guide you through the steps involved in Forex trading, from opening an account to placing your first trade.

To begin with, it is vital to choose a reliable Forex broker that suits your trading needs. The right broker will provide you with a platform to execute trades and offer valuable resources such as educational materials and trading tools. Once you have selected a broker, you need to open an account and fund it with the minimum deposit required. Afterward, you can start analyzing the market by studying economic indicators, price charts, and news events that affect currency prices.

As a beginner, it is advisable to start with a demo account before trading with real money. A demo account allows you to practice trading without risking your capital. It also helps you familiarize yourself with the trading platform and test your trading strategies. Once you have gained enough confidence, you can switch to a live account and start trading with real money.

When trading Forex, it is crucial to have a trading plan that outlines your goals, risk management strategies, and entry and exit points. A trading plan helps you stay disciplined and avoid emotional trading, which can lead to losses. Additionally, it is essential to manage your risk by using stop-loss orders to limit your losses and take-profit orders to lock in your profits.

In conclusion, Forex trading can be a rewarding venture if you take the time to learn the basics and develop a trading plan. With the right mindset, tools, and strategies, you can make consistent profits in the Forex market. So, start your journey today and trade Forex like a pro!

Daftar Isi

Introduction

Forex trading is one of the most lucrative ways to earn money online. It involves buying and selling currencies in the foreign exchange market. However, it can be a challenging venture for beginners who are not familiar with the ins and outs of the market. In this article, we will provide some tips on how to trade forex for beginners.

Understand the Basics

Before you start trading forex, it is crucial to understand the basics of the market. You should learn about currency pairs, pip values, leverage, margin, and other essential concepts. You can find many resources online that can help you understand these topics. You can also enroll in a forex trading course to get a comprehensive overview of the market.

Choose a Reliable Broker

To start trading forex, you need to open an account with a broker. There are many brokers available online, but not all of them are reliable or trustworthy. You should do your research and choose a broker that is regulated by a reputable financial authority. A good broker should offer transparent pricing, low spreads, and excellent customer support.

Practice with a Demo Account

Once you have chosen a broker, you should practice trading with a demo account. A demo account allows you to trade with virtual money, which means that you can test your strategies without risking your real money. This is an excellent way to get familiar with the trading platform and build your confidence before you start trading with real money.

Develop a Trading Strategy

To succeed in forex trading, you need to have a trading strategy. Your strategy should take into account your risk tolerance, trading style, and financial goals. You should also consider the market conditions and economic events that can affect currency prices. A good trading strategy should be flexible and adaptable to changing market conditions.

Manage Your Risk

Forex trading involves a high degree of risk, and you should always be prepared to lose money. To minimize your risk, you should use stop-loss orders and limit orders. A stop-loss order is an instruction to close your position if the price reaches a certain level. A limit order is an instruction to close your position if the price reaches a certain profit level.

Keep Up-to-date with Market News

To be a successful forex trader, you need to keep up-to-date with market news and economic events. You should follow financial news websites, read economic reports, and keep an eye on global events that can affect currency prices. By staying informed, you can make more informed trading decisions and adjust your strategy accordingly.

Don’t Overtrade

Overtrading is a common mistake that many beginners make. Overtrading means trading too frequently or risking too much money on each trade. This can lead to emotional trading, which can result in losses. To avoid overtrading, you should stick to your trading plan and only enter trades that meet your criteria.

Monitor Your Trades

Once you have entered a trade, you should monitor it closely. You should set alerts or use trailing stops to manage your trades. Trailing stops allow you to lock in profits while minimizing your risk. You should also keep a trading journal to track your progress and identify areas for improvement.

Be Patient

Forex trading requires patience and discipline. You should not expect to make a lot of money overnight. It takes time and effort to develop your trading skills and strategies. You should be prepared to face losses and learn from your mistakes. With patience and persistence, you can become a successful forex trader.

Conclusion

Forex trading can be a profitable venture for beginners, but it requires knowledge, discipline, and patience. By understanding the basics of the market, choosing a reliable broker, practicing with a demo account, developing a trading strategy, managing your risk, keeping up-to-date with market news, monitoring your trades, and being patient, you can increase your chances of success in the forex market.

Introduction to Forex Trading

Forex Trading is a popular choice among traders due to the wide range of opportunities and potential profits. However, as a beginner, it’s crucial to understand what Forex Trading entails. Simply put, Forex Trading involves buying and selling currencies with the aim of profiting from changes in exchange rates. It’s important to note that Forex Trading involves a high level of risk, and traders should be prepared to lose money.

Understanding the Basic Concepts

The basic concepts of Forex Trading include currency pairs, exchange rates, and margin. Currency pairs refer to the two currencies being traded, while exchange rates represent the value of one currency in relation to another. Margin refers to the amount of money required to open a position. It’s important to understand these concepts to gain a deeper understanding of how Forex Trading works.

Choosing a Broker

Choosing a broker is a crucial decision for any trader, as it can affect the trading environment. Brokers can control the spreads, fees, and minimum deposit amounts, among other things. As a beginner, it’s essential to conduct thorough research and compare various brokers before settling on one. Look for a broker with a good reputation, competitive spreads, and a user-friendly platform.

Learn the Trading Platform

The trading platform is the software used to trade Forex. As a beginner, it’s important to familiarize yourself with the platform. This includes learning about its features, charts, and order types. Most brokers offer a demo account that allows you to practice trading without risking real money. It’s recommended to take advantage of this feature before trading live.

Choose Your Trading Strategy

There are many Forex Trading strategies, such as technical analysis, fundamental analysis, and price action. It’s important to choose a strategy that suits your style and that you’re comfortable with. It’s also recommended to research and learn different strategies before selecting one. Keep in mind that no strategy is foolproof, and success depends on how well you execute your chosen strategy.

Money Management

Money management is crucial in Forex Trading and can make or break a trader. It involves setting stop-loss orders, sticking to trading plans, and managing risk. Before entering a trade, have a clear goal in mind and never risk more than what you can afford to lose. Remember that losses are an inevitable part of trading, and it’s important to manage them effectively.

Start Small

When starting out in Forex Trading, it’s important to begin with a small account and increase it gradually as you gain more experience. This allows you to learn from mistakes without incurring significant losses. It’s also recommended to start with a small lot size, such as micro-lots. As you become more comfortable with trading, you can increase your lot size and take on more risk.

Keep up with Economic Events

Economic events can have a significant impact on the Forex market. It’s crucial to keep up to date with economic news that may affect the currency pairs you’re trading. This includes news such as interest rate decisions, GDP releases, and political events. Staying informed about economic events can help you make better trading decisions.

Keep a Trading Journal

Keeping a trading journal allows you to keep track of your progress and review your trades. It’s a useful tool for identifying what you did right or wrong and learning from your mistakes. A trading journal can also help you develop effective trading strategies by providing insight into your trading habits and patterns.

Be Patient

Forex Trading requires patience and discipline. It takes time to develop the skills and strategies necessary to become a successful trader. It’s important to remain calm even during losing trades and stick to your trading plan. Remember that Forex Trading is not a get-rich-quick scheme, and success requires hard work and dedication. With patience and perseverance, however, it’s possible to achieve success in Forex Trading.Forex trading has become increasingly popular in recent years, with more and more people looking to make a profit from the fluctuations of global currencies. However, for beginners, it can be a daunting prospect, and it’s essential to understand the pros and cons before diving into the market.Pros of Trading Forex for Beginners:1. Accessibility: Forex trading is accessible to anyone with an internet connection. There are no barriers to entry, and you can start trading with a relatively small amount of money.2. Flexibility: Forex trading is available 24 hours a day, five days a week. This means that you can trade whenever it suits you, whether that’s early in the morning or late at night.3. High Liquidity: The forex market is the largest financial market in the world, with trillions of dollars traded every day. This means that there is always someone willing to buy or sell, making it easy to enter and exit trades.Cons of Trading Forex for Beginners:1. Volatility: The forex market is highly volatile, which means that prices can fluctuate rapidly and unpredictably. This can lead to significant losses if you’re not careful.2. Complexity: Forex trading can be complex, with many technical indicators and trading strategies to learn. It takes time and effort to become proficient, and there is a risk of making mistakes along the way.3. Risk: Forex trading is inherently risky, and there is always a chance of losing money. It’s essential to have a solid risk management strategy in place to mitigate this.In conclusion, trading forex can be a profitable venture for beginners, but it’s crucial to understand the risks involved. With proper education, patience, and discipline, anyone can become a successful forex trader.

For beginners, trading Forex can seem overwhelming and confusing. However, with the right knowledge and tools, anyone can become a successful trader. In this article, we will provide some tips on how to trade Forex for beginners.

The first step in trading Forex is to understand the basics. Familiarize yourself with terms such as pips, lots, and leverage. Learn about the different types of currency pairs and how they behave in the market. It is also important to keep up with global news events, as these can have a significant impact on the Forex market.

Once you have a good understanding of the basics, it’s time to start practicing. Many Forex brokers offer demo accounts that allow you to trade with virtual money. This is a great way to get a feel for the market and test out different strategies without risking any real money. When you feel comfortable trading on a demo account, you can then move on to a live account.

Finally, it is important to have a solid trading plan in place. This should include your goals, risk tolerance, and strategy. Stick to your plan and avoid making emotional decisions based on short-term market fluctuations. With the right mindset and approach, anyone can succeed in trading Forex.

In conclusion, trading Forex can be a rewarding experience, but it takes time and effort to become a successful trader. By understanding the basics, practicing on a demo account, and having a solid trading plan in place, beginners can start trading with confidence and increase their chances of success.

Video how to trade forex for beginners

As a beginner in forex trading, it’s natural to have a lot of questions. Here are some common ones that people ask:

-

What is forex trading?

Forex trading, also known as foreign exchange trading, involves buying and selling currencies in order to make a profit.

-

How do I start trading forex?

The first step is to choose a broker and open a trading account. You’ll need to deposit funds into the account and then you can begin trading.

-

What are the risks involved in forex trading?

Forex trading involves a high degree of risk, as the market can be volatile and unpredictable. It’s important to have a solid understanding of the market and to always use proper risk management techniques.

-

What are some basic forex trading strategies?

Some basic forex trading strategies include trend following, range trading, and breakout trading. It’s important to develop a strategy that works for your individual trading style and risk tolerance.

-

What resources are available for learning about forex trading?

There are many online courses, books, and webinars available to help beginners learn about forex trading. It’s also helpful to follow reputable traders and analysts on social media and to stay up-to-date with industry news.

Remember, forex trading requires patience, discipline, and a willingness to learn. With the right education and approach, it can be a rewarding and lucrative endeavor.