Learn how to pay your taxes with ease. File online, set up automatic payments, or visit your local IRS office. Don’t let taxes stress you out!

As the tax season approaches, many taxpayers start to feel the pressure of filing their taxes accurately and timely. While paying taxes may not be the most exciting topic to discuss, it is a crucial responsibility that each citizen must fulfill. Whether you are a seasoned taxpayer or someone who is new to the process, knowing how to pay your taxes can save you from unnecessary headaches and even legal trouble. In this article, we will explore the essential steps that you need to follow to pay your taxes efficiently and effectively.

Firstly, let’s talk about the importance of staying organized when it comes to taxes. Many people dread the thought of sorting through piles of paperwork and receipts, but doing so can make a world of difference. By keeping all your tax-related documents in one place and maintaining a record of your expenses, you can easily track your income and deductions, and minimize the chances of errors in your tax returns. Moreover, being organized can save you time and money in the long run.

Secondly, it’s essential to know the different types of taxes that you are required to pay. Income taxes, sales taxes, property taxes, and self-employment taxes are some of the most common types of taxes that individuals and businesses must pay. Depending on your income, occupation, and location, you may have to pay more than one type of tax. Understanding your tax obligations can help you plan your finances better and avoid penalties for non-payment.

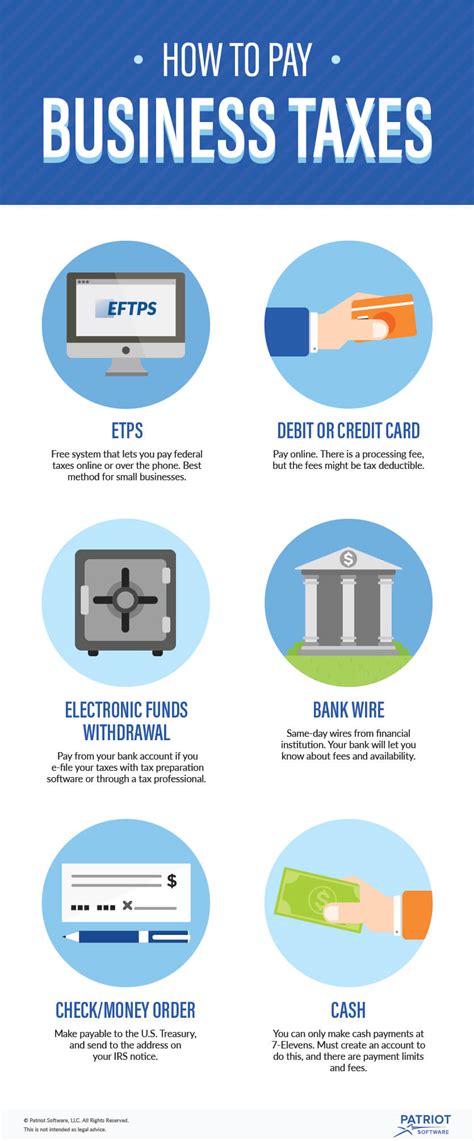

Lastly, it’s crucial to choose the right payment method when paying your taxes. While writing a check or sending a money order is still a popular way to pay taxes, many taxpayers are now opting for online payment methods. Online payments are fast, secure, and convenient, and they offer a range of options such as debit cards, credit cards, and direct bank transfers. However, it’s important to note that some payment methods may come with additional fees, so be sure to read the fine print before making a payment.

In conclusion, paying taxes may not be the most enjoyable task, but it is one that cannot be ignored. By staying organized, knowing your tax obligations, and choosing the right payment method, you can make the process of paying taxes more manageable and less stressful. Remember, paying your taxes on time is not only a legal obligation but also a civic duty that helps support the country’s infrastructure and services.

Daftar Isi

Introduction

Taxes are a necessary aspect of life that every individual must pay. However, navigating the tax system can be a challenging task. It’s important to understand the tax laws and regulations to ensure that you pay the right amount and avoid penalties. Here are some tips on how to pay taxes effectively.

Understand Your Tax Obligations

The first step in paying your taxes is understanding your tax obligations. This involves knowing the type of taxes you need to pay, when they are due, and how much you need to pay. Some common types of taxes include income tax, property tax, sales tax, and payroll tax. Make sure you consult with a tax professional or use online resources to determine your tax obligations.

Organize Your Financial Records

To pay taxes effectively, you need to have your financial records organized. This includes all receipts, invoices, and other documents related to your income and expenses. You can use accounting software or hire an accountant to help you organize your financial records. Having organized records will save you time and money during the tax season.

File Your Tax Return

Filing your tax return is a crucial part of paying taxes. You can file your tax return online or by mail. It’s important to file your tax return on time to avoid penalties. If you are unsure about how to file your tax return, you can hire a tax professional to assist you.

Take Advantage of Tax Deductions and Credits

One way to reduce your tax liability is to take advantage of tax deductions and credits. Tax deductions are expenses that you can deduct from your taxable income, while tax credits are dollar-for-dollar reductions in your tax liability. Common tax deductions and credits include charitable donations, mortgage interest, and education expenses.

Pay Your Taxes on Time

It’s important to pay your taxes on time to avoid penalties and interest charges. You can pay your taxes online, by mail, or in person. If you are unable to pay your taxes in full, you can set up a payment plan with the IRS.

Understand Tax Laws and Regulations

Tax laws and regulations can be complex and confusing. It’s important to understand the tax laws and regulations that apply to your situation. You can consult with a tax professional or use online resources to gain a better understanding of tax laws and regulations.

Keep Appropriate Records

Keeping appropriate records is essential for paying your taxes effectively. This includes all financial records, tax returns, and other documents related to your taxes. Keeping accurate records will help you avoid mistakes and ensure that you pay the right amount of taxes.

Seek Professional Help

If you are unsure about how to pay your taxes or have complicated tax situations, it’s best to seek professional help. A tax professional can provide advice on tax planning, filing your tax return, and minimizing your tax liability.

Be Prepared for Audits

In some cases, the IRS may audit your tax return. It’s important to be prepared for audits by keeping accurate records and responding promptly to any inquiries from the IRS. If you are unsure about how to handle an audit, you can seek help from a tax professional.

Conclusion

Paying taxes can be a daunting task, but by following these tips, you can make the process easier and more effective. Remember to understand your tax obligations, organize your financial records, file your tax return on time, take advantage of tax deductions and credits, and seek professional help when needed.

Understanding the Importance of Paying Taxes on Time

As a responsible citizen, paying taxes on time is not only a legal obligation but also a moral duty towards the nation’s development. Taxes are the primary source of revenue for the government, which is then utilized for various developmental activities like building roads and infrastructure, providing education and healthcare facilities, and maintaining law and order. Delayed or non-payment of taxes can lead to a negative impact on the economy and hamper the country’s progress.

Gathering All the Necessary Information

Before paying taxes, one must ensure to gather all the required information like income sources, tax codes, deductions, etc. to avoid any errors later. One should keep all the relevant documents like salary slips, investment proofs, and bank statements handy while filing taxes. It’s also vital to understand the various tax slabs and exemptions available to make informed decisions and reduce the tax liability.

Choosing the Correct Payment Method as per Convenience

Several payment methods like credit/debit cards, net banking, UPI, and e-wallets are available for making tax payments. One must choose the most convenient and secure method for oneself. It’s essential to check the transaction charges and ensure that the payment gateway is reliable and trustworthy.

Double-Checking the Calculations

After filling in all the details, it’s essential to double-check the calculations to avoid any mistakes that could lead to penalties. Any errors in the computation of taxes can result in incorrect tax filings and unnecessary financial burden. One should take the time to recheck the calculations before submitting the tax return.

Keeping a Record of All Tax Payments

Maintain a record of all tax payments as proof of payment for future references. This is especially important in case of any discrepancies or audit notices from the tax authorities. One should keep a copy of the tax return, challan receipts, and other relevant documents for at least seven years.

Utilizing Tax-Saving Options

Explore various tax-saving options like investing in tax-saving schemes, purchasing health insurance, and making charitable donations that could help in reducing one’s tax liability. It’s essential to plan investments and expenses in advance to avail maximum tax benefits and save money. However, one should avoid fraudulent schemes and illegal practices that promise unrealistic returns and tax savings.

Filing Income Tax Returns on Time

Not only paying taxes but also filing income tax returns on time is crucial to avoid penalties and legal consequences. The last date for filing tax returns is usually 31st July of the assessment year. One should be aware of the due dates and file the returns within the stipulated time frame. Late filings can attract penalties and interest charges.

Taking Professional Help if Needed

Taking the help of a chartered accountant or a tax professional can be beneficial, especially in complex tax situations. They can provide expert advice and guidance on tax planning, compliance, and dispute resolution. However, one should ensure that the professional is registered and authorized by the government and has a good reputation in the industry.

Staying Updated with Tax Laws and Regulations

Stay updated with the latest tax laws and regulations to avoid any legal issues and take advantage of any new tax-saving options. The tax laws are subject to change every year, and one should keep track of the amendments and updates to avoid any surprises. One can refer to the official government websites or consult tax experts for any clarifications.

Avoiding Tax Evasion

Tax evasion is a criminal offense, and individuals should avoid engaging in any illegal practices to reduce their tax liability. It not only attracts heavy penalties and fines but also tarnishes one’s reputation and credibility. One should be honest and transparent in their tax filings and pay taxes diligently to contribute towards the nation’s growth and development.In conclusion, paying taxes is not just a legal obligation but a moral responsibility towards the country’s growth and development. By following these tips, individuals can ensure smooth and hassle-free tax payments. It’s essential to plan and prepare in advance, stay updated with the latest tax laws, and avoid any illegal practices to maintain financial integrity and contribute towards the nation’s progress.As a journalist, it is important to inform the public about the various ways to pay taxes and the pros and cons of each method. Here are some key points to consider:1. Paying taxes online- Pros: Convenient, easy to use, can be done from anywhere with internet access- Cons: May not be secure if using an unsecured network, may require additional fees for processing2. Paying taxes in person- Pros: Allows for face-to-face interaction with tax professionals, may provide additional guidance and assistance- Cons: Requires travel to tax office, may involve long wait times, may not be available in all areas3. Paying taxes by mail- Pros: No internet access required, can be done from anywhere with a mailbox- Cons: May take longer to process, may be lost or delayed in the mail, may not be able to receive confirmation of payment immediately4. Paying taxes through automatic deductions- Pros: Convenient, ensures timely and regular payments, minimizes risk of late fees or penalties- Cons: Requires setup and maintenance, may not allow for flexibility in payment amounts or timingOverall, the best method for paying taxes will depend on individual preferences and circumstances. It is important to weigh the pros and cons of each option to determine which one is the most suitable for your needs.

As tax season approaches, many individuals may find themselves in a difficult situation where they do not have the title or proof of ownership for their properties. This can be a stressful and overwhelming time, but it is important to remember that there are still options available for paying taxes without a title.

One option is to contact the local tax assessor’s office and explain the situation. They may be able to provide alternative methods for verifying ownership, such as providing a bill of sale or documentation of previous tax payments. It is important to be honest and transparent with the tax assessor’s office and provide any relevant information to ensure a smooth process.

Another option is to seek assistance from a tax professional or attorney. They can provide guidance on the legal requirements for paying taxes without a title and assist with any necessary paperwork. It is important to research and select a reputable professional to ensure the best outcome.

In conclusion, paying taxes without a title can be a daunting task, but it is not impossible. By contacting the local tax assessor’s office or seeking assistance from a tax professional or attorney, individuals can still fulfill their tax obligations and avoid any potential legal issues. Remember to stay informed and proactive in this process to ensure a successful outcome.

Video how to pay taxes

Visit VideoAs tax season approaches, many people are wondering about the best way to pay their taxes. Here are some of the most common questions people ask about paying taxes:1. When are taxes due?

Taxes are typically due on April 15th of each year. However, if that date falls on a weekend or holiday, the deadline may be extended.

2. How do I pay my taxes?

There are several ways to pay your taxes, including:

- Online: You can pay your taxes online using the IRS website.

- By mail: You can also mail a check or money order to the IRS.

- In person: If you prefer to pay in person, you can visit an IRS office or a participating retail location.

- Installment plan: If you are unable to pay your taxes in full, you may be able to set up an installment plan with the IRS.

3. Can I use a credit card to pay my taxes?

Yes, you can use a credit card to pay your taxes. However, keep in mind that there may be fees associated with using a credit card, and these fees can add up quickly.

4. What happens if I can’t pay my taxes?

If you are unable to pay your taxes in full by the deadline, the IRS may assess penalties and interest on the amount owed. It’s important to contact the IRS as soon as possible to discuss your options and avoid additional fees.

In conclusion, paying taxes can be a stressful experience, but there are several ways to make the process easier. Whether you choose to pay online, by mail, or in person, be sure to stay informed and seek help if needed.