Forex trading laws in Islam prohibit riba or interest. Trading should be based on actual exchange and not speculative or gambling-like behavior.

Forex trading is a popular investment opportunity for many people around the world. However, for Muslims, there are certain laws and regulations that must be followed when trading in the foreign exchange market. The Islamic law of finance, also known as Shariah law, prohibits certain financial activities that involve interest payments, speculation, and uncertainty. As a result, Forex trading laws in Islam have been established to ensure that Muslims can participate in the market without violating their religious beliefs.

Despite the growing popularity of Forex trading, many Muslims are still unaware of the laws and regulations that govern this activity. This lack of knowledge can lead to unintended violations of Shariah law, which can have serious consequences for the individual and their community. It is important for Muslims to understand the principles of Islamic finance and how they apply to Forex trading, so that they can make informed decisions about their investments.

Fortunately, there are a number of resources available to help Muslims navigate the world of Forex trading within the bounds of Shariah law. From online courses to expert advisors, there are many tools and services that can assist Muslims in making ethical and profitable investments. By educating themselves and seeking out reputable sources of guidance, Muslims can participate in Forex trading with confidence and peace of mind.

Daftar Isi

Introduction

Forex trading is a popular investment option for many people around the world. With its high potential for profit, it has attracted the attention of millions of investors. However, for Muslims, there is a question of whether Forex trading is halal or haram. In this article, we will explore the laws surrounding Forex trading in Islam.

The Definition of Forex Trading

Forex trading, also known as foreign exchange trading, involves buying and selling currencies to make a profit. It is a decentralized market that operates 24 hours a day, five days a week. The value of currencies fluctuates constantly, allowing traders to profit from these changes.

The Concept of Halal and Haram in Islam

In Islam, there are certain guidelines that dictate what is considered halal (permissible) and haram (forbidden). These guidelines are based on the Quran and the teachings of Prophet Muhammad. Halal activities are those that are morally and ethically acceptable, while haram activities are those that are not.

The Debate on Forex Trading in Islam

There is a debate among Islamic scholars on whether Forex trading is halal or haram. Some scholars argue that it is haram because it involves interest (riba) and speculation (gharar). Others argue that it is halal because it is a legitimate business activity.

The Prohibition of Riba in Islam

Riba refers to interest or usury, which is forbidden in Islam. This is because it is seen as exploiting others for personal gain. In Forex trading, some transactions involve interest payments, which is why it is considered haram by some scholars.

The Issue of Gharar in Forex Trading

Gharar refers to uncertainty or risk, which is also forbidden in Islam. In Forex trading, there is a high level of risk involved due to the volatile nature of the market. This is why some scholars consider it haram.

The Permissibility of Forex Trading in Islam

Despite the debate on whether Forex trading is halal or haram, some scholars argue that it is permissible as long as certain conditions are met. These conditions include ensuring that there is no interest involved in the transactions and that they are conducted in a transparent and fair manner.

The Importance of Seeking Knowledge in Forex Trading

For Muslims who wish to engage in Forex trading, it is essential to seek knowledge on the laws surrounding it in Islam. This includes consulting with Islamic scholars and understanding the conditions that must be met for it to be considered halal.

The Role of Regulators in Forex Trading

Regulators play an important role in ensuring that Forex trading is conducted in a fair and transparent manner. In countries where Forex trading is legal, regulatory bodies oversee the industry to prevent fraud and protect investors.

Conclusion

In conclusion, the laws surrounding Forex trading in Islam are complex and subject to debate. While some scholars consider it haram due to the presence of interest and risk, others argue that it is permissible under certain conditions. For Muslims who wish to engage in Forex trading, it is important to seek knowledge and consult with Islamic scholars to ensure that it is done in a halal manner.

Introduction: Understanding Forex Trading and Islamic Law

In recent years, Forex trading has become increasingly popular among investors around the world. However, for Muslim investors, engaging in Forex trading requires careful consideration of Islamic law, or Shariah. In order to understand the relationship between Forex trading and Islamic law, it is important to have a clear understanding of both concepts individually. Forex trading refers to the buying and selling of currencies on the global market, while Islamic law is a set of religious principles and guidelines that govern Muslim conduct in all areas of life.

The Prohibition of Interest: The Basis of Islamic Finance

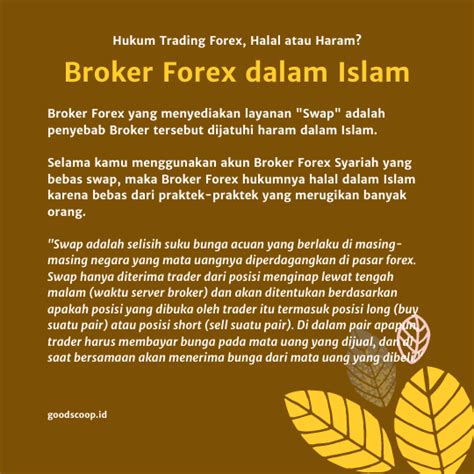

One of the most important principles of Islamic finance is the prohibition of interest, or Riba. This stems from the belief that money is simply a medium of exchange and should not be used to generate profit on its own. As such, any financial transaction that involves the charging or receiving of interest is considered haram, or sinful. In the context of Forex trading, this means that any transaction that involves interest payments, such as swap fees, would be considered haram.

The Concept of Halal Investment

In order to comply with Islamic law, Forex trading must be conducted in a manner that is considered halal, or permissible. This can be achieved by applying the principles of risk-sharing and profit-sharing, whereby the investor and the trader share the risk and reward of the transaction. In other words, the investor and the trader should enter into an agreement where they agree to share any profits or losses that may arise from the transaction. This ensures that the transaction is based on mutual benefit and avoids the charging or receiving of interest.

The Role of Shariah Advisors

To help ensure that their transactions comply with Islamic law, many Forex traders turn to Shariah advisors for guidance. These advisors are typically Islamic scholars who are well-versed in both the principles of Islamic law and the intricacies of the Forex market. They can provide guidance on which currencies are considered halal, how to structure transactions in a halal manner, and how to avoid any haram elements.

The Importance of Transparency and Disclosure

In addition to seeking guidance from Shariah advisors, Forex traders who wish to comply with Islamic law must also ensure that they are transparent in their dealings and disclose all relevant information to their partners. This includes disclosing any fees or charges associated with the transaction, as well as any other relevant details. By being transparent and honest in their dealings, traders can ensure that their transactions are based on mutual benefit and avoid any potential haram elements.

The Permissible Currencies in Islamic Forex Trading

Another important consideration for Forex traders is the choice of currencies. While most currencies can be traded on the global Forex market, not all of them are considered halal for Islamic Forex trading. Some scholars recommend sticking to currencies that are widely used in Islamic countries or that are backed by gold or silver. This ensures that the transaction is based on tangible assets and avoids any potential haram elements.

The Emergence of Islamic Forex Trading Platforms

To meet the growing demand for halal Forex trading options, a number of platforms have emerged in recent years that are specifically designed to comply with Islamic law. These platforms often offer specialized tools and services, such as Shariah-compliant trading accounts and Islamic finance calculators. By using these platforms, Muslim investors can engage in Forex trading while ensuring that their transactions are compliant with Islamic law.

The Risks and Challenges of Islamic Forex Trading

While Islamic Forex trading can be a viable option for Muslim investors, it is also important to bear in mind the risks and challenges involved. These include the volatile nature of the Forex market, the potential for fraud and scams, and the need to constantly stay abreast of changes in both the market and Islamic law. Muslim investors should be aware of these risks and take steps to mitigate them, such as conducting thorough research and seeking advice from trusted advisors.

The Importance of Education and Due Diligence

To mitigate the risks associated with Islamic Forex trading, it is essential for Muslim investors to engage in education and due diligence before entering the Forex market. This includes seeking advice from trusted advisors, conducting thorough research into potential investment opportunities, and staying up-to-date on both market trends and Islamic law. By being informed and diligent, Muslim investors can make informed decisions about their investments and ensure that they comply with Islamic law.

Conclusion: Balancing Legal and Religious Requirements

In sum, Forex trading in accordance with Islamic law requires a careful balance between legal and religious requirements. Muslim investors must be aware of the principles of Islamic finance, including the prohibition of interest, and take steps to ensure that their transactions are compliant with Islamic law. With the right guidance, education, and due diligence, however, it is possible for Muslim investors to engage in this global market while also upholding their religious beliefs and principles.

Forex trading laws in Islam have been a topic of debate among Muslims for many years. While some believe that it is permissible, others argue that it is against Islamic principles. Here are the pros and cons of Forex trading laws in Islam:

Pros:

- Forex trading can be a source of income for Muslims who are looking to invest their money. It can provide an opportunity to earn profits through legitimate means.

- Forex trading can be a way to diversify one’s investment portfolio, which can help reduce risk and increase returns.

- Forex trading can be done in accordance with Islamic principles if certain conditions are met, such as avoiding interest-based transactions and ensuring that trades are made in a fair and transparent manner.

Cons:

- Forex trading can be highly speculative and risky, which can lead to significant losses. This can be especially problematic for those who may not have the financial resources to absorb such losses.

- Forex trading can be complex and difficult to understand, which can make it more challenging for individuals to navigate the market effectively.

- There is ongoing debate among scholars about whether Forex trading is permissible under Islamic law, which can create confusion and uncertainty for those interested in pursuing this type of investment.

Overall, the question of Forex trading laws in Islam is a complex and nuanced issue that requires careful consideration. While there are certainly potential benefits to this type of investment, it is important for individuals to weigh these against the potential risks and to ensure that any investments they make are in line with their personal values and beliefs.

As a journalist, it is my responsibility to inform the public about pertinent issues, and one of these is the laws surrounding Forex trading in Islam. The topic of Forex trading has been a controversial one among Muslims for many years, with some arguing that it is haram (forbidden) while others believe that it is permissible under certain conditions.

Firstly, let’s define what Forex trading is. Forex trading involves buying and selling currencies on the foreign exchange market, with the aim of making a profit. This type of trading is often done through a broker and can be done online. However, the Islamic view on Forex trading is that it falls under the category of riba, which is the Arabic term for usury or interest.

Islamic scholars have different opinions on Forex trading, with some arguing that it is haram due to the presence of interest. However, others believe that it is permissible as long as certain conditions are met. One of these conditions is that the trading must be done on a spot basis, meaning that the exchange of currencies must happen on the same day as the trade. Additionally, the transaction must be free from any form of interest, such as swap fees or rollover interest.

In conclusion, Forex trading in Islam is a complex issue that requires careful consideration. While some argue that it is haram due to the presence of interest, others believe that it is permissible under certain conditions. As a visitor to this blog, it is important to do your own research and consult with Islamic scholars before making any decisions about Forex trading. Remember to always prioritize your faith and seek guidance from Allah in all your financial endeavors.

Video Forex trading laws in Islam

As Forex trading gains popularity among Muslims around the world, many are wondering about the Islamic laws that apply to this type of investment. Here are some of the most common questions people ask about Forex trading laws in Islam:

- Is Forex trading halal or haram in Islam?

- What are the Islamic rules for Forex trading?

- Is it permissible to earn interest on Forex trading?

- How can Muslims trade Forex in compliance with Islamic law?

Let’s take a closer look at each question:

- Is Forex trading halal or haram in Islam?

- What are the Islamic rules for Forex trading?

- Is it permissible to earn interest on Forex trading?

- How can Muslims trade Forex in compliance with Islamic law?

There is no clear consensus among Islamic scholars about whether Forex trading is halal or haram, as opinions vary depending on the interpretation of Islamic law. Some argue that Forex trading is permissible as long as it does not involve riba (usury) or gharar (uncertainty), while others believe it violates the principles of Islamic finance.

According to Islamic law, any business or transaction must comply with the principles of shariah, which include the prohibition of riba (usury), gharar (uncertainty), and maysir (gambling). Therefore, Forex trading must be conducted in a way that avoids these forbidden elements.

No, earning interest (or any other form of usury) is strictly prohibited in Islam. Therefore, any Forex trading strategy that involves earning interest on overnight positions or using leverage to increase profits is not permissible for Muslims.

One way for Muslims to trade Forex in compliance with Islamic law is to use an Islamic Forex account, which operates according to the principles of shariah and does not charge or pay interest. Another option is to engage in Forex trading through a halal investment fund, which invests in Shariah-compliant assets and follows Islamic ethical standards.

Ultimately, it is up to each individual Muslim to decide whether Forex trading is permissible for them based on their interpretation of Islamic law and their personal beliefs and values.