Learn how to trade forex for beginners with our step-by-step guide. Understand the basics, develop a strategy, and start trading with confidence.

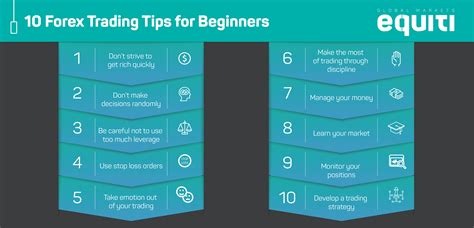

Trading in the foreign exchange market, commonly known as forex, can be an exciting and profitable experience for beginners. However, it can also be overwhelming, confusing, and risky if you do not know how to navigate the market properly. To help you get started, here are some essential tips that will guide you towards a successful trading journey.

Firstly, it is crucial to understand the basics of forex trading, including the currencies involved, the terminologies used, and the different trading strategies available. Secondly, you need to choose a reputable broker who can provide you with the necessary tools, resources, and support to make informed trading decisions. Thirdly, develop a trading plan that aligns with your goals, risk tolerance, and trading style.

Furthermore, always keep an eye on the market trends, news, and events that can affect currency prices. Remember that forex trading requires patience, discipline, and continuous learning. As a beginner, it is advisable to start small, practice on a demo account, and avoid taking unnecessary risks.

In conclusion, forex trading can be an excellent opportunity to generate income, but it requires dedication, perseverance, and the right mindset. By following these tips, you can minimize your risks and maximize your profits as a beginner trader in the forex market.

Daftar Isi

Introduction

Forex trading is an exciting and potentially profitable activity for beginners, but it can also be complex and risky. To trade forex successfully, beginners need to have a clear understanding of the basics and develop effective strategies. In this article, we will provide some tips on how to get started with forex trading.

What is Forex Trading?

Forex trading involves buying and selling currencies in the foreign exchange market. The aim is to make a profit from the difference between the buying and selling price of a currency pair. Forex trading is done through a broker or a platform that provides access to the market.

Understanding Currency Pairs

In forex trading, currencies are always traded in pairs. The first currency in the pair is called the base currency, while the second currency is the quote currency. For example, in the EUR/USD pair, the euro is the base currency and the US dollar is the quote currency.

The Importance of a Demo Account

Before starting to trade with real money, beginners should practice with a demo account. A demo account is a simulated trading environment that allows traders to learn and practice without risking any real money. This is an essential step for beginners to gain confidence and experience.

Developing a Trading Strategy

A trading strategy is a set of rules and guidelines that a trader follows to make trading decisions. A good trading strategy should be based on sound analysis and risk management principles.

Technical Analysis

Technical analysis involves using charts and indicators to analyze past price movements and identify trends and patterns. This is a popular approach among forex traders as it can provide useful insights into market movements.

Fundamental Analysis

Fundamental analysis involves analyzing economic and political factors that may affect currency prices. This approach is particularly useful for long-term trading as it takes into account broader trends and events.

Managing Risk

Forex trading carries significant risks, and beginners need to have a clear understanding of risk management principles.

Setting Stop Losses

A stop loss is an order that automatically closes a trade if the price reaches a certain level. This is a useful tool for managing risk as it limits potential losses.

Using Leverage

Leverage allows traders to control larger positions with a smaller amount of capital. While this can increase potential profits, it also increases potential losses, so beginners should use leverage with caution.

Conclusion

Forex trading can be a challenging but rewarding activity for beginners. By understanding the basics, developing effective strategies, and managing risk, beginners can increase their chances of success in the forex market.As a beginner in Forex trading, it is crucial to understand the basics before diving into the market. First and foremost, one should know that Forex trading involves buying and selling currency pairs. The goal is to profit from the fluctuations in the exchange rate between the two currencies. To get started, it is essential to choose a reliable Forex broker that offers competitive spreads and a user-friendly trading platform. Once you have found a broker, it’s time to master the art of price charts and technical analysis. This involves understanding the different types of charts and using tools such as trend lines, support, and resistance levels to make informed trading decisions.Another vital aspect of Forex trading is learning the different types of orders. These include market orders, limit orders, and stop-loss orders, among others. Each type of order has its own set of advantages and disadvantages, and it is crucial to understand how they work before executing a trade.Developing a Forex trading plan is also crucial to success. A trading plan should outline your goals, risk tolerance, and entry/exit strategies. A well-thought-out plan can help you stay focused and disciplined, minimizing the risk of emotional trading.One way to practice Forex trading without risking real money is by using a demo account. A demo account allows you to trade in a simulated environment, giving you the opportunity to test your trading strategies before going live.Managing your risk is another critical aspect of Forex trading. Proper risk management techniques, such as setting stop-loss orders and limiting your position size, can help you minimize losses and protect your capital.Staying updated with Forex news and events is also crucial to success. Economic indicators, central bank announcements, and geopolitical events can all impact the Forex market. Keeping abreast of these developments can help you make more informed trading decisions.Keeping a record of your Forex trades is also essential. This will allow you to analyze your performance and identify areas for improvement. It can also help you identify patterns and trends in your trading behavior.Finally, having patience and discipline is crucial to success in Forex trading. The market can be volatile, and it can be tempting to make impulsive trades based on emotions rather than logic. By sticking to your trading plan and managing your risk, you can minimize the impact of emotions on your trading decisions.In summary, Forex trading can be a lucrative venture for beginners who take the time to understand the basics, choose a reliable broker, master price charts and technical analysis, learn the different types of orders, develop a trading plan, practice with a demo account, manage their risk, stay updated with Forex news and events, keep a record of their trades, and maintain patience and discipline.Forex trading is a popular investment option for those who want to diversify their portfolio. It involves buying and selling currency pairs to profit from the changes in their exchange rates. While it may seem like a simple concept, trading forex requires knowledge and skills that can only be acquired through experience. In this article, we will discuss the pros and cons of how to trade forex beginners.Pros:1. Low Capital Requirements: Forex trading does not require a large capital investment compared to other investment options. You can start with as little as $100 and still be able to make a profit.2. High Liquidity: The forex market is the largest financial market in the world, with an average daily trading volume of over $5 trillion. This means that there is always someone willing to buy or sell currency pairs, making it easy to enter and exit trades quickly.3. Flexibility: Forex trading can be done from anywhere in the world, at any time of the day or night. This makes it a convenient option for those who have other commitments during regular trading hours.Cons:1. High Risk: Forex trading involves high risks, especially for beginners who do not have the necessary knowledge and skills. The market can be unpredictable, and sudden changes in exchange rates can lead to significant losses.2. Complex Concepts: Forex trading involves concepts such as leverage, margin, and pip values, which can be confusing for beginners. It requires a lot of research and practice to understand these concepts and apply them effectively.3. Emotional Trading: Forex trading can be emotionally challenging, especially for beginners who may get carried away by their emotions. It is essential to develop discipline and control to avoid making impulsive decisions that can lead to significant losses.In conclusion, forex trading can be a lucrative investment option for those who are willing to put in the time and effort to learn and practice. However, it is essential to understand the pros and cons of trading forex beginners before diving in. With proper education and discipline, you can minimize the risks and maximize the rewards of forex trading.

Forex trading is one of the most lucrative investment options available today. However, it is also one of the riskiest. As a beginner, you may be tempted to dive in headfirst without proper knowledge and experience. This could lead to disastrous consequences. But fear not, for there are ways to trade forex as a beginner without losing your shirt.

Firstly, start by educating yourself on the basics of forex trading. Learn about currency pairs, pip values, and leverage. There are numerous online resources available for free that can help you get started, such as video tutorials, webinars, and e-books. Remember, the more you know, the better equipped you will be to make informed decisions when trading.

Secondly, practice with a demo account. Many forex brokers offer demo accounts where you can trade with virtual money. This is a great way to get a feel for the market and test out different strategies without risking real money. Treat your demo account as seriously as you would a real account. Set goals, keep a trading journal, and track your progress. Once you feel confident enough, you can move on to a live account.

Lastly, be patient and disciplined. Forex trading requires a lot of discipline and self-control. Avoid making impulsive decisions based on emotions or rumors. Stick to your strategy and be patient. The market can be unpredictable, so don’t get discouraged if you encounter losses. Remember, successful traders are not made overnight. It takes time, effort, and a lot of practice to become a skilled trader.

In conclusion, forex trading can be a daunting task for beginners, but it doesn’t have to be. By educating yourself, practicing with a demo account, and being patient and disciplined, you can avoid common pitfalls and increase your chances of success. Always remember to approach forex trading with caution and never invest more than you can afford to lose.

As a journalist, I often come across questions from people about trading forex for beginners. Here are some of the most commonly asked questions and their answers:

1. What is forex trading?

Forex trading, also known as foreign exchange trading, involves buying and selling currencies in order to make a profit. The goal is to buy a currency when it’s low and sell it when it’s high.

2. How do I start trading forex?

- Choose a reputable broker

- Create a trading account

- Deposit funds into your account

- Learn the basics of forex trading

- Start trading with small amounts to gain experience

3. What are the risks of forex trading?

Forex trading comes with its own set of risks, just like any other form of investment. The biggest risk is losing money due to market fluctuations. It’s important to have a solid understanding of the market and to use risk management strategies to minimize losses.

4. How can I improve my chances of success?

- Learn as much as you can about forex trading

- Develop a trading strategy and stick to it

- Use risk management techniques to minimize losses

- Stay up to date on market news and events

- Practice with a demo account before trading with real money

5. Can I trade forex part-time?

Yes, many people trade forex part-time while still working a full-time job. However, it’s important to have a solid understanding of the market and to be able to commit enough time to analyze the market and execute trades.

Overall, forex trading can be a lucrative investment opportunity, but it’s important to approach it with caution and a solid understanding of the market.