Forex trading online offers a convenient and accessible way to trade currencies from anywhere in the world. Learn how to make profitable trades today.

Forex trading online has revolutionized the way individuals and corporations trade currencies. With the click of a button, traders can access a global market that is worth trillions of dollars. Despite its appeal, forex trading is a complex and highly competitive industry that requires a deep understanding of the market and its fluctuations. In this article, we will explore the ins and outs of forex trading online, from the basics to the latest trends and strategies.

First and foremost, it is important to understand that forex trading is not for the faint-hearted. It is a fast-paced and dynamic environment where fortunes can be made or lost in a matter of seconds. However, for those who are willing to put in the time and effort to learn the ropes, forex trading can be an extremely lucrative venture.

One of the key advantages of forex trading online is the accessibility it provides. Traders can operate from anywhere in the world, at any time of day, thanks to the internet and mobile devices. This means that even those with busy schedules or limited resources can participate in the market and take advantage of its opportunities.

But with great opportunity comes great risk. The forex market is highly susceptible to volatility and political instability, which can lead to sudden price movements and significant losses. Therefore, it is crucial for traders to stay informed and up-to-date on the latest news and events that may impact the market.

In the next sections, we will delve deeper into the world of forex trading online, exploring the different types of traders and strategies, as well as the tools and platforms available to help traders make informed decisions. So buckle up and get ready to embark on an exciting journey into the world of forex trading!

Daftar Isi

Introduction

Forex trading is a popular way to invest money and earn profits online. It allows individuals to buy, sell and exchange different currencies through a trading platform. With the advancement of technology, forex trading has become more accessible and convenient than ever before. Online forex trading has become a great opportunity for people who want to make money from the comfort of their homes.

How does Forex Trading Work?

Forex trading involves buying one currency and selling another at the same time. The value of a currency is determined by its supply and demand in the market. When you buy a currency, you are essentially betting that its value will increase in the future. If it does, you can sell it for a profit. On the other hand, if its value decreases, you will incur a loss.

Factors that Affect Currency Prices

The value of a currency is influenced by several factors such as political stability, economic growth, inflation rates, interest rates, and geopolitical events. These factors can cause fluctuations in currency prices, making forex trading a dynamic and exciting market to invest in.

Online Forex Trading Platforms

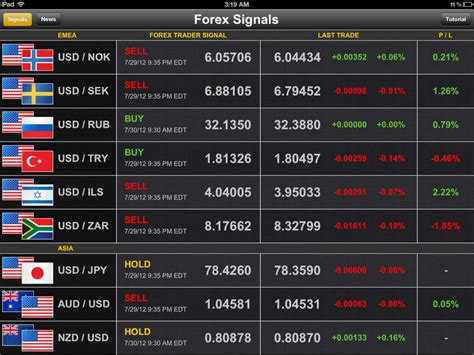

To participate in online forex trading, you need to have access to a trading platform. These platforms allow you to monitor currency prices, place orders and execute trades. Some popular online forex trading platforms include MetaTrader 4, cTrader, and NinjaTrader.

Choosing a Forex Broker

Before you can start trading forex online, you need to select a reputable broker. A broker is a company that provides traders with access to the forex market. They act as intermediaries between traders and liquidity providers. When choosing a broker, it’s essential to consider factors such as regulation, fees, trading tools, and customer service.

Types of Forex Trading Strategies

Forex traders use different strategies to make profits from the market. Some popular strategies include:

Scalping

Scalping is a strategy that involves making multiple trades within a short period. Traders aim to make small profits from each trade by exploiting small price movements.

Swing Trading

Swing trading involves holding trades for several days or weeks. Traders aim to capture medium-term price movements by analyzing market trends and patterns.

Position Trading

Position trading involves holding trades for several months or even years. Traders aim to capture long-term trends in the market by analyzing economic and geopolitical factors.

Risks of Forex Trading

Forex trading can be a high-risk investment. The market is volatile, and prices can fluctuate rapidly, leading to significant losses. It’s essential to have a risk management strategy in place when trading forex online. This can include setting stop-loss orders, using leverage wisely, and diversifying your portfolio.

Regulation

Regulation is an important aspect of forex trading. It helps to protect traders from fraud and ensures that brokers adhere to industry standards. It’s essential to choose a regulated broker to ensure that your funds are secure.

Conclusion

Forex trading online can be a lucrative investment opportunity for those who are willing to take risks and learn the market. With the right strategy, tools, and knowledge, you can make profits from the comfort of your home. However, it’s essential to approach forex trading with caution and to have a risk management strategy in place. Always choose a regulated broker and never invest more than you can afford to lose.

Online Forex Trading: An Overview

Forex trading is a global market where traders buy and sell currencies. It is the largest financial market in the world, with an average daily turnover of over $6 trillion. With the increasing popularity of online trading platforms, forex trading has become easily accessible to anyone with an internet connection. Online forex trading allows traders to participate in the market from anywhere in the world, at any time of the day.

The Basics of Forex Trading

The goal of forex trading is to profit from fluctuations in currency exchange rates. Traders buy a currency when they believe its value will increase in relation to another currency, and sell it when they believe its value will decrease. The difference between the buying and selling price is the profit or loss.

Forex trading involves currency pairs, with one currency being traded for another. For example, the EUR/USD currency pair represents the euro against the US dollar. The first currency, known as the base currency, is the one being bought or sold. The second currency, known as the quote currency, is the currency being used to make the purchase.

How Does Online Forex Trading Work?

To start trading forex online, a trader needs to open an account with a forex broker. The broker provides access to a trading platform, which is software that allows traders to place trades, monitor their positions, and view charts and other market data.

Traders can enter trades based on their analysis of the market and their trading strategy. Most trading platforms offer a variety of order types, including market orders, limit orders, stop-loss orders, and more. Traders can also use leverage to increase their buying power and potentially increase their profits. However, leverage also increases the risk of losses.

Advantages of Trading Forex Online

One of the biggest advantages of online forex trading is the accessibility. Traders can participate in the market from anywhere in the world, at any time of the day. This allows for flexibility and convenience, as traders can fit trading around their other commitments.

Online forex trading also offers a wide range of trading instruments, including currency pairs, commodities, indices, and more. This allows traders to diversify their portfolios and potentially reduce their risk.

Another advantage of online forex trading is the transparency. Most brokers provide real-time market data, which allows traders to make informed decisions based on current market conditions. Additionally, most brokers are regulated by financial authorities, which helps to ensure the safety of traders’ funds.

Risks Involved in Forex Trading

While there are many potential benefits to trading forex online, there are also risks involved. One of the biggest risks is the volatility of the market. Currency exchange rates can fluctuate rapidly and unpredictably, which can lead to significant losses.

Another risk is the use of leverage. While leverage can increase potential profits, it also increases the potential for losses. Traders should be aware of the risks involved before using leverage and should only use it if they fully understand how it works.

There is also the risk of fraud or scams. Traders should only use reputable brokers and should be wary of any offers that seem too good to be true.

Choosing the Best Online Forex Trading Platform

Choosing the right online forex trading platform is important for successful trading. Traders should look for a platform that is user-friendly, reliable, and offers a wide range of trading instruments. The platform should also offer real-time market data and should be regulated by financial authorities.

Traders should also consider the fees and commissions charged by the broker. While some brokers offer low spreads, they may charge higher fees or commissions. Traders should compare different brokers to find the one that offers the best value for their trading style.

Strategies for Successful Forex Trading

Successful forex trading requires a solid strategy and disciplined approach. Traders should have a clear understanding of their trading goals and should develop a trading plan that aligns with those goals.

Traders should also have a thorough understanding of technical analysis and fundamental analysis. Technical analysis involves studying charts and other market data, while fundamental analysis involves analyzing economic and political events that may affect currency exchange rates.

Additionally, traders should be patient and disciplined. They should not let emotions drive their trading decisions and should stick to their trading plan even during periods of losses.

Factors Influencing Forex Exchange Rates

There are many factors that can influence currency exchange rates. These include economic indicators such as GDP, inflation, and employment data, as well as political events such as elections and geopolitical tensions. Central bank policies, interest rates, and trade balances can also affect currency exchange rates.

Traders should stay informed on these factors and how they may impact the currencies they are trading. They should also be aware of any upcoming news releases or events that may affect the market.

Staying Informed on Forex Market Conditions

Staying informed on forex market conditions is crucial for successful trading. Traders should regularly monitor market data and news releases, and should stay up-to-date on economic and political events that may affect currency exchange rates.

Many brokers offer educational resources and market analysis, which can help traders stay informed. Traders can also use technical analysis tools and indicators to analyze the market and identify potential trading opportunities.

Best Practices for Online Forex Trading

Some best practices for online forex trading include setting realistic trading goals, developing a trading plan, and sticking to that plan. Traders should also use proper risk management techniques, such as using stop-loss orders and avoiding over-leveraging.

Traders should also stay disciplined and avoid letting emotions drive their trading decisions. They should be patient and avoid taking unnecessary risks.

Ultimately, successful forex trading requires a combination of knowledge, discipline, and practice. By staying informed on market conditions and following best practices, traders can increase their chances of success in the forex market.

Forex trading online has become increasingly popular in recent years, with many people hoping to make a quick profit from the currency markets. While there are certainly advantages to trading forex online, it is important to be aware of the potential downsides as well.

The Pros of Forex Trading Online:

- 24/7 trading: Unlike traditional stock markets, forex trading is available around the clock, allowing traders to take advantage of opportunities as they arise.

- Low barriers to entry: With online forex brokers, it is easy and relatively inexpensive to get started with trading. Many brokers offer demo accounts for practice, and you can start trading with just a few hundred dollars.

- Leverage: Forex trading allows for high leverage, which means that traders can control large positions with relatively small amounts of capital. This can amplify profits if trades go well.

- Global market: The forex market is the largest financial market in the world, with trillions of dollars traded every day. This means that there are always opportunities to trade, no matter where you are located.

The Cons of Forex Trading Online:

- High risk: Trading forex involves a high degree of risk, and it is not uncommon for traders to lose their entire investment. It is important to have a solid understanding of the markets and to use risk management strategies to minimize losses.

- Scams: The online forex industry has its fair share of scams and fraudulent brokers. It is important to do your research and only trade with reputable brokers who are regulated by financial authorities.

- Volatility: The forex market is highly volatile, with prices fluctuating rapidly in response to news events and other factors. This can make it difficult for traders to predict market movements and make profitable trades.

- Complexity: Forex trading can be complex and difficult to understand, particularly for beginners. It is important to take the time to learn about the markets and develop a trading strategy before risking real money.

Overall, forex trading online can be a lucrative and exciting way to invest your money. However, it is important to approach it with caution and to be aware of both the potential rewards and risks involved.

As the digital world continues to expand, more and more people are turning to online forex trading as a means of making money. While there are certainly opportunities for success in this field, it is important to approach it with caution and education.

One of the key things to keep in mind when trading forex online is the importance of research and analysis. Before making any trades, it is essential to thoroughly examine market trends and economic indicators to ensure that you have the best possible chance of success. Additionally, it is crucial to understand the risks involved in forex trading and to develop a solid risk management strategy to help mitigate those risks.

Overall, while online forex trading can be a lucrative venture, it is important to approach it with care. By doing your research and developing a thoughtful strategy, you can increase your chances of success and minimize your risk of loss. So if you’re considering diving into the world of forex trading, take the time to educate yourself and make informed decisions.

Video forex trading online

As forex trading gains popularity, many people have questions about it. Here are some common questions people ask about forex trading online:

-

What is forex trading?

- Forex trading is the buying and selling of currencies in the foreign exchange market.

-

Is forex trading legal?

- Yes, forex trading is legal in most countries, but it is important to check the regulations in your country before you start trading.

-

How much money do I need to start forex trading?

- You can start forex trading with as little as $100, but it is recommended to have at least $1000 to start with.

-

What is leverage in forex trading?

- Leverage is the ability to control a large amount of money with a small amount of capital. It allows traders to increase their potential profits, but it also increases their potential losses.

-

What are the risks of forex trading?

- The risks of forex trading include losing all your capital, high volatility, and the possibility of scams or fraud.

-

What are the benefits of forex trading?

- The benefits of forex trading include high liquidity, 24-hour market, low transaction costs, and the potential for high profits.

-

How do I choose a forex broker?

- You should choose a forex broker that is regulated, has a good reputation, offers competitive spreads and commissions, and has a user-friendly trading platform.

-

How do I learn forex trading?

- You can learn forex trading through online courses, books, webinars, and practice on demo accounts.

By understanding the basics of forex trading and doing your research, you can start trading with confidence and potentially earn profits.