High frequency trading involves using computer algorithms to make trades at lightning-fast speeds, potentially earning big profits in milliseconds.

High frequency trading (HFT) has revolutionized the financial industry, but not without controversy. In recent years, HFT has been widely criticized for its potential to destabilize markets and give an unfair advantage to big players in the game. Despite this, it continues to be a dominant force in the world of finance. So what exactly is high frequency trading, and why is it so controversial?

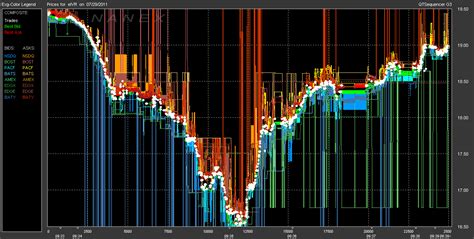

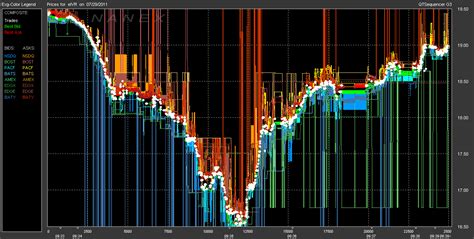

Firstly, HFT involves the use of powerful computers and algorithms to execute trades at lightning-fast speeds. These trades are often made in fractions of a second, and can involve millions of shares. This allows HFT firms to profit from small price discrepancies that may only exist for a fraction of a second. However, critics argue that this rapid-fire trading can cause market volatility and even crashes, as seen in the infamous Flash Crash of 2010.

Furthermore, HFT has been accused of giving unfair advantages to large institutional investors, who can afford to invest in expensive technology and infrastructure. This means that smaller investors and retail traders may be left behind, unable to compete with the lightning-fast trades of HFT firms. The debate over the merits and drawbacks of high frequency trading is far from settled, and it remains a contentious issue in the world of finance.

Daftar Isi

The Rise of High Frequency Trading

High frequency trading, or HFT, is a type of algorithmic trading that relies on powerful computers and complex algorithms to execute trades at lightning-fast speeds. Over the past decade, HFT has become increasingly popular among large financial institutions and hedge funds, with some estimates suggesting that it now accounts for more than half of all trades in the stock market.

The Advantages of High Frequency Trading

One of the key advantages of HFT is speed. By using sophisticated technology and algorithms, traders can execute trades in a matter of microseconds, allowing them to take advantage of even the smallest market movements. This can lead to higher profits and greater efficiency in the market.

Another advantage of HFT is the ability to process vast amounts of data. By analyzing market trends and patterns in real-time, traders can identify opportunities for profit that might otherwise be missed.

The Controversies Surrounding High Frequency Trading

Despite its many benefits, HFT has also been the subject of much controversy over the years. One of the main criticisms of HFT is that it creates an uneven playing field, giving large financial institutions an unfair advantage over smaller investors.

Some critics have also argued that HFT can contribute to market instability, particularly during times of high volatility. By placing a large number of trades in a short period of time, HFT can exacerbate price movements and create artificial market conditions.

The Regulatory Landscape for High Frequency Trading

In response to these concerns, regulators around the world have implemented a variety of measures designed to increase transparency and reduce the risks associated with HFT. In the United States, for example, the Securities and Exchange Commission (SEC) has introduced rules requiring HFT firms to register with the agency and adhere to specific reporting requirements.

Other regulators have taken a more aggressive approach, with some countries banning HFT altogether. For example, in 2016, Germany introduced regulations that effectively banned HFT firms from trading on its exchanges.

The Future of High Frequency Trading

Despite the controversies surrounding HFT, many experts believe that it will continue to play an important role in the financial markets in the years to come. As technology continues to evolve and computing power becomes even more advanced, the speed and efficiency of HFT are only likely to increase.

However, there are also concerns that HFT could become too dominant in the market, leading to a lack of diversity and potentially creating new risks for investors. As such, it is likely that regulators will continue to closely monitor the activities of HFT firms and take action as needed to ensure that the market remains fair and transparent for all participants.

In conclusion

High frequency trading has revolutionized the way that financial markets operate, providing traders with unprecedented speed and efficiency. However, it has also been the subject of much controversy over the years, with some critics arguing that it creates an uneven playing field and contributes to market instability. As such, the regulatory landscape for HFT continues to evolve, with regulators around the world taking steps to ensure that the market remains transparent and fair for all participants.

Introduction to High Frequency Trading (HFT)

High frequency trading is a type of trading that utilizes advanced computer algorithms to execute trades in milliseconds. This practice has gained popularity in recent years as technology has revolutionized the financial industry. HFT allows traders to take advantage of market changes before other investors, resulting in potentially higher profits and more efficient markets. However, the use of advanced technology in this type of trading also comes with risks, such as potential market manipulation and instability.

The Advantages of HFT

One of the greatest advantages of HFT is the speed of execution. With the ability to execute trades in milliseconds, traders can take advantage of market changes before other investors. This speed can result in potentially higher profits and more efficient markets. Additionally, HFT allows for increased liquidity in the market, which can benefit investors by providing more opportunities for buying and selling securities.

The Risks of HFT

Although HFT offers many advantages, the use of advanced technology also comes with risks. One of the biggest risks associated with HFT is the potential for market manipulation. Critics argue that HFT can create artificial market demand and cause prices to fluctuate rapidly, which can lead to instability in the market. Additionally, HFT has been linked to flash crashes, where sudden drops in the market value occur in just minutes.

HFT and Market Volatility

HFT has been blamed for creating a volatile environment in which investors may struggle to predict future market trends. The use of algorithms to execute trades quickly and take advantage of sudden market changes can create an unpredictable market. Flash crashes, such as the 2010 flash crash that wiped out nearly a trillion dollars in market value in just minutes, have been linked to the use of HFT.

HFT and Algorithmic Trading

HFT is a subset of algorithmic trading, which is becoming increasingly popular in the financial industry. Algorithmic trading uses computer programs to execute trades based on predetermined criteria, such as price or volume. HFT relies on algorithms to execute trades quickly and take advantage of sudden market changes.

Regulation of HFT

There has been a push for increased regulation of HFT, with some advocating for stricter rules to address potential market manipulation and instability. However, others argue that excessive regulation could stifle innovation and create inefficiencies in the market. The Securities and Exchange Commission (SEC) has implemented rules to address concerns about HFT, but there is still debate about whether more regulation is needed.

HFT and Trading Strategies

Traders who specialize in HFT use a variety of strategies to maximize profits. Scalping and momentum trading are two common strategies used by HFT traders. These strategies rely on the ability to execute trades quickly and take advantage of sudden market changes.

HFT and the Race to Zero

Traders engaged in HFT are often competing to execute trades faster than their competitors, leading to a race to zero in which milliseconds can make a significant difference in profits. Some traders invest heavily in technology and infrastructure to gain an edge in this race. This competition can contribute to market instability and increase the risk of flash crashes.

Future of HFT

The use of HFT is expected to continue growing as technology advances and more investors see the potential for profits. However, there are concerns that increased regulation and market instability could have a negative impact on the practice in the future. As technology continues to evolve, it is likely that HFT will continue to play a significant role in the financial industry.

The Ethics of HFT

The use of HFT has raised ethical questions about fairness and market manipulation. Critics argue that the practice allows insider traders to gain an unfair advantage and erodes trust in the financial industry. The debate over the ethics of HFT is ongoing, and it is likely that more regulation and oversight will be implemented in the future to address these concerns.High frequency trading, also known as HFT, is a controversial topic in the financial world. Some experts argue that this type of trading is beneficial for the market, while others believe it poses significant risks. Let’s take a closer look at the pros and cons of high frequency trading.Pros:1. Faster Execution: HFT uses advanced algorithms and powerful computers to execute trades at lightning-fast speeds. This allows traders to take advantage of small price movements in the market and make profits quickly.2. Increased Liquidity: HFT provides liquidity to the market by constantly buying and selling securities. This helps ensure that there are always buyers and sellers for any given security, which can prevent large price swings.3. Lower Costs: HFT can reduce trading costs because it eliminates the need for human traders and reduces the bid-ask spread.Cons:1. Market Instability: HFT can cause volatility in the market, as large volumes of trades are executed in a short amount of time. This can lead to sudden price fluctuations and market crashes.2. Unfair Advantage: HFT gives an unfair advantage to traders with access to the fastest technology and data. This can lead to a concentration of wealth among a small group of traders, which can be harmful to the overall economy.3. Lack of Transparency: HFT can be difficult to regulate and monitor, as it often operates in the dark pools of the market. This lack of transparency can make it difficult to detect illegal activities such as insider trading.In conclusion, high frequency trading has both benefits and drawbacks. While it can increase liquidity and reduce costs, it also poses risks such as market instability and unfair advantages. It is up to regulators and policymakers to strike a balance between promoting innovation and protecting the interests of investors and the economy as a whole.

As the world becomes more digitized, the finance industry is no exception. High frequency trading (HFT) has become increasingly popular in recent years, with some estimates suggesting that it accounts for nearly 50% of all trades made in the US market. HFT is a computerized trading strategy that uses complex algorithms to buy and sell assets at lightning-fast speeds. While proponents argue that HFT provides much-needed liquidity to markets, others are concerned about its potential drawbacks.

One of the main criticisms of HFT is that it can exacerbate market volatility. Because HFT algorithms operate on extremely short timeframes, they can react quickly to even the smallest changes in market conditions. This can lead to sudden swings in asset prices, which can be difficult for other traders to keep up with. In extreme cases, this volatility can even trigger flash crashes, as we saw in 2010 when the Dow Jones Industrial Average plummeted nearly 1,000 points in a matter of minutes.

Another concern with HFT is that it can create an uneven playing field for different types of traders. Because HFT algorithms can execute trades so quickly, they have a significant advantage over traditional traders who rely on slower manual methods. This means that HFT firms can potentially profit at the expense of other market participants, particularly those who don’t have access to the same level of technology or resources. Some critics argue that this creates an unfair market environment that ultimately undermines the integrity of financial markets.

In conclusion, high frequency trading is a complex and controversial topic in the world of finance. While it has certainly revolutionized the way that markets operate, there are legitimate concerns about its potential downsides. As investors, it’s important to be aware of these issues and to consider them when making decisions about how to trade. Ultimately, the future of HFT will depend on how regulators and market participants respond to these challenges, and whether they can find ways to mitigate the risks while still reaping the benefits of this innovative approach to trading.

Video high frequency trading

High frequency trading has become a topic of interest to many people in the financial world. As a result, there are several common questions that people ask about high frequency trading. Here are some of those questions and their answers:

1. What is high frequency trading?

- High frequency trading (HFT) is a type of trading where computers use algorithms to buy and sell securities at a very high speed.

2. How does high frequency trading work?

- The HFT firm uses complex algorithms to analyze market data and identify potential trades.

- The algorithms then place buy or sell orders on the securities, often in fractions of a second.

- The trades are executed automatically, without any human intervention.

- The profits from these trades come from small price differences that occur over a large number of trades.

3. Is high frequency trading legal?

- Yes, high frequency trading is legal in most countries.

4. What are the advantages of high frequency trading?

- High frequency trading can provide liquidity to the market by making it easier for buyers and sellers to find each other.

- HFT firms can also benefit from small price differences that occur over a large number of trades.

5. What are the disadvantages of high frequency trading?

- High frequency trading can make the market more volatile and increase the risk of flash crashes.

- Some critics also argue that HFT gives an unfair advantage to firms with the fastest computers and best algorithms.

Overall, high frequency trading is a complex topic that requires careful consideration. While it can provide benefits to the market, it also has the potential to create problems if not regulated properly.