Copy trading is a revolutionary way to trade in the financial markets. Follow expert traders and watch your profits soar!

For investors looking for an alternative to traditional stock market investing, copy trading has become an increasingly popular option. With copy trading, investors can automatically replicate the trades made by successful traders, allowing them to benefit from the experience and expertise of others in the market. Not only does this eliminate the need for extensive research and analysis, but it also offers the potential for higher returns. However, as with any investment strategy, there are risks involved. Therefore, it is important to understand the ins and outs of copy trading before jumping in.

Firstly, it’s important to note that copy trading is not a get-rich-quick scheme. While it may offer the potential for higher returns, there is no guarantee of success. Investors should carefully consider their risk tolerance and investment goals before deciding to engage in copy trading. Additionally, investors must choose the right traders to follow, as the success of the strategy relies heavily on the performance of those being copied. This requires careful research and analysis on the part of the investor.

Despite these risks, the popularity of copy trading continues to grow. It offers a convenient and potentially lucrative way for investors to participate in the market without the need for extensive knowledge or experience. As with any investment strategy, however, caution and careful consideration are key.

Daftar Isi

Introduction

Copy trading is a modern way of investing that has taken the financial world by storm. It allows traders to automatically copy the trades of successful investors, thereby increasing their chances of making profits in the market. In this article, we will discuss what copy trading is all about, how it works, its benefits and risks, and how you can start copy trading today.

What is copy trading?

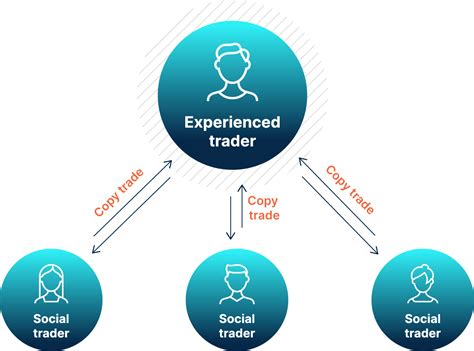

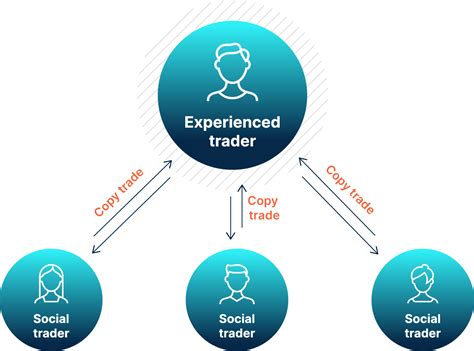

Copy trading is a form of social trading where traders copy the trading strategies of other traders. It involves linking your trading account with that of another trader, and automatically replicating their trades in your own account. This means that you can make the same trades as an experienced trader without having to spend time analyzing the markets or learning technical analysis.

How does copy trading work?

Copy trading platforms allow traders to browse through the profiles of other traders and select the ones they want to copy. These platforms also provide performance statistics of each trader, including their win rate, return on investment, and risk level. Once you have selected a trader to copy, you can set the amount of money you want to allocate to their trades, and the platform will automatically execute the same trades in your account.

Benefits of copy trading

One of the biggest advantages of copy trading is that it allows novice traders to learn from experienced traders. By copying the trades of successful traders, you can gain valuable insights into the markets and improve your own trading skills. Copy trading also saves time, as you do not need to spend hours analyzing the markets or monitoring your trades. Additionally, copy trading can be profitable, as you can make money by following the trades of successful investors.

Risks of copy trading

Like any form of trading, copy trading carries risks. The performance of the trader you are copying can have a significant impact on your own trading results. If the trader makes losses, you will also make losses. Additionally, copy trading platforms charge fees for their services, which can eat into your profits. It is important to carefully consider the risks before engaging in copy trading.

How to choose a trader to copy

When choosing a trader to copy, it is important to look at their performance statistics. Look for traders who have a high win rate, consistent returns, and low risk levels. It is also important to consider the trader’s trading style and strategy, as this can have an impact on your own trading results. Finally, it is a good idea to diversify your copy trading portfolio by copying multiple traders with different strategies and risk profiles.

Copy trading platforms

There are many copy trading platforms available, each with its own features and benefits. Some of the most popular platforms include eToro, ZuluTrade, and NAGA Trader. These platforms allow traders to connect with other traders from around the world and copy their trades. They also provide a range of tools and features to help traders manage their copy trading portfolios.

Setting up a copy trading account

To start copy trading, you will need to open an account with a copy trading platform. This involves filling out an application form and providing some personal information. You will also need to link your trading account with the platform and choose the traders you want to copy. Once you have set up your copy trading account, you can sit back and let the platform do the work for you.

Conclusion

Copy trading is a powerful tool that can help novice traders learn from experienced investors and potentially make profits in the market. However, it is important to carefully consider the risks and choose traders with a proven track record of success. With the right approach, copy trading can be a highly profitable and rewarding way to invest in the financial markets.

Disclaimer

The information provided in this article is for educational purposes only and does not constitute investment advice. Copy trading involves risks, and past performance is not indicative of future results. Always do your own research and consult with a licensed financial advisor before making any investment decisions.

Understanding Copy Trading: A Beginner’s Guide

Copy trading is a popular investment strategy that allows traders to automatically copy the trades of experienced traders. It involves a trader copying the trading strategies of another trader who has a proven track record of success. The concept of copy trading is simple, but it is important to understand the basics before diving in.

The Pros and Cons of Copy Trading

Like any investment strategy, copy trading has its pros and cons. One of the main advantages is that it can save time and effort because traders can simply copy the trades of successful traders instead of conducting their own research. Additionally, copy trading can help new traders learn from experienced traders and gain valuable insights into the market.

However, there are also some disadvantages to copy trading. For example, traders may become over-reliant on the strategies of others and may not fully understand the risks involved in certain trades. Additionally, traders may not be able to customize their trades to suit their individual needs and risk tolerance.

Copy Trading vs. Social Trading: What’s the Difference?

Copy trading and social trading are often used interchangeably, but they are not the same thing. Social trading involves traders sharing information and ideas with each other, while copy trading involves directly copying the trades of another trader. Both strategies can be valuable, but it is important to understand the differences before deciding which one to use.

How to Choose the Right Copy Trading Platform

Choosing the right copy trading platform is critical to success. There are many platforms available, but not all of them offer the same features and benefits. When choosing a platform, traders should consider factors such as fees, ease of use, and the quality of traders available to copy. It is also important to ensure that the platform is regulated and reputable.

Top Copy Trading Strategies for Successful Trades

Successful copy trading requires a solid strategy. Some of the top strategies include diversifying trades, setting stop-loss orders, and monitoring the performance of copied traders closely. Additionally, traders should be sure to choose traders with a proven track record of success and avoid those who take excessive risks.

The Importance of Risk Management in Copy Trading

Risk management is critical in copy trading. While copying successful traders can be profitable, there is always a risk involved. Traders should set realistic goals and limits and be prepared to exit trades if necessary. Additionally, traders should be sure to only copy traders who have a low risk score and a history of successful trades.

Learning from Other Traders: The Benefits of Copy Trading

One of the main benefits of copy trading is the ability to learn from other traders. By copying successful traders, traders can gain valuable insights into the market and learn about different trading strategies. This can be especially beneficial for new traders who are still learning the ropes.

Copy Trading and the Myth of Easy Money

While copy trading can be a profitable investment strategy, it is important to remember that there is no such thing as easy money. Traders should not expect to get rich overnight and should be prepared to put in the time and effort to learn and improve their copy trading skills.

The Role of Regulation in Copy Trading

Regulation is an important consideration in copy trading. Traders should only use platforms that are regulated by reputable authorities to ensure that their investments are protected. Additionally, regulation can help prevent fraud and ensure that traders have access to accurate information.

The Future of Copy Trading: Trends and Predictions

The future of copy trading looks bright. As technology continues to advance, copy trading platforms are likely to become even more sophisticated and user-friendly. Additionally, there is likely to be a greater focus on social trading and community-based investing, which can help traders learn from each other and build a sense of camaraderie.

Overall, copy trading can be a profitable and valuable investment strategy for traders of all levels. By understanding the basics and following best practices, traders can increase their chances of success and achieve their financial goals.

Copy trading has become a popular way for novice investors to gain access to the markets without extensive knowledge or experience. Copy trading involves replicating the trades of successful traders, often through an online platform. While there are certainly benefits to copy trading, there are also potential drawbacks that investors should consider before jumping in.Pros of Copy Trading:1. Access to Expertise: Copy trading allows investors to follow and replicate the trades of successful traders, providing access to their expertise without having to do the research themselves.2. Reduced Risk: By copying the trades of successful traders, investors can reduce their risk exposure as these traders have already done the research and analysis necessary to make informed trades.3. Time-Saving: Copy trading can save investors time by eliminating the need for extensive research and analysis, as well as the need to monitor the markets constantly.Cons of Copy Trading:1. Lack of Control: Copy trading means investors are surrendering control of their investments to another trader. This lack of control could lead to losses if the copied trader makes poor decisions.2. Hidden Fees: Some copy trading platforms may charge fees that are not immediately apparent. These fees can add up and eat into profits over time.3. Limited Learning Opportunities: While copy trading may provide short-term gains, it does not provide the educational opportunities that come with researching and analyzing the markets oneself. This could limit an investor’s long-term growth potential.In conclusion, copy trading can be a useful tool for novice investors looking to gain access to the markets quickly and easily. However, investors should be aware of the potential drawbacks, such as lack of control and hidden fees, and consider whether copy trading aligns with their long-term investment goals.

Copy trading has become a popular method for traders to increase their profits by mimicking the trades of successful traders. It’s an easy way for beginners to get started in trading without having to learn complex strategies and market analysis. However, it’s important for traders to understand the risks involved in copy trading before they start investing their money.

One of the biggest risks of copy trading is the potential for slippage. When copying trades from other traders, there may be a delay between the time they execute their trade and the time your copy is executed. This can result in a difference in price, which can lead to losses. Additionally, traders should be cautious when selecting which traders to copy. Just because a trader has a high success rate doesn’t mean they will continue to perform well in the future. It’s important to do your own research and analysis before deciding who to copy.

Overall, copy trading can be a useful tool for beginner traders to learn and profit from the market. However, it’s important to approach it with caution and understand the risks involved. As with any type of investment, it’s important to do your own research and analysis before making any decisions. By understanding the potential risks and taking the necessary precautions, traders can increase their chances of success in copy trading.

Video copy trading

Copy trading has become an increasingly popular topic among traders and investors. As a result, many people have questions about this method of investing. Here are some common questions and answers:

-

What is copy trading?

Copy trading is a form of investing where a trader copies the trades of another trader. The copied trader is typically more experienced and successful, and the idea is that the copying trader can benefit from their expertise and generate profits as well.

-

How does copy trading work?

Copy trading platforms allow users to connect their account to the account of a trader they want to copy. The platform then automatically copies the trades of the copied trader in real-time. The copying trader can adjust their settings to control things like the amount of money they invest in each trade and how many trades they want to copy.

-

Is copy trading safe?

There are some risks associated with copy trading, such as the possibility of the copied trader making a losing trade. However, reputable copy trading platforms typically have measures in place to minimize these risks, such as vetting the traders they allow on their platform and offering risk management tools for copying traders.

-

Can I make money with copy trading?

Yes, it is possible to make money with copy trading. Many traders have had success using this method of investing, but it is important to remember that there are no guarantees in the stock market. It is also important to do your own research and choose a copied trader carefully.

-

What are the benefits of copy trading?

Copy trading can be beneficial for traders who are new to the stock market or do not have the time or expertise to conduct their own research and analysis. It can also be a way to learn from more experienced traders and potentially generate profits with less effort than traditional investing.