Learn how to profit from the foreign exchange market with Arti Forex Trading. Get expert insights and strategies for successful trading.

Forex trading, also known as foreign exchange trading, has become increasingly popular in recent years. With the rise of online trading platforms and the accessibility of information, more and more people are diving into the world of forex trading. But what exactly is forex trading? How does it work? And is it a viable option for making money? In this article, we’ll explore the ins and outs of forex trading and provide you with the information you need to decide if it’s right for you.

First and foremost, let’s address the elephant in the room: forex trading is not a get-rich-quick scheme. It requires education, practice, and discipline. That being said, the potential rewards can be significant. With the ability to trade 24/7 and access to leverage (the ability to control large positions with a small amount of capital), forex trading can be a lucrative venture for those who are willing to put in the time and effort.

But how does forex trading actually work? Essentially, it involves buying and selling different currencies with the goal of profiting from the fluctuations in their exchange rates. For example, if you buy the US dollar when it’s low and sell it when it’s high compared to another currency like the Euro, you can make a profit. Of course, this is oversimplifying it – there are many factors that can impact currency values, from global events to economic indicators.

So, is forex trading worth considering? It depends on your goals and risk tolerance. Like any investment, there is always a level of risk involved. However, with education and practice, it’s possible to minimize that risk and potentially reap the rewards. Stay tuned for our next article, where we’ll dive deeper into the strategies and tools you can use to succeed in forex trading.

Daftar Isi

The World of Forex Trading

As the world of finance continues to evolve, so does the world of forex trading. For those who are not familiar with forex trading, it is the buying and selling of currencies in order to make a profit. The forex market is the largest and most liquid market in the world, with trillions of dollars traded on a daily basis. In this article, we will explore the ins and outs of forex trading, including its benefits and risks, as well as the strategies used by successful traders.

The Benefits of Forex Trading

One of the main benefits of forex trading is that it allows for a high degree of leverage. This means that traders can control large amounts of currency with only a small amount of capital. Another benefit is that the forex market is open 24 hours a day, allowing traders to trade at any time. Additionally, the forex market is highly liquid, meaning that there is always a buyer and seller for any given currency pair.

The Risks of Forex Trading

While there are many benefits to forex trading, there are also risks involved. One of the biggest risks is the volatility of the market. Currencies can fluctuate rapidly and unpredictably, which can lead to significant losses for traders. Another risk is the use of leverage, which can amplify both profits and losses. It is important for traders to manage their risk carefully and to have a solid understanding of the market before diving in.

The Role of Brokers

In order to participate in forex trading, traders need to work with a broker. Brokers act as intermediaries between traders and the market, providing access to trading platforms and executing trades on behalf of their clients. There are many different types of brokers, including full-service brokers and discount brokers. It is important for traders to choose a broker that fits their needs and provides them with the tools and resources they need to succeed.

Trading Strategies

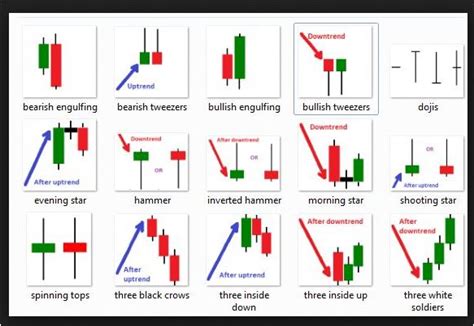

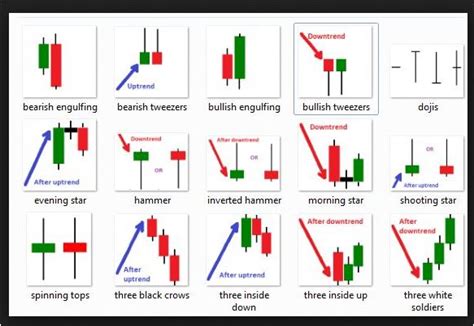

Successful forex traders use a variety of different strategies to make profits in the market. One popular strategy is technical analysis, which involves using charts and indicators to identify trends and patterns in the market. Another strategy is fundamental analysis, which involves analyzing economic data and news events to predict market movements. Traders may also use a combination of both strategies, along with risk management techniques, to maximize their profits.

Technical Analysis

Technical analysis is based on the idea that historical price and volume data can be used to predict future market movements. Traders use charts and indicators to identify trends and patterns, which can help them make buy and sell decisions. Some popular indicators include moving averages, Bollinger Bands, and Relative Strength Index (RSI).

Fundamental Analysis

Fundamental analysis involves analyzing economic data and news events to predict market movements. Traders look at factors such as interest rates, inflation, and political developments to determine the direction of a currency pair. For example, if a country is experiencing high inflation, its currency may depreciate relative to other currencies.

Risk Management

Risk management is an essential part of any successful trading strategy. Traders use a variety of techniques to manage their risk, including setting stop-loss orders, using trailing stops, and diversifying their portfolios. It is important for traders to have a solid understanding of their risk tolerance and to use risk management techniques that fit their individual needs and goals.

The Future of Forex Trading

The world of forex trading is constantly evolving, with new technologies and strategies emerging all the time. One trend that is likely to continue is the move towards automation, with many traders using algorithms and trading robots to execute trades automatically. Another trend is the increasing popularity of social trading, which allows traders to share information and strategies with each other through online platforms.

Conclusion

Forex trading can be a highly rewarding but also highly risky endeavor. Traders who are willing to put in the time and effort to learn about the market and develop sound trading strategies can potentially make significant profits. However, it is important to remember that forex trading is not a get-rich-quick scheme, and success requires discipline, patience, and careful risk management.

Forex trading, also known as foreign exchange, is a popular way for traders to buy and sell currencies on the global market. The basics of forex trading involve exchanging one currency for another with the hope of making a profit. One of the advantages of forex trading is its low initial capital requirements, which makes it accessible to a wide range of investors. Additionally, the flexible trading hours allow traders to trade at any time of day or night, and traders can profit in both rising and falling markets. However, while there are many benefits to forex trading, it is important to understand the risks involved. These include volatility, leverage, and geopolitical events that can impact currencies. To access the market, traders need to use a forex broker, who acts as an intermediary between the trader and the market. When choosing a forex broker, traders need to consider factors such as regulation, trading platforms offered, account types, fees and commissions, and customer support. There are a wide range of forex trading strategies that traders can use, including technical analysis, fundamental analysis, and automated trading systems. Technical analysis involves analyzing charts and identifying patterns and trends to predict future price movements, while fundamental analysis involves analyzing economic and political events that may affect the value of currencies. Automated trading systems are software programs that are designed to execute trades on a trader’s behalf. To be successful in forex trading, traders need to develop a trading plan that includes guidelines and rules for making trading decisions, risk management guidelines, and a clear trading schedule.

Forex trading, also known as foreign exchange trading, is the buying and selling of currencies. It has become a popular way for individuals to make money online. However, like any investment opportunity, it comes with its own set of pros and cons.

Pros of Forex Trading

- High Liquidity: The forex market is the largest financial market in the world, with an average daily trading volume of over $5 trillion. This means that there is always someone willing to buy or sell currency, making it easy to enter or exit trades.

- Leverage: Forex brokers offer leverage, which allows traders to control larger positions with smaller amounts of capital. This can increase potential profits, but also magnify losses.

- 24-Hour Market: Unlike other financial markets that operate during specific hours, the forex market is open 24 hours a day, five days a week. This allows traders to trade at any time, which can be convenient for those with busy schedules.

- Low Transaction Costs: In comparison to other financial markets, forex trading has low transaction costs. Most brokers do not charge commissions, but make their money through spreads.

Cons of Forex Trading

- High Risk: Forex trading is a high-risk, high-reward investment opportunity. The market can be volatile and unpredictable, which means that traders can experience significant losses.

- Complexity: Forex trading requires a lot of knowledge and skill. It can take years to master the art of forex trading, and even then, there are no guarantees of success.

- Scams: The forex market is also home to many scams, including fraudulent brokers and trading systems. Traders must be cautious and do their research before investing their money.

- Emotional Trading: Traders can become emotionally attached to their trades, which can lead to irrational decision-making and further losses.

Overall, forex trading can be a lucrative investment opportunity for those who are willing to put in the time and effort to learn it. However, it is not without its risks and should be approached with caution.

As a journalist, it is my duty to inform and educate my readers. Today, I want to discuss the topic of Forex trading. Forex trading is the buying and selling of foreign currencies in the hopes of making a profit. It is a high-risk investment that requires knowledge, skill, and discipline. Despite the risks, many people are drawn to Forex trading because of its potential for big rewards. However, before you decide to invest your hard-earned money, there are some things you need to know.

First and foremost, Forex trading is not a get-rich-quick scheme. It takes time and effort to learn the ins and outs of the market. There are many factors that can affect the value of a currency, such as political instability, economic data, and global events. As a trader, you need to be able to analyze these factors and make informed decisions. This requires a lot of research and practice.

Secondly, it is important to have a risk management strategy in place. Forex trading can be very volatile, and it is not uncommon for traders to lose their entire investment in a single trade. To avoid this, you need to set stop-loss orders and limit your exposure to the market. It is also important to have a clear understanding of your financial goals and risk tolerance.

In conclusion, Forex trading can be a lucrative investment opportunity, but it is not without risks. Before you decide to invest, make sure you have a solid understanding of the market and a risk management strategy in place. Remember, success in Forex trading comes from knowledge, skill, and discipline.

Video arti forex trading

As a journalist, I have come across numerous people who have asked about Arti Forex Trading. Here are some of the most common questions and their answers:

1. What is Arti Forex Trading?

Arti Forex Trading is an advanced automated trading system that uses artificial intelligence (AI) to make trading decisions. It uses complex algorithms to analyze market data and predict future trends. The system then executes trades based on those predictions, all without human intervention.

2. Is Arti Forex Trading safe?

Like any investment, there is always some risk involved with Arti Forex Trading. However, the system uses advanced security protocols and risk management tools to minimize risk. Additionally, the system is constantly updated to ensure it remains up-to-date with the latest market trends.

3. How much money do I need to start using Arti Forex Trading?

The minimum deposit required to use Arti Forex Trading varies depending on the broker you choose. However, many brokers allow you to start with as little as $250.

4. Can I use Arti Forex Trading if I have no trading experience?

Yes, you can. Arti Forex Trading is designed for both experienced traders and beginners. The system does all the work for you, so you don’t need any trading experience to use it effectively.

5. How much profit can I expect to make with Arti Forex Trading?

The amount of profit you can make with Arti Forex Trading depends on several factors, including the amount of money you invest and the market conditions at the time. While there is no guarantee of profit, many users have reported making significant returns on their investments.

In conclusion, Arti Forex Trading is an innovative trading system that uses AI to make trading decisions. While there is always some risk involved with any investment, the system is designed to minimize that risk and maximize profitability. Whether you are an experienced trader or a beginner, Arti Forex Trading could be a great option for you.