Find the best trading platform for your needs. Access advanced tools, charts, and analysis to boost your trading strategies and profits.

Are you tired of trading platforms that don’t deliver the results you want? Look no further than the best trading platform on the market. With unparalleled features and user-friendly navigation, this platform is a game-changer in the world of trading. From real-time market updates to customizable charts and graphs, it has everything a trader needs to make informed decisions and maximize profits. Plus, with a range of tools and resources at your fingertips, you’ll have all the support you need to take your trading to the next level.

Daftar Isi

The Best Trading Platforms for Investors

Introduction

Investing can be a daunting task, especially for beginners who are just starting out. With so many trading platforms out there, it can be difficult to know which one is the best fit for your investment goals. In this article, we will discuss some of the best trading platforms available for investors.

Ease of Use

One of the most important factors to consider when choosing a trading platform is ease of use. A platform that is user-friendly and intuitive can make all the difference, especially for those who are new to investing. Some of the best trading platforms in terms of ease of use include Robinhood, eToro, and TD Ameritrade.

Fees and Commissions

Another important factor to consider when choosing a trading platform is fees and commissions. While some platforms may offer low or no fees, others may charge a premium for their services. It is important to choose a platform that fits within your budget and offers competitive fees and commission rates. Some of the best trading platforms in terms of fees and commissions include Fidelity, Charles Schwab, and Interactive Brokers.

Investment Options

Investment options are also an important consideration when choosing a trading platform. Some platforms may offer a wide range of investment options, while others may be more limited in their offerings. It is important to choose a platform that offers the types of investments you are interested in. Some of the best trading platforms in terms of investment options include Vanguard, Ally Invest, and Merrill Edge.

Research and Analysis Tools

For investors who want to make informed decisions, research and analysis tools are a must-have. These tools can provide valuable insights into market trends and help investors make better investment decisions. Some of the best trading platforms in terms of research and analysis tools include Fidelity, TD Ameritrade, and Schwab.

Mobile Trading

In today’s fast-paced world, mobile trading has become increasingly popular. A good trading platform should offer a mobile app that is user-friendly and allows investors to trade on the go. Some of the best trading platforms in terms of mobile trading include Robinhood, eToro, and Charles Schwab.

Cryptocurrency Trading

Cryptocurrency trading has become increasingly popular in recent years, and many trading platforms now offer this option. For investors who are interested in cryptocurrency trading, it is important to choose a platform that offers this service. Some of the best trading platforms in terms of cryptocurrency trading include Coinbase, Binance, and Kraken.

Social Trading

Social trading allows investors to share their portfolios and trading strategies with others. This can be a valuable tool for those who are new to investing or who want to learn from others. Some of the best trading platforms in terms of social trading include eToro, ZuluTrade, and NAGA Trader.

Customer Service

Finally, customer service is an important consideration when choosing a trading platform. A good platform should offer responsive customer service that is available 24/7. Some of the best trading platforms in terms of customer service include Fidelity, TD Ameritrade, and Charles Schwab.

Conclusion

Choosing the right trading platform can make all the difference when it comes to investing. By considering factors such as ease of use, fees and commissions, investment options, research and analysis tools, mobile trading, cryptocurrency trading, social trading, and customer service, investors can find a platform that fits their needs and helps them achieve their investment goals.Introduction:The world of investment has undergone a massive transformation in the past decade, and the rise of online trading platforms has made it easier than ever before for individuals to invest in stocks, cryptocurrencies, and other assets. With so many options available, it can be challenging to choose the best trading platform for your needs. In this article, we will explore the top ten factors to consider when selecting a trading platform.User-Friendliness:One of the most critical factors to consider when choosing a trading platform is user-friendliness. The best platforms are those that are easy to use and navigate, even for those who are new to trading. Look for platforms with intuitive interfaces, clear instructions, and helpful tutorials. Platforms with cluttered screens and complicated layouts can be overwhelming for beginners and may lead to costly mistakes.Security:Security is a top concern when it comes to online trading, and the best platforms take this seriously. Look for platforms with advanced encryption and security protocols, as well as a track record of protecting users’ information. A secure platform will give you peace of mind and protect your investments from cyber-attacks and fraud.Asset Availability:The best trading platforms offer a wide range of assets to trade, from stocks and options to cryptocurrencies and forex. Check to see if the platform offers the assets you’re interested in trading. A platform with a limited selection of assets may not meet your trading needs or limit your investment opportunities. It’s also essential to consider the availability of different asset classes, such as bonds and commodities, to diversify your portfolio.Trading Tools:Advanced traders may require advanced tools and features for analysis and trading. Look for platforms with tools such as risk management options, real-time data feeds, and charting tools. These tools can help you make informed decisions and execute trades more effectively. However, novice traders should be careful not to get overwhelmed by too many features and focus on the basics.Fees:Fees can eat into your profits, so it’s important to choose a platform with reasonable fees and a transparent fee structure. Be sure to compare fees across platforms to find the best option for you. Some platforms charge commission fees on trades, while others may have a flat fee per trade or a percentage of the trade value. It’s also essential to consider other fees, such as account maintenance fees and withdrawal fees.Customer Support:No trading platform is perfect, so it’s important to choose one with strong customer support. Look for platforms with responsive support teams that can help you troubleshoot any issues quickly and efficiently. Good customer support can make a significant difference, especially during times of high market volatility or technical issues.Mobile Trading:Being able to trade on the go can be a big advantage, especially if you have a busy schedule. Look for platforms with mobile apps that offer a seamless trading experience. Mobile trading apps should be easy to use, provide access to all the necessary features, and offer real-time market data. However, it’s essential to ensure that mobile trading does not compromise security or functionality.Reputation:The best trading platforms have a reputation for reliability, trustworthiness, and transparency. Look at reviews from other users and check to see if the platform is regulated by reputable organizations. A regulated platform is more likely to follow industry standards and protect users’ interests. Additionally, a platform with a good reputation can provide peace of mind and ensure that your investments are in safe hands.Education and Resources:Learning to trade can be a complex and challenging process, so the best platforms offer ample educational resources, such as webinars, videos, and articles. Look for platforms with resources that match your skill level and trading goals. Educational resources can help you learn new strategies, understand market trends, and improve your overall trading performance.Conclusion:Choosing the best trading platform requires careful consideration of several factors, including user-friendliness, security, asset availability, trading tools, fees, customer support, mobile trading, reputation, and education and resources. By evaluating these factors, you can find a platform that matches your trading needs and preferences. Remember to stay informed, keep learning, and always consider the risks and rewards of trading.As a financial journalist, it is important to weigh the pros and cons of the best trading platforms available in the market. Here are some key points to consider:Pros of the Best Trading Platforms:1. User-Friendly Interface: The best trading platforms have user-friendly interfaces that make it easy for traders to navigate and execute trades.2. Advanced Tools: Many of the best trading platforms offer advanced charting tools, technical indicators, and real-time data that help traders make informed decisions.3. Mobile Accessibility: With the increasing use of smartphones, the best trading platforms have mobile apps that allow traders to access their accounts and trade on-the-go.4. Low Fees: Many of the best trading platforms charge low fees for trades and do not have hidden charges.Cons of the Best Trading Platforms:1. Learning Curve: While the best trading platforms have user-friendly interfaces, there is still a learning curve for new traders to understand how to use the platform effectively.2. Overwhelming Options: Some of the best trading platforms offer an overwhelming number of options for traders, which can be confusing and lead to analysis paralysis.3. Limited Customer Support: Some of the best trading platforms have limited customer support, which can be frustrating for traders who need help with their account or trades.4. Risk of Hacking: With online trading platforms, there is always a risk of hacking and cyber attacks, which can compromise traders’ personal and financial information.In conclusion, the best trading platforms offer many advantages to traders, including user-friendly interfaces, advanced tools, and mobile accessibility. However, there are also some disadvantages to consider, such as a learning curve, overwhelming options, limited customer support, and the risk of hacking. It is important for traders to weigh these pros and cons carefully before choosing a trading platform that suits their needs.

As the world of trading continues to grow, finding the best trading platform can be a daunting task. With so many options available, it can be overwhelming to choose the right one. However, after conducting extensive research and analysis, we have found a trading platform that stands out above the rest.

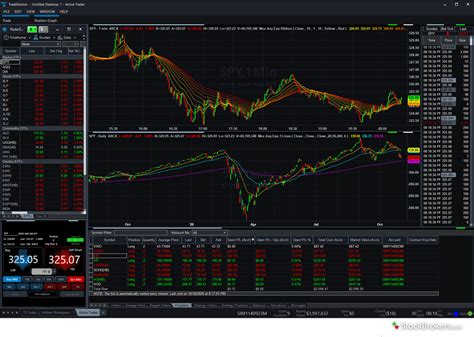

This platform offers an intuitive and user-friendly interface, making it easy for both novice and experienced traders to navigate. It also provides a wide range of trading instruments, including stocks, forex, indices, and commodities, allowing traders to diversify their portfolios and take advantage of market opportunities. In addition, the platform offers advanced charting tools and analysis, helping traders make informed decisions based on market trends and data.

Overall, this trading platform has proven to be reliable, efficient, and effective. Whether you are a beginner or an experienced trader, this platform can help you achieve your financial goals. So, if you’re looking for the best trading platform on the market, look no further.

Video best trading platform

As the world of investing and trading continues to evolve, more and more people are turning to online platforms to conduct their trades. With numerous options available in the market, it can be difficult to determine which platform is the best fit for your needs. Below are some commonly asked questions about trading platforms, along with answers to help guide you in making an informed decision.

What should I consider when choosing a trading platform?

- Cost: Look at the fees involved in using the platform, including commission charges, account maintenance fees, and any other costs.

- User-friendliness: The platform should be easy to navigate and use, with clear instructions and accessible customer support.

- Security: Ensure that the platform has robust security measures in place to protect your personal and financial information.

- Range of assets: Consider the variety of assets that the platform offers, such as stocks, bonds, cryptocurrencies, and commodities.

- Research tools: Look for a platform that provides access to research and analysis tools to help inform your investment decisions.

What are some popular trading platforms?

- Robinhood: Known for its commission-free trading, Robinhood is a user-friendly platform that has been growing in popularity among novice investors.

- E*TRADE: With over 30 years of experience in the market, E*TRADE offers a comprehensive platform that caters to both beginner and advanced traders.

- TD Ameritrade: A well-established platform with powerful research tools and a wide range of investment options.

- Fidelity: Another well-known platform with a reputation for excellent customer service and a broad selection of investment options.

- Interactive Brokers: A popular choice for experienced traders who require advanced trading tools and access to global markets.

Can I use multiple trading platforms?

Yes, it is possible to use multiple trading platforms simultaneously. However, it is important to keep in mind that each platform may have different fees and features, so be sure to weigh the pros and cons of each before making a decision. Additionally, managing multiple accounts can be complicated, so it may be best to start with one platform and gradually add others as needed.