Stay ahead of the game with our expert gold trading predictions for today. Make informed decisions and maximize your profits. Start trading now!

As the world continues to grapple with the economic fallout of the COVID-19 pandemic, investors are keeping a close eye on the gold market. Analysts predict that the price of gold is set to rise in the coming months due to ongoing uncertainty in global markets.

According to industry experts, the current low-interest rates, geopolitical tensions, and a weaker US dollar are all factors that are likely to push up the price of gold. In addition, the ongoing pandemic continues to wreak havoc on the global economy, prompting investors to turn to safe-haven assets such as gold.

However, it’s important to note that the gold market can be notoriously difficult to predict. While some analysts are bullish on the precious metal, others caution that there are still risks to the market, including potential vaccine breakthroughs and an unexpected uptick in inflation.

Despite the uncertainty, many investors are turning to gold as a way to diversify their portfolios and protect against potential market volatility. As we head into the final quarter of 2021, all eyes will be on the gold market to see if these predictions come to fruition.

Daftar Isi

Introduction

Gold trading has been a popular investment option for years, and it continues to hold a significant position in the financial markets. The global pandemic has affected the economy, and investors are looking for safe-haven assets like gold. In this article, we will discuss the predictions for gold trading today.

Current Situation of Gold Trading

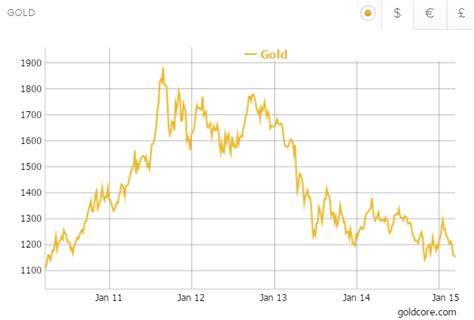

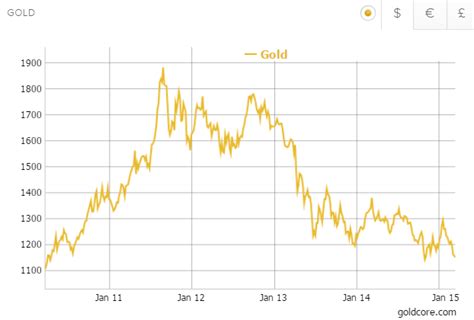

The price of gold has been fluctuating recently, and it has affected the traders’ sentiments. The gold prices were trading at a high of $1,900 per ounce in August 2020, but it fell to $1,680 in March 2021. Currently, gold is trading at $1,775 per ounce, but the trend is uncertain.

Factors Affecting Gold Trading Today

Several factors affect gold trading, and investors need to keep an eye on them to make informed decisions. The US dollar’s value, inflation rates, economic policies, geopolitical tensions, and interest rates are some of the significant factors affecting gold trading today.

The US Dollar’s Value

The US dollar’s value has a significant impact on gold trading, as they have an inverse relationship. When the US dollar weakens, the price of gold rises, and vice versa. The US dollar has been volatile lately, and it may affect gold prices.

Inflation Rates

Inflation rates also affect gold prices, as gold is considered a hedge against inflation. When inflation rates rise, investors turn to gold as a safe-haven asset, and it affects its prices.

Economic Policies

Economic policies like fiscal and monetary policies also affect gold trading. The policies implemented by the government and central banks can impact gold prices. For example, if the government increases spending, it may lead to inflation, which may drive gold prices up.

Geopolitical Tensions

Geopolitical tensions like wars, conflicts, and political instability can also affect gold prices. When there is uncertainty in the global markets, investors turn to gold, which increases its demand and prices.

Interest Rates

Interest rates also play a role in gold trading. When interest rates are low, investors turn to gold as it offers better returns. However, when interest rates rise, investors prefer other investment options, which may affect gold prices.

Predictions for Gold Trading Today

The predictions for gold trading today are mixed, and it is uncertain which direction gold prices will take. Some analysts predict that gold prices may rise due to the weakening US dollar, inflation rates, and geopolitical tensions. On the other hand, some analysts predict that gold prices may fall due to the recovering economy, low-interest rates, and improving COVID-19 situation.

Conclusion

In conclusion, gold trading remains an attractive investment option for investors looking for safe-haven assets. However, several factors affect gold prices, and investors need to keep an eye on them to make informed decisions. The predictions for gold trading today are uncertain, and investors should exercise caution while investing.

Experts Predict Increase in Gold Trading Prices Amidst Global Economic Uncertainty

Gold trading has been experiencing a volatile market lately, and experts predict that this trend will continue for the coming weeks. The uncertainty surrounding the global economy is one of the main factors driving this volatility, with trade wars and geopolitical tensions contributing to the unpredictability of gold prices.

Trade Wars and Geopolitical Tensions Driving Gold Trading Volatility

The ongoing trade tensions between the United States and China have caused a ripple effect in the global economy, with many countries feeling the impact of these disputes. This has led to an increase in demand for gold as a safe haven asset, which has driven up gold trading prices.

Geopolitical tensions around the world, such as the situation in the Middle East and North Korea’s nuclear program, have also contributed to the volatility of gold trading. Investors turn to gold in times of uncertainty, which has led to fluctuations in the price of the precious metal.

Inflation Concerns Also a Factor in Gold Trading Predictions

Inflation concerns are another factor that is impacting gold trading predictions for the coming weeks. With the US Federal Reserve expected to cut interest rates, there is a risk of higher inflation, which could drive up gold trading prices even further.

The US Federal Reserve’s Announcement on Interest Rates Could Impact Gold Trading Trends

The US Federal Reserve’s announcement on interest rates is expected to have a significant impact on gold trading trends. If the Federal Reserve cuts interest rates, it could lead to a weaker US dollar, which would stimulate demand for gold. Conversely, if interest rates remain stable, it could lead to a decrease in gold trading prices.

Gold Trading Could Face Ups and Downs Next Year, with Conflicting Economic Indicators

Looking ahead, gold trading could face ups and downs next year due to conflicting economic indicators. On the one hand, there are concerns about a global recession, which would lead to an increase in demand for gold. On the other hand, economic growth in some countries could lead to a decrease in demand for the precious metal.

Investors Keeping a Close Eye on the US-China Trade Dispute’s Effect on Gold Prices

Investors are keeping a close eye on the US-China trade dispute’s effect on gold prices. If a resolution is reached, it could lead to a decrease in demand for gold as a safe haven asset. Alternatively, if tensions continue to escalate, it could lead to a further increase in demand for gold.

The Imminent Brexit Decision Could Also Impact Gold Trading in the Short Term

The imminent Brexit decision is also expected to impact gold trading in the short term. If a deal is reached, it could lead to a decrease in demand for gold, as investors become more optimistic about the global economy. Conversely, if a no-deal Brexit occurs, it could lead to a further increase in demand for gold.

Gold Trading Could Benefit Greatly from a Weak US Dollar, Which Stimulates Demand for the Precious Metal

A weak US dollar is another factor that could benefit gold trading. When the US dollar is weak, it stimulates demand for gold, as investors turn to the precious metal as a safe haven asset. This could lead to an increase in gold trading prices.

Central Bank Gold Buying is a Key Factor to Watch in 2020 and Beyond

Central bank gold buying is a key factor to watch in 2020 and beyond. Many central banks around the world have been increasing their gold reserves in recent years, which has contributed to the increase in demand for the precious metal. If this trend continues, it could lead to a further increase in gold trading prices.

Analysts Recommend Diversification of Investment Portfolios to Hedge Against Gold Trading Risks

Given the volatility of gold trading, analysts recommend diversification of investment portfolios to hedge against risks. This means investing in a variety of assets, such as stocks, bonds, and real estate, in addition to gold. By diversifying their portfolios, investors can reduce their exposure to gold trading risks and increase their chances of achieving long-term financial success.

As gold trading continues to be a topic of interest among investors, many are making predictions about the future of the precious metal. Here are some of the pros and cons of gold trading predictions today:

Pros:

- Historical data suggests that gold has been a reliable store of value over time.

- Many experts believe that economic uncertainty and political instability could lead to increased demand for gold as a safe haven asset.

- With the rise of digital currencies, some investors may be looking to diversify their portfolios with physical assets like gold.

- The current low interest rate environment may make gold more attractive to investors seeking higher returns.

Cons:

- Predicting the future price of gold is notoriously difficult, as it is influenced by a wide range of factors including macroeconomic trends, geopolitical events, and supply and demand dynamics.

- Some investors may be overly optimistic about the potential returns from gold trading, leading them to take on excessive risks or ignore other opportunities.

- Investing in physical gold can be costly and inconvenient, as it requires storage and insurance.

- The value of gold is highly dependent on market sentiment, which can be volatile and unpredictable.

Overall, while gold trading predictions can provide useful insights into market trends, it is important for investors to do their own research and consider the risks and benefits before making any investment decisions.

As the world continues to grapple with the ongoing COVID-19 pandemic, the economic landscape has been significantly impacted. With this in mind, many investors are turning to gold as a safe haven asset. In fact, gold prices have soared to record highs in recent months, reaching levels not seen in almost a decade. But what do the experts predict for gold trading today?

According to industry analysts, gold is likely to remain a popular investment option in the coming months. This is due to several factors, including ongoing uncertainty surrounding the global economy, tensions between major world powers, and the potential for inflation. Additionally, the US Federal Reserve has indicated that it will keep interest rates low for the foreseeable future, which could further boost demand for gold.

That being said, it’s important to remember that predicting the future of any financial market is always a tricky business. There are many variables at play, and unforeseen events can quickly shift the direction of prices. As such, anyone interested in investing in gold should do their own research and carefully consider their options.

In conclusion, while the current outlook for gold trading appears positive, it’s important to approach any investment with caution and a clear understanding of the risks involved. By staying informed and making careful decisions, investors can position themselves for success in this ever-changing market.

Video gold trading predictions today

As the price of gold continues to fluctuate, many people are turning to experts for predictions on gold trading today. Here are some common questions people ask:

- 1. Will the price of gold go up or down today?

- 2. How will economic factors like inflation and interest rates affect gold trading?

- 3. Should I invest in gold today or wait for a better opportunity?

While it is impossible to predict gold prices with complete accuracy, there are some factors that can give us an idea of what to expect.

- Global economic uncertainty: As long as there are concerns about global trade, geopolitical tensions, and other economic uncertainties, investors tend to turn to gold as a safe haven asset. This could lead to an increase in demand for gold and push prices higher.

- US dollar strength: Because gold is priced in US dollars, a strong dollar can put downward pressure on gold prices. If the dollar strengthens compared to other currencies, gold may become less attractive to investors and prices may fall.

- Inflation: Gold has historically been seen as a hedge against inflation. As inflation rises, investors may turn to gold as a way to protect their wealth, which could push prices higher.

Ultimately, the decision to invest in gold today will depend on your individual financial goals and risk tolerance. It is important to do your own research and consult with a financial advisor before making any investment decisions.