Forex trading involves using mathematical formulas to predict market movements and make profitable trades. Learn how to use these tools effectively!

Forex trading is a subject that has been gaining more and more attention in recent years. It involves the buying and selling of different currencies in order to make a profit. But what exactly goes into making a successful forex trade? How do traders know when to buy or sell a particular currency? The answer lies in mathematical formulas and technical analysis.

One of the most popular formulas used by forex traders is the Fibonacci retracement. This formula is based on the idea that markets will often retrace a predictable portion of a move, after which they will continue to move in the original direction. Another important formula is the moving average, which helps traders identify trends and potential entry and exit points.

But it’s not just about plugging numbers into formulas. Successful forex trading also requires a deep understanding of market trends, global events, and political factors. Traders must be able to analyze data and make quick decisions based on their findings. With so many variables at play, it’s no wonder that forex trading can be a complex and challenging endeavor.

However, for those who are willing to put in the time and effort to master this skill, the rewards can be substantial. With the right strategy and a bit of luck, forex traders can earn significant profits from their trades. So if you’re up for the challenge, dive into the world of forex trading and see what you can achieve with your knowledge of mathematics and market analysis.

Daftar Isi

Introduction

Forex trading has become one of the most popular investment options in recent years. With the rise of online trading platforms, it has become easier than ever to enter this market. However, success in forex trading requires a deep understanding of the underlying principles and a mastery of mathematical formulas.

Understanding Forex Trading

Forex trading involves buying and selling currencies with the goal of making a profit. The exchange rates between currencies are constantly changing, and traders try to predict these changes and take advantage of them. The key to success in forex trading is to have a solid strategy and to be able to analyze the data effectively.

Mathematical Formulas for Forex Trading

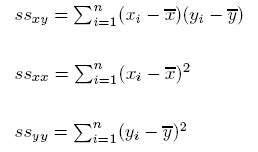

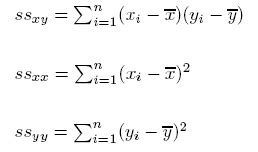

There are several mathematical formulas that are essential for forex trading. These include:

1. The Bid-Ask Spread

The bid-ask spread is the difference between the price at which a currency can be bought and the price at which it can be sold. This spread represents the cost of trading and is a critical factor in determining the profitability of a trade.

2. Pip Value

A pip is the smallest unit of measurement in forex trading, and its value varies depending on the currency pair being traded. Understanding the value of a pip is essential for calculating potential profits and losses.

3. Margin and Leverage

Margin is the amount of money required to open a position, while leverage refers to the amount of money that can be borrowed to increase the size of a trade. Both margin and leverage can significantly impact the profitability of a trade.

4. Moving Averages

Moving averages are used to smooth out fluctuations in the price of a currency pair and help traders identify trends. They can be calculated using various timeframes and are an essential tool for technical analysis.

5. Fibonacci Retracements

Fibonacci retracements are used to identify potential levels of support and resistance in the price of a currency pair. They are based on mathematical ratios and are often used in conjunction with other technical indicators.

Using Formulas in Forex Trading

Once you have a solid understanding of these mathematical formulas, you can begin to use them in your forex trading strategy. This involves analyzing data, identifying trends, and making informed decisions about when to enter and exit trades.

Risk Management in Forex Trading

One critical aspect of forex trading is risk management. By using mathematical formulas, traders can calculate potential profits and losses, set stop-loss orders to limit losses, and manage their overall risk exposure.

Automating Forex Trading

Many traders use automated trading systems that rely on mathematical formulas to make trades automatically. These systems can be highly effective but require significant testing and tuning to ensure they are profitable.

Conclusion

Forex trading can be a highly lucrative investment option, but it requires a deep understanding of the underlying principles and a mastery of mathematical formulas. By taking the time to learn these formulas and incorporating them into your trading strategy, you can increase your chances of success in this dynamic and exciting market.Understanding the Basics: The Formula for Calculating Profit and Loss in Forex TradingAs a forex trader, it is essential to have a strong grasp on the basics of the market. One key element to understand is the formula for calculating profit and loss. The formula is relatively simple: Profit/Loss (P/L) = (Bid Price – Ask Price) x Number of Units Traded x Pip Value. It is imperative that traders comprehend how this formula works so that they can accurately calculate their potential earnings or losses from a trade.The Bid Price is the highest price a buyer is willing to pay for a particular currency pair, while the Ask Price is the lowest price a seller is willing to accept. The difference between these two prices is known as the Spread. The number of units traded refers to the size of the position taken by the trader for a particular currency pair. The Pip Value is the smallest incremental price movement in the forex market, which varies depending on the currency pair being traded.By using the formula for calculating P/L, traders can determine the profitability of their trades. If the Bid Price is higher than the Ask Price, the trader will have a negative P/L, indicating a loss. Conversely, if the Bid Price is lower than the Ask Price, the trader will have a positive P/L, indicating a profit.Determining Position Sizing: The Kelly Criterion FormulaProper position sizing is a crucial aspect of successful forex trading. The Kelly Criterion formula is a mathematical equation that can help traders determine the optimal size of their positions. The formula takes into account the trader’s edge, or the probability of winning a trade, and the ratio of the potential win to the potential loss.The Kelly Criterion formula is expressed as follows: Kelly % = W – [(1 – W) / R], where W is the probability of winning a trade and R is the ratio of the potential win to the potential loss. The Kelly % represents the percentage of the trader’s account that should be risked on each trade to maximize long-term growth.For example, if a trader has a 60% probability of winning a trade with a potential win-to-loss ratio of 2:1, the Kelly % would be calculated as follows: Kelly % = 0.6 – [(1 – 0.6) / 2] = 0.2 or 20%. This means that the trader should risk 20% of their account on this particular trade to maximize long-term growth.Making Sense of Pips: The Formula for Calculating Pip ValuePips, or the smallest incremental price movements in the forex market, are a crucial element in calculating potential profits and losses. The formula for calculating pip value is: (Pip in decimal places / Exchange rate) x Lot size. Understanding this formula can help traders accurately calculate the value of their trades.The Pip in decimal places refers to the value of a pip for a particular currency pair, which varies depending on the quote currency. For example, the pip value for a EUR/USD trade would be different than the pip value for a USD/JPY trade. The Exchange rate refers to the current market exchange rate for the currency pair being traded, while the Lot size refers to the number of units being traded.By using the formula for calculating pip value, traders can accurately calculate the potential profit or loss of a trade. For example, if a trader buys 10,000 units of EUR/USD at an exchange rate of 1.2000 and the pip value is $1, the potential profit or loss would be calculated as follows: (0.0001 / 1.2000) x 10,000 x $1 = $8.33.The Power of Compounding: The Compound Interest FormulaCompounding is a powerful tool that can lead to exponential growth in forex trading. The compound interest formula is: A = P (1 + r/n)^(nt), where A is the ending balance, P is the initial investment, r is the interest rate, n is the number of times interest is compounded per year, and t is the number of years. By reinvesting profits, traders can use the power of compound interest to greatly increase their earnings.For example, if a trader invests $10,000 with an annual interest rate of 5% compounded quarterly for five years, the ending balance would be calculated as follows: A = $10,000 (1 + 0.05/4)^(4 x 5) = $12,832. This means that the trader would earn a total of $2,832 in interest over the five-year period.Calculating Risk: The Risk/Reward Ratio FormulaManaging risk is a crucial aspect of successful forex trading. The risk/reward ratio formula is a key tool for assessing potential risk. The formula is: Risk/Reward Ratio = Potential Risk / Potential Reward. By using this formula, traders can better understand the potential risk of a trade in relation to its potential reward.For example, if a trader sets a stop-loss at 50 pips and a take-profit at 100 pips, the potential risk would be 50 pips while the potential reward would be 100 pips. The risk/reward ratio would be calculated as follows: Risk/Reward Ratio = 50 / 100 = 0.5 or 1:2. This means that the potential reward is twice the size of the potential risk.Using Moving Averages: The Simple Moving Average FormulaMoving averages are a popular tool used by forex traders to help identify trends in the market. The simple moving average (SMA) formula calculates the average price of a currency over a specified period of time. The formula for calculating the SMA is: SMA = (Sum of Closing Prices over Time Period) / Number of Time Periods.For example, if a trader wants to calculate the 10-day SMA for USD/JPY, they would add up the closing prices for the past 10 days and divide by 10. This would give them the average price of USD/JPY over the last 10 days, which can be used to identify trends in the market.Identifying Overbought/Oversold Conditions: The Relative Strength Index (RSI) FormulaThe Relative Strength Index (RSI) is a technical indicator that measures the momentum of price movements. The RSI formula is: RSI = 100 – (100 / (1 + RS)), where RS is the average of x days’ up closes /average of x days’ down closes. The RSI can help traders identify overbought or oversold conditions in the market.For example, if the RSI for a particular currency pair is above 70, it may indicate that the pair is overbought and due for a correction. Conversely, if the RSI is below 30, it may indicate that the pair is oversold and due for a potential reversal.Understanding Volatility: The Average True Range (ATR) FormulaThe Average True Range (ATR) is a technical indicator that measures volatility in the market. The ATR formula is: ATR = (Current ATR x (n – 1) + TR) / n, where TR is the true range for the current period and n is the number of periods being analyzed. By understanding volatility through the ATR formula, traders can better manage risk and make informed trading decisions.For example, if the ATR for a particular currency pair is high, it may indicate that the pair is experiencing increased volatility. Traders may want to adjust their position sizing or consider implementing a stop-loss to manage potential risk.Analyzing Trends: The Fibonacci Retracement FormulaThe Fibonacci retracement is a popular tool used to identify potential support and resistance levels in the market. The formula is based on the Fibonacci sequence, where the percentage levels are: 23.6%, 38.2%, 50%, 61.8%, and 100%. The formula for calculating these levels is: (High – Low) x Fibonacci Level + Low.For example, if a trader wants to identify potential support levels for a currency pair, they may use the Fibonacci retracement tool to draw lines at the 38.2% and 61.8% levels. If the price of the currency pair bounces off these levels, it may indicate that they are acting as support.Using Technical Analysis: The Moving Average Convergence Divergence (MACD) FormulaThe Moving Average Convergence Divergence (MACD) is a technical indicator that helps traders identify trends and potential changes in momentum. The MACD formula is: MACD = 12-day EMA – 26-day EMA, and the signal line formula is: 9-day EMA of MACD. By using the MACD formula, traders can better analyze trends and make informed trading decisions.For example, if the MACD line crosses above the signal line, it may indicate that the currency pair is experiencing bullish momentum. Conversely, if the MACD line crosses below the signal line, it may indicate that the currency pair is experiencing bearish momentum.In conclusion, understanding these mathematical formulas is essential for success in forex trading. By comprehending the basics of profit and loss, determining position sizing, making sense of pips, using compounding, calculating risk, using moving averages, identifying overbought/oversold conditions, understanding volatility, analyzing trends, and using technical analysis, traders can make informed trading decisions and maximize their potential earnings.Forex trading is a popular investment option for many individuals looking to make a profit in the financial markets. It involves buying and selling currencies with the aim of making a profit from the fluctuations in exchange rates. While forex trading can be lucrative, it also involves risk and requires an understanding of mathematical formulas and analysis.Pros of Forex Trading with Mathematical Formulas:1. Increased Accuracy: By using mathematical formulas and analysis, traders can make more accurate predictions about the direction of currency exchange rates. This can help them make informed decisions about when to buy and sell currencies.2. Automation: Many forex trading platforms offer automated trading systems that use mathematical formulas and algorithms to execute trades based on predetermined criteria. This can save time and effort for traders who don’t have the expertise or time to analyze market data themselves.3. Risk Management: Mathematical formulas can be used to manage risk by setting stop-loss orders and take-profit levels. This helps traders limit their losses and maximize their profits.Cons of Forex Trading with Mathematical Formulas:1. Complex Learning Curve: Understanding and applying mathematical formulas and analysis can be challenging for novice traders. It requires a significant amount of time and effort to learn and apply these techniques effectively.2. Overreliance on Technology: Automated trading systems can be prone to glitches and errors, leading to unexpected losses. Traders must be cautious when relying on technology to make trading decisions.3. Incomplete Analysis: Mathematical formulas and analysis can only provide a partial picture of market conditions. Other factors such as political events, economic data, and social trends can also impact currency exchange rates.In conclusion, forex trading with mathematical formulas can be a powerful tool for traders looking to make informed decisions and manage risk. However, it also requires a significant amount of expertise and caution to avoid potential pitfalls. Traders should weigh the pros and cons carefully before deciding whether to use mathematical formulas in their trading strategies.

As a financial journalist, it is important to inform and educate readers about the various methods available in the world of forex trading. One such approach is through the use of mathematical formulas to make informed investment decisions.

These formulas are designed to analyze market trends and patterns, identifying potential opportunities for traders to enter or exit trades. By utilizing these tools, traders can reduce their reliance on emotions and gut feelings, instead relying on data-driven insights to make informed decisions.

However, it is important to note that while these formulas can be powerful tools, they should not be relied upon solely. It is crucial for traders to have a deep understanding of the market and its underlying factors, as well as the risks and potential rewards associated with each trade.

In conclusion, forex trading with mathematical formulas can be an effective method for making informed investment decisions. However, it is important to approach these tools with caution and to supplement them with a thorough understanding of the market and its various factors. By combining these approaches, traders can increase their chances of success in the world of forex trading.

Video forex trading with mathematical formulas

Visit VideoForex trading can be a complicated topic, especially for those who are new to the world of finance. As a result, people often have many questions about forex trading with mathematical formulas. Here are some of the most frequently asked questions, along with their answers:

1. What is the formula for calculating profits and losses in forex trading?

- The formula for calculating profits in forex trading is: (Close Price – Open Price) x Trade Size x Lot Size.

- The formula for calculating losses in forex trading is: (Open Price – Close Price) x Trade Size x Lot Size.

2. How do I calculate the value of a pip?

- The formula for calculating the value of a pip is: (Pip Value / Exchange Rate) x Trade Size.

- Pip value is usually represented as the fourth decimal point in currency pairs.

3. What is the formula for calculating margin?

- The formula for calculating margin is: (Trade Size x Lot Size / Leverage) x 100.

- Leverage is the amount of money a trader can borrow from the broker.

4. How can I calculate my risk-reward ratio?

- The formula for calculating risk-reward ratio is: Take Profit / Stop Loss.

- A good risk-reward ratio is typically 2:1 or higher.

By understanding these mathematical formulas, traders can make more informed decisions when it comes to forex trading. However, it’s important to remember that these formulas are just one aspect of successful trading. It’s also important to have a solid understanding of market trends, economic indicators, and risk management strategies.