Forex trading can lead to significant losses if not managed properly. Learn how to minimize risks and protect your investments.

Forex trading can be a highly lucrative investment, but it also comes with significant risks. One of the biggest dangers lies in the potential for trading losses, which can leave investors with significant financial setbacks. Despite this risk, many individuals continue to engage in forex trading without fully understanding the potential consequences. In this article, we’ll take a closer look at the realities of forex trading losses and explore some key strategies for minimizing your risk.

First and foremost, it’s important to recognize that forex trading losses are a very real possibility. In fact, many traders experience losses at some point during their careers – even those who consider themselves to be highly skilled and knowledgeable. This is because the forex market is constantly changing and evolving, and even the most experienced traders can struggle to keep up with these shifts.

However, not all forex trading losses are created equal. Some traders may experience small losses that are easily absorbed by their overall portfolio, while others may suffer catastrophic losses that wipe out their entire investment. The difference often comes down to strategy and risk management. Traders who take a measured and cautious approach to forex trading are more likely to minimize their losses and emerge from difficult situations relatively unscathed.

Daftar Isi

The Risks of Forex Trading

Forex trading is a popular form of investment that has the potential to generate high returns. However, it is not without risks. In recent years, many individuals have suffered significant losses in the forex market. In this article, we will explore some of the reasons why forex trading can be risky and why traders should be cautious.

Volatility of the Forex Market

The forex market is highly volatile, which means that prices can fluctuate rapidly and unpredictably. This volatility can be caused by various factors such as political events, economic indicators, and global crises. Traders who are not prepared for sudden changes in the market can suffer significant losses.

Leverage and Margin Trading

Leverage and margin trading are commonly used in forex trading to increase potential profits. However, they also increase the risk of losses. Leverage allows traders to control a large amount of currency with a small initial investment, but it also magnifies any losses. Margin trading involves borrowing money from a broker to trade, which can lead to significant losses if not managed properly.

Lack of Knowledge and Experience

Forex trading requires a solid understanding of the market, technical analysis, and risk management. Traders who lack knowledge and experience may make poor decisions that result in losses. It is essential to educate oneself about the forex market before investing any money.

Overtrading and Emotions

Some traders become addicted to trading, constantly monitoring the market and making impulsive trades. Overtrading can lead to exhaustion and poor decision-making. Emotions such as fear and greed can also cloud judgement and cause traders to make irrational decisions.

Fraudulent Brokers and Scams

Unfortunately, the forex market is also a breeding ground for fraudulent brokers and scams. Traders should be cautious of promises of high returns with little to no risk. Always do research on a broker before investing any money.

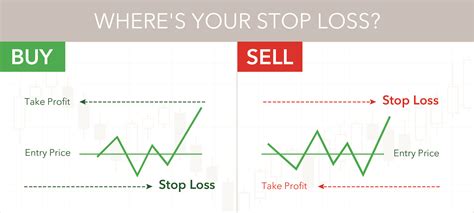

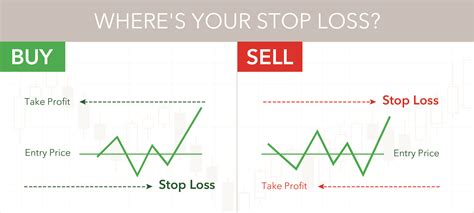

Failure to Use Stop Losses

A stop loss order is a tool used by traders to limit their losses. It is a pre-determined price at which a trader will exit a trade if the price moves against them. Failure to use a stop loss can result in significant losses if the market moves against a trader.

Ignoring Fundamental Analysis

Technical analysis is an important part of forex trading, but it should not be the only factor considered. Fundamental analysis, which looks at economic and political events, can also have a significant impact on the forex market. Ignoring fundamental analysis can lead to poor decision-making and losses.

Not Diversifying Investments

Forex trading should be just one part of a diversified investment portfolio. Traders who put all their money into forex trading are at a higher risk of losing everything. Diversification helps to spread risk and protect against losses.

Unrealistic Expectations

Some traders enter the forex market with unrealistic expectations of making huge profits in a short amount of time. This mentality can lead to impulsive trades and poor decision-making. It is essential to have realistic expectations and a long-term strategy for success in forex trading.

Conclusion

In conclusion, forex trading can be a profitable investment, but it is not without risks. Traders should be aware of the potential risks and take steps to manage them. It is also essential to have a solid understanding of the market, technical analysis, and risk management. With the right approach, forex trading can be a rewarding investment opportunity.

Introduction: Overview of Forex Trading Losses

Forex trading is a complex and volatile world that can be both rewarding and risky. With a daily volume of $5.3 trillion, the forex market is the largest financial market on the planet. However, it is also riddled with risks, and losses are a common phenomenon. In this article, we will discuss some of the most significant forex trading losses in history and their impact on traders.

The Swiss National Bank’s Black Thursday

On January 15, 2015, the Swiss National Bank made a shocking announcement that it was scrapping the Swiss franc’s peg to the euro. This caused the currency to skyrocket, catching many traders off guard and resulting in colossal losses. The event, known as Black Thursday, was one of the most significant forex losses ever recorded, with some traders losing more than their entire account balance.

The Russian Ruble Crisis of 2014

In 2014, the Russian ruble suffered a massive devaluation due to the combination of falling oil prices and Western sanctions. As a result, many Russian forex traders experienced steep losses, with some losing their entire investments. The crisis highlighted the importance of understanding geopolitical risks when trading currencies.

The Brexit Vote and the Pound

The United Kingdom’s decision to leave the European Union in June 2016 came as a surprise to global markets, causing the pound sterling to plummet 10% against the US dollar in a matter of hours. Many forex traders were caught off guard, resulting in huge losses. The event demonstrated the impact of political events on currency volatility and the importance of risk management in forex trading.

Lehman Brothers’ Collapse and Forex Losses

The bankruptcy of Lehman Brothers in 2008 was a monumental event in financial history, with repercussions felt throughout the world. Forex traders who had positions in the US dollar or the Japanese yen suffered significant losses, as the value of these currencies fluctuated drastically. The event highlighted the importance of diversification and risk management in forex trading.

Long-Term Capital Management (LTCM) Crisis

In 1998, a hedge fund called Long-Term Capital Management (LTCM) collapsed, causing a widespread panic across financial markets. Forex traders who had borrowed heavily from LTCM were hit hard, with some losing all their investments. The event demonstrated the risks associated with leverage in forex trading and the importance of understanding counterparty risk.

The Eurozone Debt Crisis and Forex Trading Losses

Between 2010 and 2012, the Eurozone was in the grips of a debt crisis, with several countries facing the prospect of defaulting on their debt. This caused immense volatility in forex markets, leading to substantial losses for forex traders. The crisis highlighted the need for traders to understand macroeconomic events and their impact on currency markets.

Rogue Trading at UBS and Forex Trading Losses

In 2011, UBS discovered that one of its traders had carried out unauthorized trades that resulted in a loss of $2.3 billion. The incident highlighted the risks associated with rogue trading and the importance of risk management in forex trading. It also led to increased regulatory scrutiny of forex trading practices.

The Collapse of MF Global and Forex Losses

In 2011, MF Global, a brokerage firm specializing in futures markets, filed for bankruptcy. The firm had been heavily invested in European debt, and the collapse resulted in massive losses for traders who had positions in futures markets. The event underscored the importance of understanding counterparty risk and the need for traders to diversify their investments.

The Flash Crash of 2010 and Forex Trading Losses

The Flash Crash of 2010 was a sudden and intense market crash that occurred over a few short minutes, followed by a swift return to normalcy. The crash sent shockwaves throughout global financial markets, including the forex market, leading to significant losses for many traders. The event demonstrated the importance of risk management and the need for traders to have stop-loss orders in place.

Conclusion

In conclusion, forex trading is a dynamic and volatile world that can result in significant losses. However, by understanding the risks associated with trading currencies and implementing effective risk management strategies, traders can minimize their losses and increase their chances of success. The events discussed in this article demonstrate the importance of staying informed, diversifying investments, and having a sound risk management plan in place.

Forex trading can be a lucrative investment opportunity, but it also comes with risks and potential losses. Here are some pros and cons to consider when it comes to forex trading losses:

Pros of Forex Trading Losses

- Learning experience: Losses provide an opportunity to learn from mistakes and improve trading strategies.

- Tax benefits: In some countries, forex trading losses can be used to offset capital gains taxes.

- Risk management: Setting stop-loss orders can limit potential losses and help manage risk.

Cons of Forex Trading Losses

- Financial loss: The obvious downside of forex trading losses is the financial impact they can have on investors.

- Emotional stress: Losing money can cause emotional stress and anxiety, leading to impulsive decisions and further losses.

- Market volatility: The forex market can be highly volatile, making it difficult to predict and manage risks.

Overall, forex trading losses should be viewed as a learning opportunity rather than a failure. With careful risk management and a disciplined trading strategy, investors can minimize potential losses and increase their chances of success in the forex market.

As a journalist, it is crucial to inform our readers about the risks involved in forex trading, especially the losses that come with it. Forex trading may seem like an easy way to make money, but it is not a get-rich-quick scheme. If you are not careful, you can lose more than you gain.

One of the main reasons why forex traders experience losses is because they lack knowledge and experience. Before diving into forex trading, it is essential to learn the basics, understand the market trends, and develop your trading strategy. It is also important to start small and gradually increase your trading volume as you gain more experience.

Furthermore, emotions play a significant role in forex trading. Fear and greed can cloud your judgment and lead to impulsive decisions that can result in heavy losses. To avoid this, it is vital to have a disciplined approach to trading and stick to your trading plan.

In conclusion, forex trading losses can be devastating, but they can be avoided if you take the time to learn, develop a strategy, and remain disciplined. Remember, forex trading is not a game of chance but a game of skill. As a journalist, my advice to anyone interested in forex trading is to approach it with caution and be prepared to face the risks involved.

Video forex trading losses

As a journalist, I often receive questions from people about forex trading losses. Here are some of the most common questions and their answers:

1. What is forex trading?

Forex trading, or foreign exchange trading, is the act of buying and selling currencies on the foreign exchange market. The goal of forex traders is to profit from the fluctuations in exchange rates between different currencies.

2. Why do people lose money in forex trading?

There are several reasons why people lose money in forex trading:

- Lack of knowledge or experience

- Overtrading or taking on too much risk

- Emotional trading, such as letting fear or greed guide their decisions

- Not using proper risk management techniques

3. How much money can you lose in forex trading?

The amount of money you can lose in forex trading depends on how much you invest, the leverage you use, and how the market moves. It’s possible to lose all of your investment if the market goes against you.

4. Can you make money in forex trading?

Yes, it is possible to make money in forex trading. However, it requires knowledge, skill, and discipline. Successful forex traders often have a solid trading strategy and use proper risk management techniques.

5. What should I do if I’ve lost money in forex trading?

If you’ve lost money in forex trading, the first step is to review your trading strategy and identify any mistakes you may have made. It’s also important to use proper risk management techniques, such as setting stop-loss orders and not risking more than you can afford to lose. If you’re struggling, it may be helpful to seek the advice of a professional forex trader or financial advisor.